Bitcoin has lengthy been a trademark of the cryptocurrency markets, thriving on its 24/7 accessibility. Weekend buying and selling, as soon as a infamous breeding floor for volatility, has been particularly important within the cryptocurrency panorama.

Nonetheless, a latest report by Kaiko reveals a not so rosy image – BTC weekend buying and selling volumes have plunged to historic lows, probably marking a brand new period dominated by institutional weekday warriors.

Associated Studying

Bitcoin Buying and selling Exercise Takes A Nap

Kaiko’s knowledge is easy: Bitcoin weekend buying and selling exercise has shrunk dramatically, dropping from a excessive of 28% in 2019 to a mere 16% in 2024. This dramatic decline coincides with the extremely anticipated launch of spot Bitcoin ETFs within the US. These exchange-traded funds, mirroring the conduct of shares, can solely be traded throughout conventional market hours.

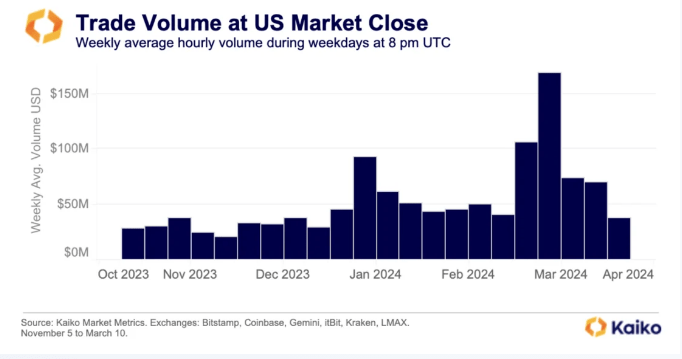

The affect of institutional traders, who are inclined to favor these regulated merchandise, is clear. The report highlights a surge in Bitcoin buying and selling exercise through the “benchmark fixing window” – the ultimate hour of US inventory market buying and selling. This means establishments are shaping new buying and selling patterns, prioritizing weekdays over the once-active weekends.

Past Weekends: A Multifaceted Market Transformation

The decline in weekend exercise isn’t solely attributable to ETFs. The closure of crypto-friendly banks like Signature and Silicon Valley Financial institution in March 2023 is one other contributing issue. These establishments offered 24/7 infrastructure that enabled market makers to always place purchase and promote orders. Their absence has created a void in weekend liquidity, additional dampening buying and selling exercise.

Nonetheless, the altering panorama isn’t all doom and gloom. The report affords a glimmer of hope for traders looking for stability. The diminished weekend volatility may make Bitcoin a extra predictable asset, probably attracting a brand new wave of institutional curiosity. Moreover, the historic development suggests July might be a constructive month for Bitcoin, with worth will increase noticed in seven out of the previous 11 Julys.

Jitters On The Horizon?

Whereas the weekend buying and selling scene could also be quieting down, the approaching weeks look to be considerably turbulent for the crypto market. The potential approval of Ethereum ETFs may additional gasoline institutional involvement and probably impression Bitcoin’s dominance.

Associated Studying

The Highway Forward

The dwindling weekend buying and selling exercise signifies a possible paradigm shift within the Bitcoin market. Whereas the once-volatile weekends might grow to be a relic of the previous, the approaching months promise to be eventful.

Institutional traders are actually within the highlight, shaping new buying and selling patterns and probably ushering in an period of better stability. Nonetheless, this month may nonetheless introduce important volatility, protecting traders on the sting of their seats.

Featured picture from Inc. Journal, chart from TradingView