Abstract

- BNB Chain reached 51.6 million month-to-month energetic addresses on Sept. 17, with charges and income up greater than 23% prior to now month.

- The surge comes as Binance founder Changpeng Zhao plans a $1 billion BNB Treasury Firm to assist prime institutional tasks.

- The BNB token hit $1,000 on Sept. 18, amid hypothesis about Zhao’s doable return to Binance.

BNB Chain noticed report exercise with 51.6 million month-to-month addresses alongside rising income over the previous month. BNB hit $1,000 as Zhao outlined plans for a $1 billion Treasury Firm, fueling rumors about his return to Binance.

BNB Chain, the blockchain behind Binance‘s native token (BNB), reached a brand new milestone on Sept. 17, when month-to-month energetic addresses hit 51.9 million, surpassing a earlier all-time excessive recorded in September 2024, based on Token Terminal knowledge.

The surge in exercise comes alongside progress in community metrics, as over the previous 30 days, charges collected on the chain reached $13.2 million, a greater than 24% leap in contrast with the earlier interval, whereas income reached $1.4 million, up 23%, indicating that extra customers are interacting with the community.

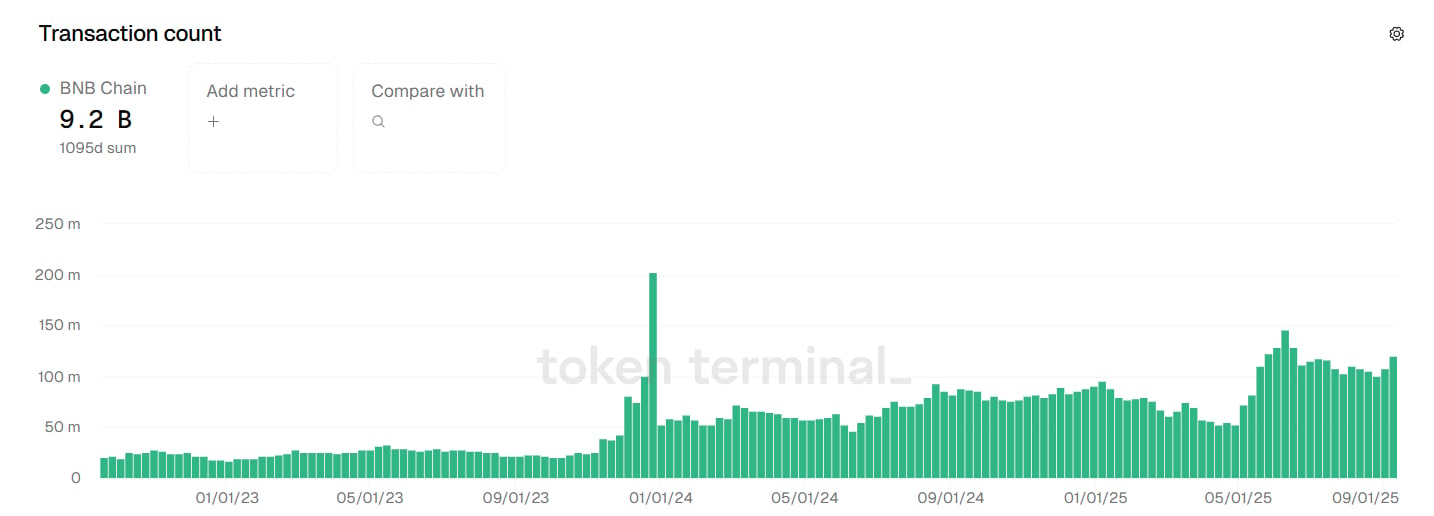

By transaction depend, BNB Chain additionally retains reinforcing its place within the prime three layer 1 networks, based on Token Terminal. Whereas Web Pc leads with 412.2 billion transactions, Solana follows it at 354.5 billion, and BNB Chain with the transaction depend at 9.2 billion.

As of September, the community helps over 1,095 tasks throughout sectors, together with DeFi, gaming, and NFTs, with the whole worth locked in in BNB Chain standing at $7.68 billion, nonetheless down round 65% from 2021’s peak.

Talking with crypto.information, Marwan Kawadri, DeFi lead and head of EMEA at BNB Chain, attributed the expansion to a giant person base of 4 million day by day energetic customers and greater than 625 million distinctive addresses, in addition to deep international liquidity with greater than $11 billion in TVL and stablecoin circulation.

Kawadri added that the staff is now aiming to achieve a “CEX-like expertise” in order that transactions “will probably be confirmed in beneath 150 milliseconds.”

“General, BNB Chain is focusing on to develop into a settlement layer and monetary infrastructure for all property, it won’t be particularly restricted to any specific buying and selling state of affairs. The route and preliminary type of this chain are nonetheless constantly evolving, and we’ll discover and construct this along with the neighborhood.”

Marwan Kawadri

The expansion in on-chain exercise coincides with an increase in BNB’s market worth because the token not too long ago hit a brand new all-time excessive of $962. A part of this momentum appears to be tied to bulletins from Binance founder Changpeng Zhao, who outlined plans for the upcoming BNB Treasury Firm in an interview with Leon Lu, founding father of B Technique.

As crypto.information reported earlier, Zhao described BNB as a “true utility coin,” highlighting its multi-chain compatibility and its use throughout buying and selling reductions, yield era, launch swimming pools, launchpads, and the Binance Alpha ecosystem. He additionally emphasised BNB’s position throughout each centralized and decentralized platforms, together with cross-border funds and dApps worldwide, noting that the ecosystem has untapped potential in areas equivalent to Southeast Asia, Europe, the Center East, and Africa.

Again as CEO

The deliberate BNB Treasury Firm is anticipated to boost $1 billion with backing from YZi Labs. Zhao stated the initiative will goal institutional demand, focusing assist on sturdy, well-positioned tasks. “We’ve been approached by in all probability greater than 50 corporations for BNB particularly…we’ll solely try this to a really small variety of DAT corporations. Principally, the very prime, sturdy ones,” Zhao stated within the podcast.

Hypothesis about Zhao’s doable return to Binance has additionally grown. On Sept. 17, the Binance founder up to date his X profile, altering it from “ex-@binance” again to “@binance.” Zhao stepped down as CEO practically two years in the past following a $4.3 billion settlement with the U.S. Division of Justice in November 2023 over anti-money laundering violations.

Reviews additionally recommend that the DOJ could quickly raise compliance restrictions on Binance, which has fueled rumors about his potential return, although Zhao has said he doesn’t plan to renew the CEO position.

Information from crypto.information reveals BNB hit an all-time excessive of $1,000 on Sept. 18, setting a brand new historic milestone for the BNB Chain ecosystem. As of press time, the token is up 3.7% prior to now 24 hours, buying and selling round $989, and it has risen over 10% over the previous week.