Bitcoin’s current decline is being pushed by mid-cycle holders, not long-term whales, in line with new on-chain analysis from VanEck analysts.

The agency famous in a current report that long-term holders proceed to build up whereas short-term futures markets present deeply oversold situations following tariff-driven liquidations.

Regardless of widespread hypothesis that early Bitcoin whales triggered the selloff, on-chain information reveals that cash held for 5 years or extra proceed to rise.

These older cohorts elevated their holdings by roughly 278,000 BTC over the previous two years, signaling restricted turnover amongst wallets with the longest histories.

In distinction, provide amongst wallets that final moved their cash three to 5 years in the past has dropped for each measurement window. Over the previous two years, this tranche fell by 32% as cash had been transferred to new addresses.

The VanEck analysts view these sellers as cycle-driven merchants reasonably than long-term traders.

“Weak palms” set early stress: VanEck

The previous month delivered a −13% drawdown, pushed partly by outflows from bitcoin ETPs. Since October 10, bitcoin ETP balances have fallen by 49,300 BTC — about 2% of complete AUM — as current patrons exited positions throughout rate-cut uncertainty and shifting AI-market sentiment.

Sentiment indicators additionally present rising worry amongst retail members. Bitcoin’s fear-and-greed index fell to its lowest studying since March, aligning with the onset of tariff-related volatility.

Whale holdings are shifting in a extra nuanced sample than outright distribution, VanEck famous. Massive holders with 10,000–100,000 BTC have decreased provide over the long term — down 6% over six months and 11% over 12 months — whereas mid-sized holders within the 100–1,000 BTC vary absorbed this provide and elevated their balances by 9% and 23% over the identical durations.

Extra lately, some massive cohorts have become internet patrons. The ten,000–100,000 BTC group elevated holdings over the previous 30, 60, and 90 days, coinciding with a pointy drop in futures market open curiosity throughout tariff-driven liquidations.

Whereas the analysts cease wanting making directional predictions, the information reveals that the longest-term bitcoin holders stay largely in place, mid-cycle merchants are driving promoting, and futures markets have undergone a major reset.

After a month of pronounced liquidations, the analysts characterize present situations as aligned with prior durations of tactical re-entry for some traders.

Mid-cycle Bitcoin holders present probably the most promoting

When analyzing cash by age reasonably than pockets dimension, promoting stress is most concentrated amongst holders who final moved their bitcoin throughout the previous six months to 5 years. These teams noticed vital outflows over the previous month.

Holders within the 6-month to 2-year band have rotated into the market as sellers, whereas the 3- to 5-year cohort continues to shrink throughout all durations reviewed. Analysts join this habits to merchants who entered throughout prior down cycles and are actually exiting on worth weak point.

By comparability, cash that final moved greater than 5 years in the past present minimal churn, reinforcing the concept that long-term holders should not driving the selloff.

Bitcoin’s futures markets reset as funding and open curiosity collapse

The futures market noticed a fast unwinding of speculative positioning. Open curiosity in bitcoin perpetual futures dropped roughly 19% in 12 hours through the selloff and is down 20% in BTC phrases since October.

Funding charges — a key measure of futures optimism — additionally fell to their lowest ranges since late 2023.

VanEck analysts famous that giant basis-trading operations, together with structured merchandise and funds utilizing long-spot/short-perp methods, could also be suppressing funding alerts.

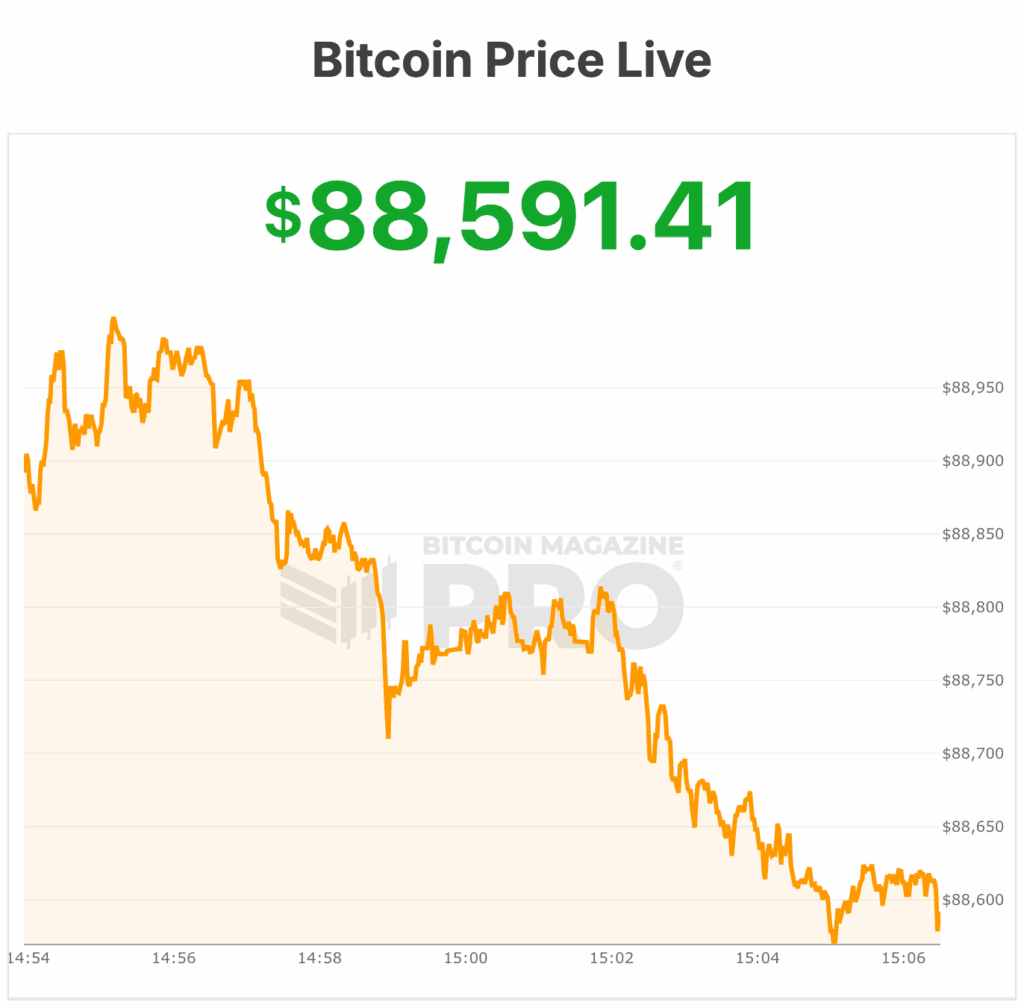

On the time of writing, Bitcoin is close to $88,500 — its lowest stage in seven months — as crypto markets lengthen their retreat and main crypto shares dump sharply. Bitcoin is down 4% in 24 hours, buying and selling close to the underside of its weekly vary with a $71 billion each day quantity and a $1.78 trillion market cap.