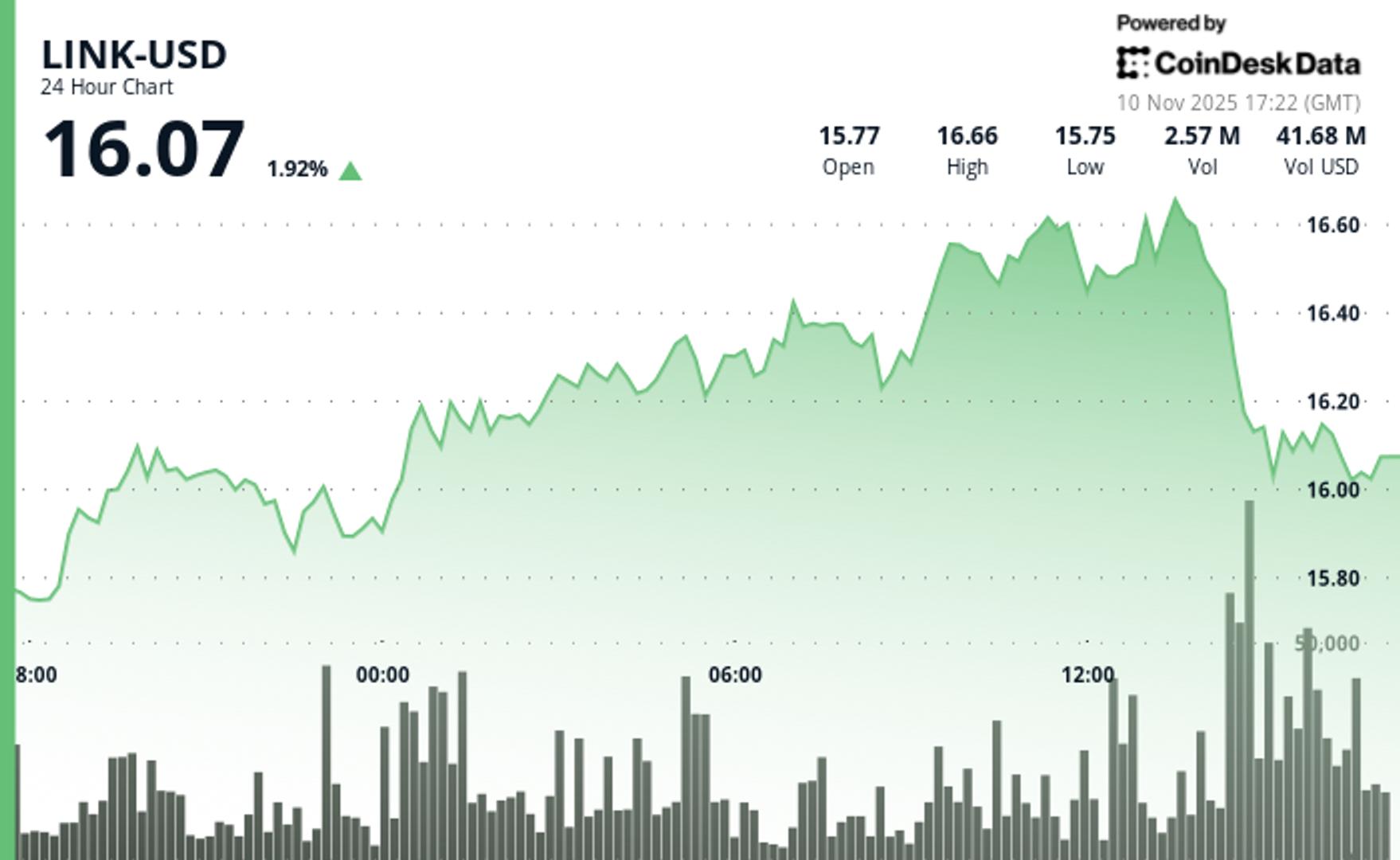

Chainlink’s native token LINK rebounded on Monday, advancing 5.2% over the 24-hour interval to a session excessive of $16.66 earlier than profit-taking kicked in.

The value soar adopted a gentle upward pattern with increased lows and robust participation from merchants, however the failure to carry above $16.50 signaled near-term exhaustion, CoinDesk Analysis’s technical evaluation mannequin mentioned.

Essentially the most vital transfer got here at midnight UTC, when 1.82 million tokens modified fingers — practically 70% above the day by day common — confirming a breakout via the important $16.00 stage and validating the rally’s momentum.

Nonetheless, the uptrend stalled as merchants started taking earnings close to session highs. Quantity exceeded 60,000 tokens in a brief sell-off after 14:00 UTC, knocking LINK again to round $16, capping bullish continuation makes an attempt for now, the mannequin mentioned.

The motion occurred simply forward of Chainlink’s Rewards Season 1, set to launch November 11. This system permits eligible LINK stakers to earn token rewards from 9 associate initiatives by allocating non-transferable factors referred to as Cubes.

Key Technical Ranges Sign Consolidation for LINK

- Help/Resistance: Main help is established at $16.47 following the breakdown, with $16.50 now serving as speedy resistance after the failed breakout try

- Quantity Evaluation: Midnight surge to 1.82M shares (69% above common) confirms breakout validity, although subsequent promoting stress exceeds 60K quantity throughout the reversal

- Chart Patterns: 24-hour ascending pattern with increased lows intact regardless of 60-minute consolidation failure; $16.51-$16.66 vary defines near-term boundaries

- Targets & Danger/Reward: Bulls goal return above $16.50 for continuation towards $16.66, whereas breakdown beneath $16.47 may check $16.30 help with $16.00 as final draw back goal

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage..