9 spot Ethereum ETFs commenced buying and selling on the US inventory market on Tuesday, marking a pivotal second for the crypto business following the Securities and Change Fee’s (SEC) inexperienced mild on Monday.

Ethereum ETFs See $1B In Buying and selling Quantity On Debut

James Seyffart, a senior ETF analyst at Bloomberg, described the Monday ETF launch as a “fairly massive success,” in line with a Fortune report. Nonetheless, the preliminary enthusiasm was tempered by a stark comparability to Bitcoin’s ETF debut earlier this 12 months, which garnered $655 million in inflows on its first buying and selling day.

Associated Studying

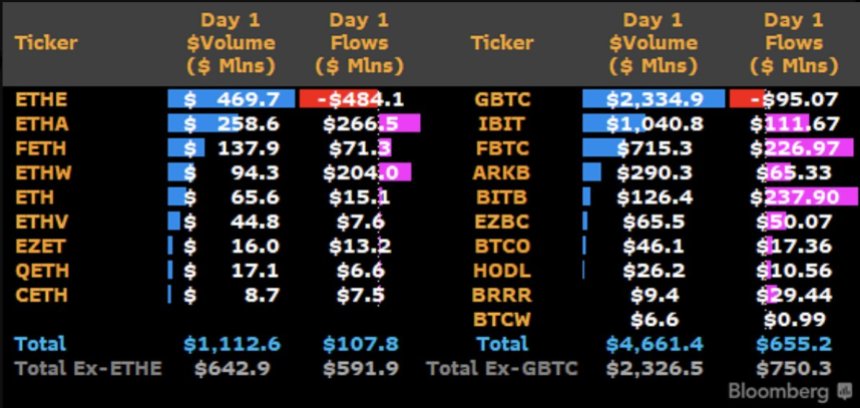

Diving into the specifics, the Ethereum ETFs collectively amassed $10.2 billion in property, with buying and selling volumes surpassing $1.1 billion on day one. Grayscale’s Ethereum Belief (ETHE) led the amount race with $469.7 million.

Among the many key gamers, BlackRock led the cost with $266 million in inflows, adopted intently by Bitwise with $204 million and Constancy with $71 million.

Regardless of these figures, the ETFs collectively witnessed internet inflows of $107 million, overshadowed by Grayscale’s Ethereum Belief’s outflows of $484 million, as per Bloomberg knowledge.

Nonetheless, the market response to the ETFs didn’t translate right into a noticeable affect on Ethereum’s worth, which skilled a marginal 0.8% decline since buying and selling commenced.

At present, the second largest cryptocurrency in the marketplace is buying and selling at $3,420, with a 27% lower in buying and selling quantity on this space, amounting to $16 billion within the final 24 hours, and no vital adjustments to Tuesday’s worth worth per coin.

Brilliant Future Regardless of Challenges

Provided that Ethereum’s market cap is a fraction of Bitcoin’s, the comparatively smaller inflows had been considerably to be anticipated. As well as, the Fortune report famous that the shortage of a staking function within the ETFs, which is prohibited by the SEC, additionally drove some buyers to purchase Ethereum immediately, bypassing the brand new Ethereum ETFs mechanism.

One other sturdy motive for the outflows on the primary day of the ETHE fund is Grayscale’s 2.5% price in comparison with opponents charging 0.25% or much less, an element that’s believed to have influenced investor habits and contributed to ETHE’s outflows.

Associated Studying

Regardless of the shortage of market response, Seyffart stays optimistic concerning the reception of the Ethereum ETFs, citing the sturdy efficiency of “smaller gamers” corresponding to 21 Shares’ Core Ethereum ETF, which attracted $8.7 million in inflows. Seyffart mentioned to Fortune:

Very profitable launch day by any commonplace ETF’s first day of buying and selling. On high of this, the amount numbers had been very sturdy.

Including to the optimistic outlook for the Ethereum ETFs, it’s noteworthy that Bitcoin (BTC) surged to an all-time excessive of $73,700 on March 14, simply two months after the permitted ETFs began buying and selling.

Though ETFs investing in ETH’s worth might not appeal to as a lot influx and buying and selling quantity as BTC, this might result in a sustained improve in ETH’s worth in the long run.

Featured picture from DALL-E, chart from TradingView.com