Bitcoin was designed to operate as digital gold, a decentralised retailer of worth that protects wealth from inflation, forex debasement, and the long-term dominance of the greenback. At present, the market behaviour is telling a unique story as de-dollarisation accelerates and traders search security from geopolitical danger and inflation pressures, with gold capturing the majority of that capital.

Is Bitcoin Nonetheless A Retailer Of Worth Or A Danger Asset?

Crypto investor Himanshu Sinha has acknowledged on X that Bitcoin was purported to be digital gold as a result of it was constructed for de-dollarisation, however gold and silver are profitable the commerce and fulfilling that function. Over the previous 12 months, gold has risen by roughly 55%, silver has surged round 150%, whereas BTC has remained flat.

Associated Studying

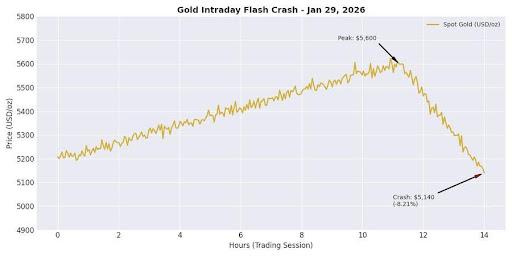

The Central banks are the drivers; they don’t need volatility that they will’t handle, they usually don’t need an asset that strikes in lockstep with the Nasdaq. As a substitute, they need a controllable financial infrastructure, they usually’re shopping for gold on the highest price in historical past. Simply hours in the past, gold hit $5,600, then collapsed by 8.21% in a straight vertical drop to $5,140, which is a textbook margin liquidation.

On the identical time, Microsoft dropped 11.7% as tech bought their gold as a result of it was their solely worthwhile asset, and the traders wanted money quick. This is similar liquidity contagion that was once seen within the crypto market.

In keeping with Sinha, gold can’t be sanctioned in a bar. Because the West weaponizes the greenback by sanctions and monetary controls, the remainder of the world wants a impartial exit. Ultimately, BTC nonetheless proved it’s a speculative instrument, whereas gold is proving to be the substitute.

Why Gold Is Probably To Hold Outperforming Bitcoin

A crypto dealer often known as Physician Revenue identified that almost a 12 months in the past, he shared a Gold versus Bitcoin chart, highlighting that when 0.02 BTC equals 1 ounce of gold, it ought to mark the highest for BTC. In the meantime, when 0.11 BTC equals 1 ounce of gold, it marks the underside for BTC. This occurred in 2021 through the BTC prime and through the BTC backside in 2022.

Associated Studying

In keeping with Physician Revenue, the evaluation was later confirmed proper this 12 months by calling the BTC prime at $125,000 at 0.02 for 1 ounce of gold. Calculating this transfer, if 1 BTC is $5,500 in gold value and divided by 0.11, it needs to be $50,000 BTC, which matches the evaluation of BTC backside for this cycle between $50,000 and $60,000 BTC.

Nevertheless, the evaluation performed out as anticipated. If calculated with a gold value of $7,000, the equal of BTC backside needs to be round $63,000, which additionally aligns with the underside goal. Within the Physician Revenue view, gold may proceed to outperform BTC within the coming months.

Featured picture from Getty Photos, chart from Tradingview.com