Premiums of an notorious bitcoin (BTC) commerce popularized by Sam Bankman-Fried have popped again to vital ranges amid a market massacre brought on by rising U.S. tariffs, a market signal that some contemplate bearish within the quick time period.

The so-called Kimchi premium, or the distinction in bitcoin costs on Korean exchanges in comparison with international bourses, rose simply over 10% as of Asian morning hours Monday as BTC dropped 6% up to now 24 hours.

The arbitrage includes shopping for bitcoin on a worldwide change and promoting it on a Korean change for a riskless revenue in Korean received. Pocketing the precise positive factors is tough as a result of South Korea’s strict capital controls, however the premium is usually used alongside different elements to gauge market sentiment.

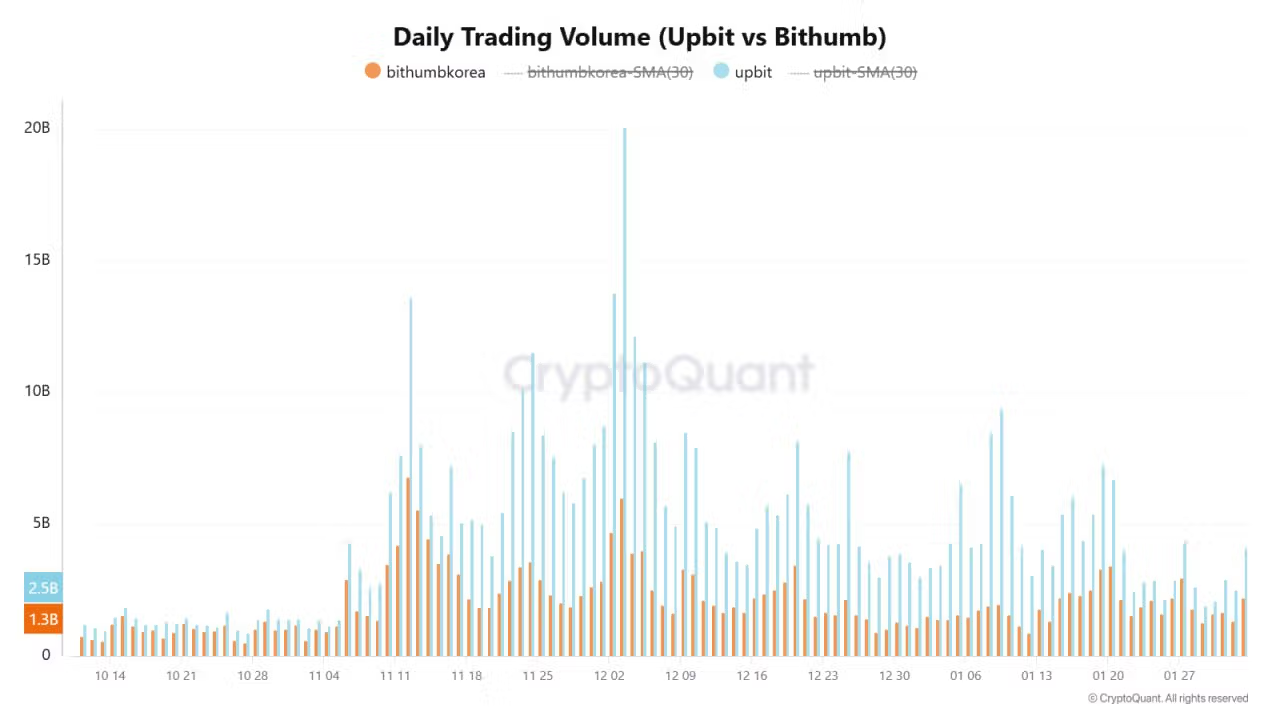

Buying and selling volumes on Korean exchanges Bithumb and Upbit have dropped considerably up to now week, indicating a drop in retail buying and selling exercise. In the meantime, balances of dollar-margined stablecoin tether have been on the decline on each exchanges with cases of withdrawal delays.

“It appears that evidently most retail buyers are both already totally invested in spot or have withdrawn their funds to interact in DEX actions,” Seoul-based DNTV Analysis analyst Bradley Park instructed CoinDesk in a Telegram message.

“On this scenario, the kimchi premium doesn’t signify retail buyers’ overbuying; relatively, it seems to have risen as a passive response to the uncertainty of a powerful greenback atmosphere,” Park added.

“The kimchi premium can surge excessively when buying and selling quantity will increase, however it could additionally assist defend costs when the asset costs on abroad exchanges drop considerably,” Park stated, including that was seemingly “not a optimistic signal” within the short-term for bitcoin.