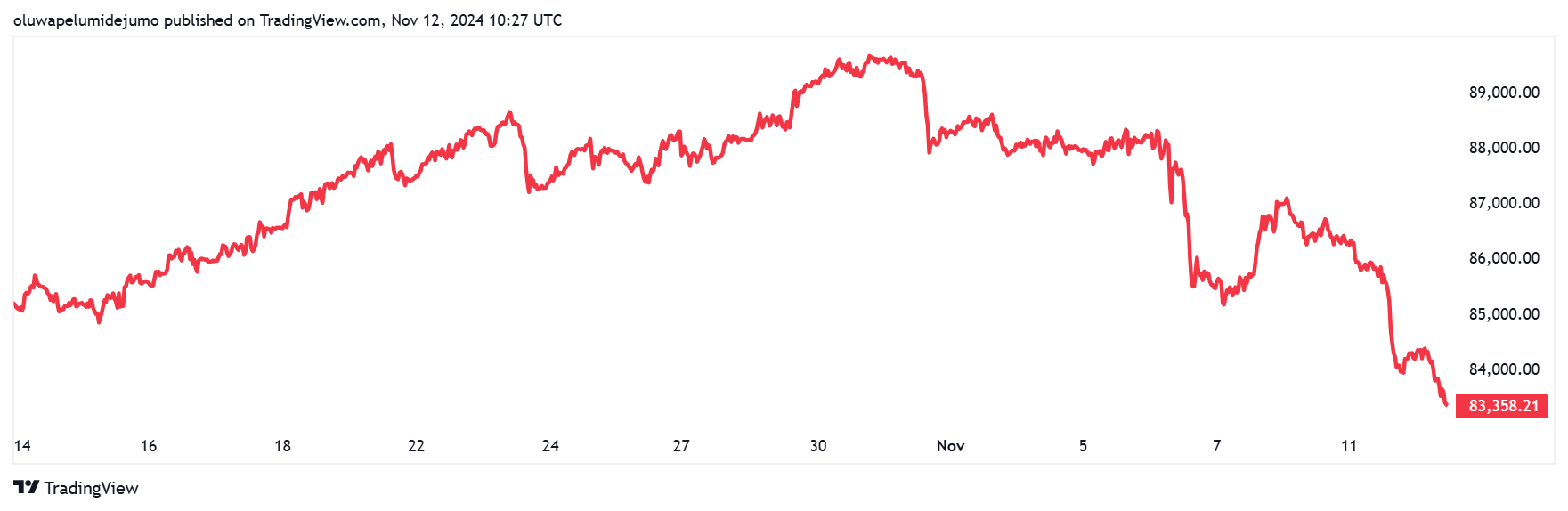

Bitcoin’s record-breaking value streak to almost $90,000 has positioned the highest crypto asset forward of silver and gold in key market metrics.

Information tracked by TradingView confirmed that gold is on a downward slope. The value of 1 kilogram of gold dropped to $83,439 as spot gold declined by 1.8% to $2,636 per ounce as of press time. This fall marks the steepest time for the dear metallic since early Might.

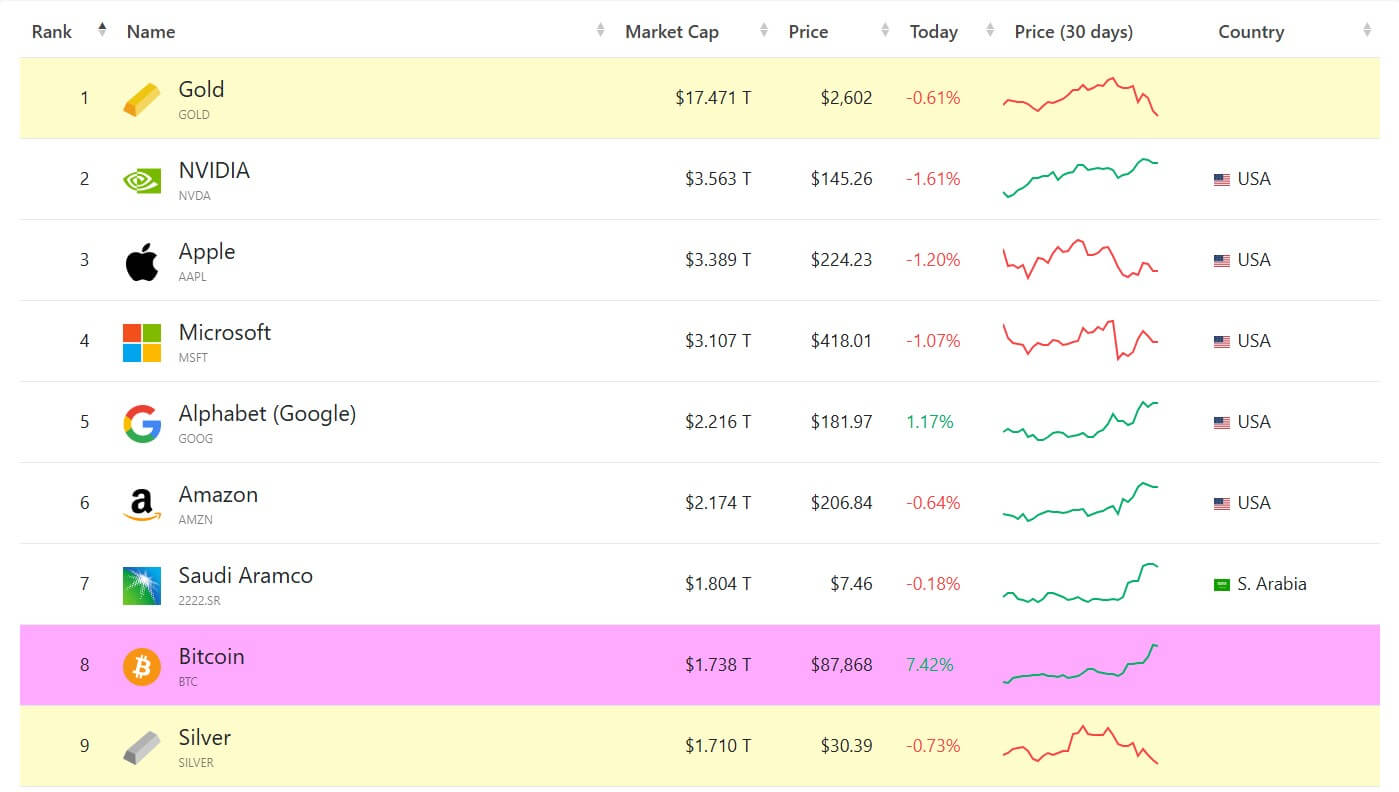

In stark distinction, Bitcoin has surged by practically 27% over the previous week to a brand new all-time excessive of $89,956, boosted by optimism round Donald Trump’s ascension to the White Home. Unsurprisingly, Bitcoin’s fast climb has pushed its market capitalization previous silver’s, a notable achievement for an asset usually known as “digital gold.”

Now valued at roughly $1.73 trillion, Bitcoin is the world’s eighth-largest asset, edging silver with a $1.71 trillion market cap. In the meantime, gold stays the main international asset, with a commanding market cap of $17.4 trillion.