Bitcoin’s excessive volatility this week has worn out a big quantity of unrealized earnings throughout the whole market.

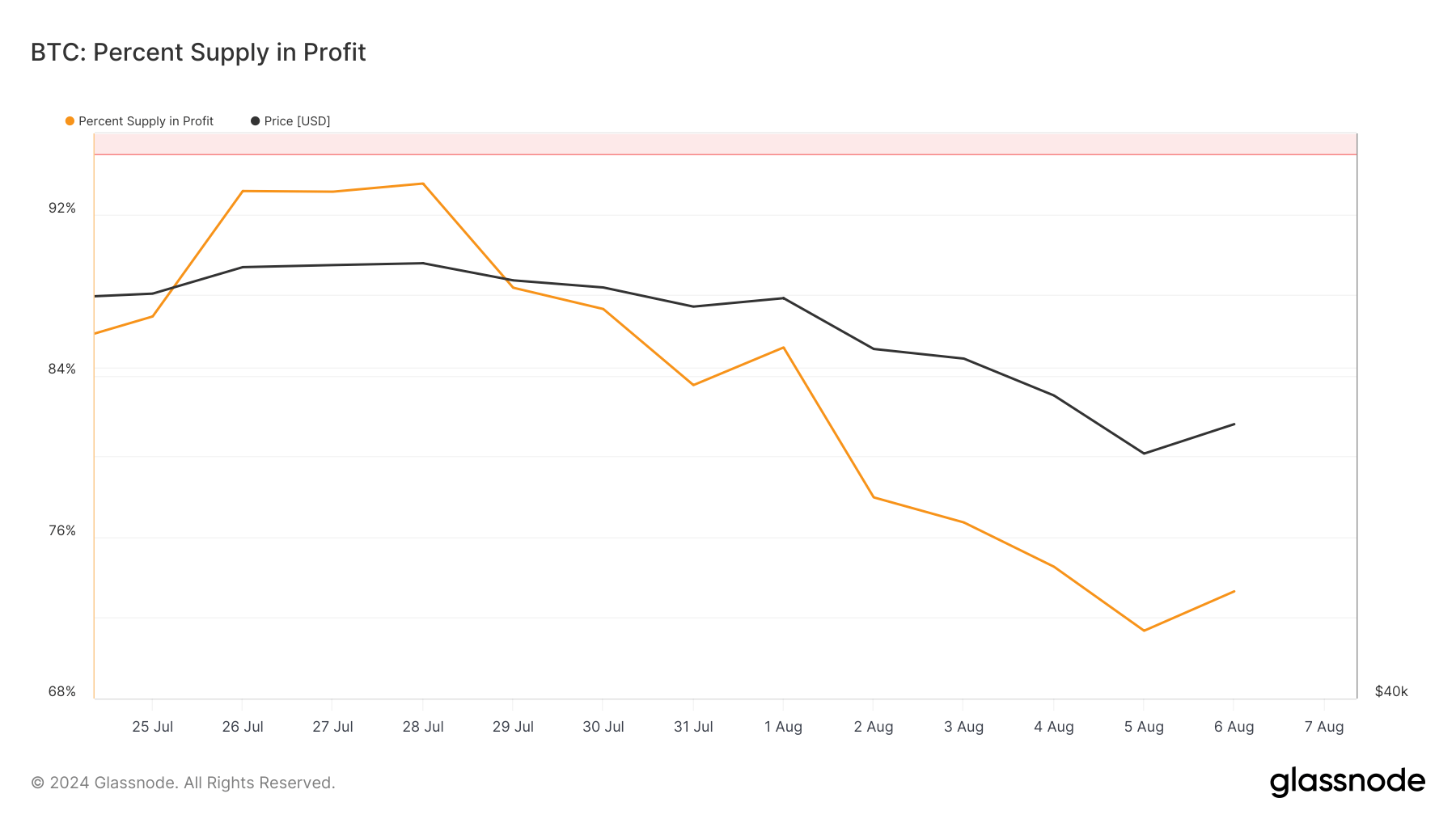

Information from Glassnode confirmed that on Aug. 1, over 85% of Bitcoin’s circulating provide was in revenue, reflecting a steady and enduring bullish sentiment as the value settled at round $65,000. Nonetheless, as the value started declining over the previous week, an enormous chunk of this profitability was wiped away.

With Bitcoin dropping to under $50,000 on Aug. 5, the share of provide in revenue fell to 71%, the bottom since October final 12 months. Though the value recovered to round $56,000 on Aug. 6, the availability in revenue stays at simply above 73%.

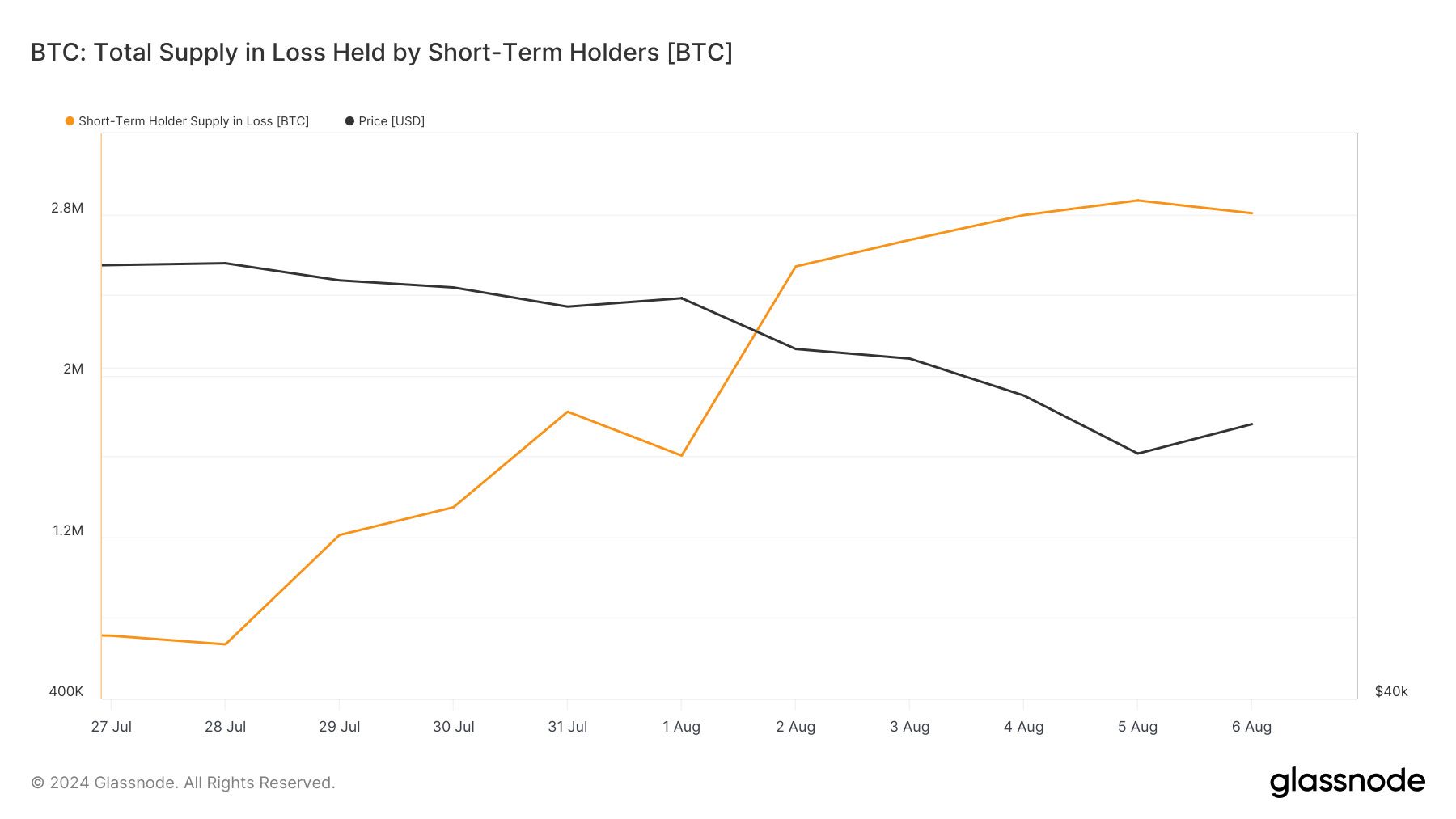

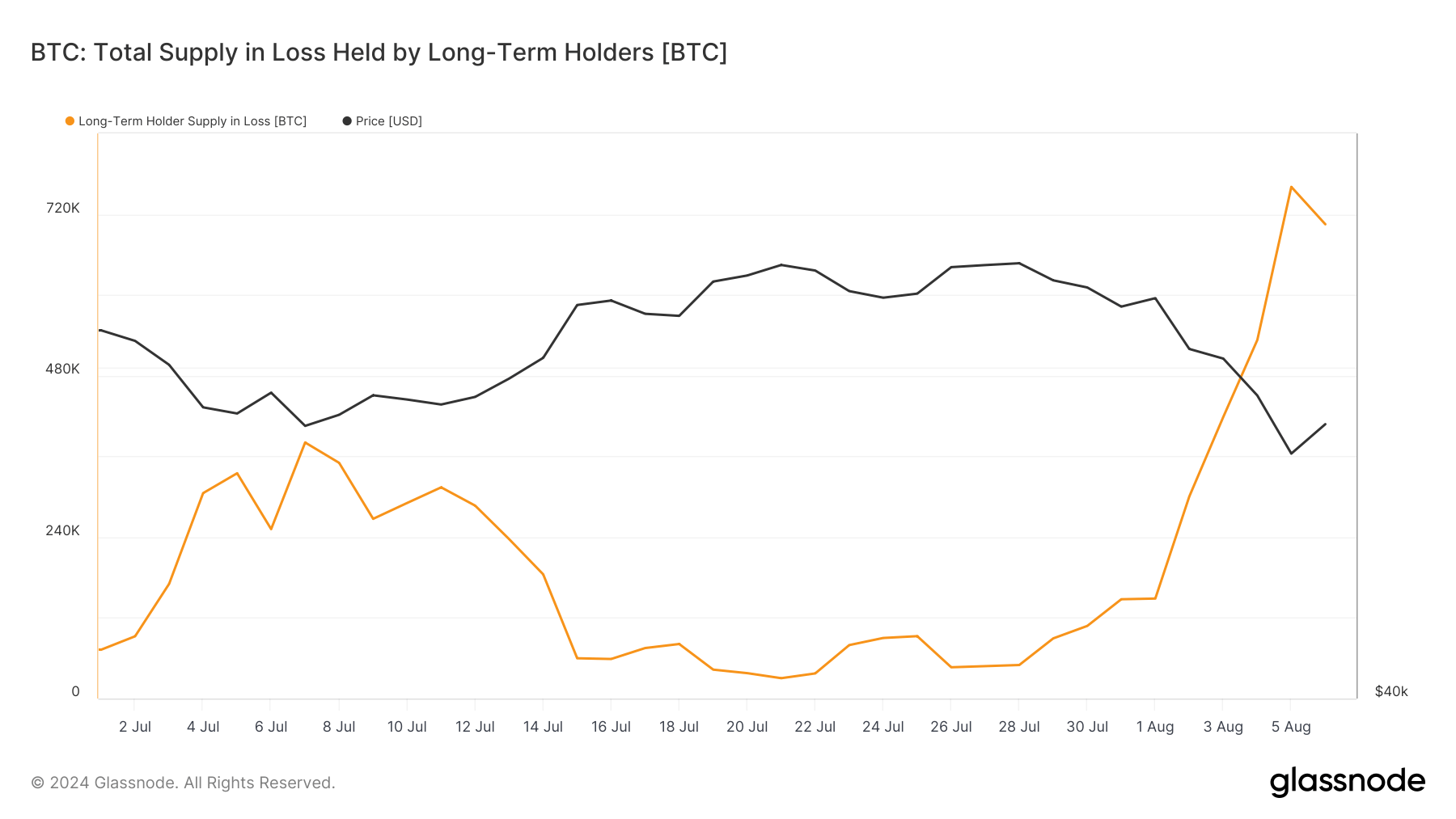

Each long-term and short-term holders noticed a pointy enhance of their provide held in loss.

On Aug. 1, STHs held 1.603 million BTC in loss, however this determine rose to 2.868 million on Aug. 5 earlier than lowering barely to 2.804 million BTC the subsequent day. This exhibits that over 1.2 million BTC was purchased at costs greater than present market costs, and STHs are sitting on a big quantity of unrealized losses.

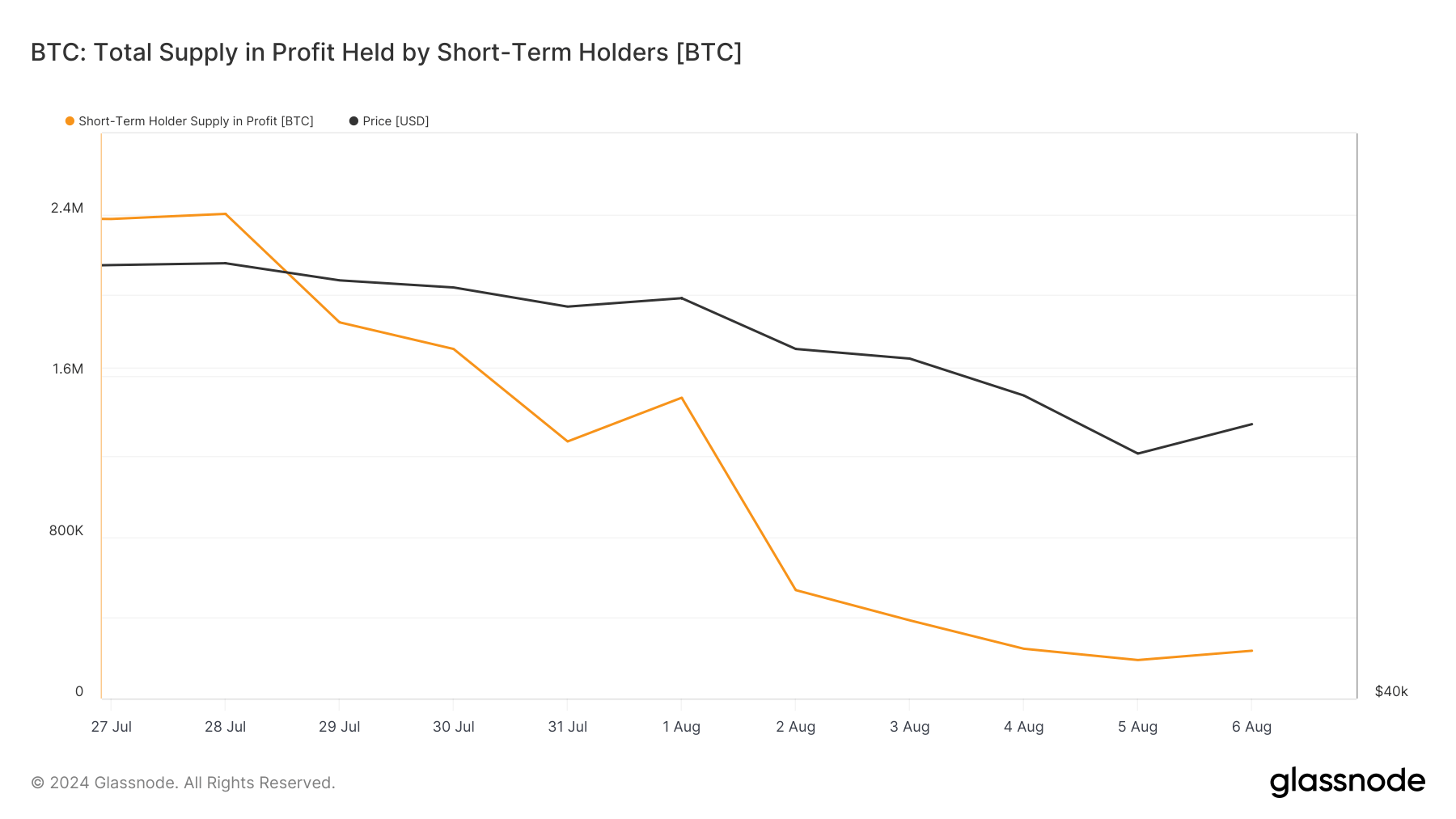

The short-term provide in revenue plummeted as effectively. Between Aug. 1 and Aug. 5, the STH provide in revenue fell from 1.490 million BTC to simply 190,724 BTC, recovering barely to 236,790 BTC on Aug. 6.

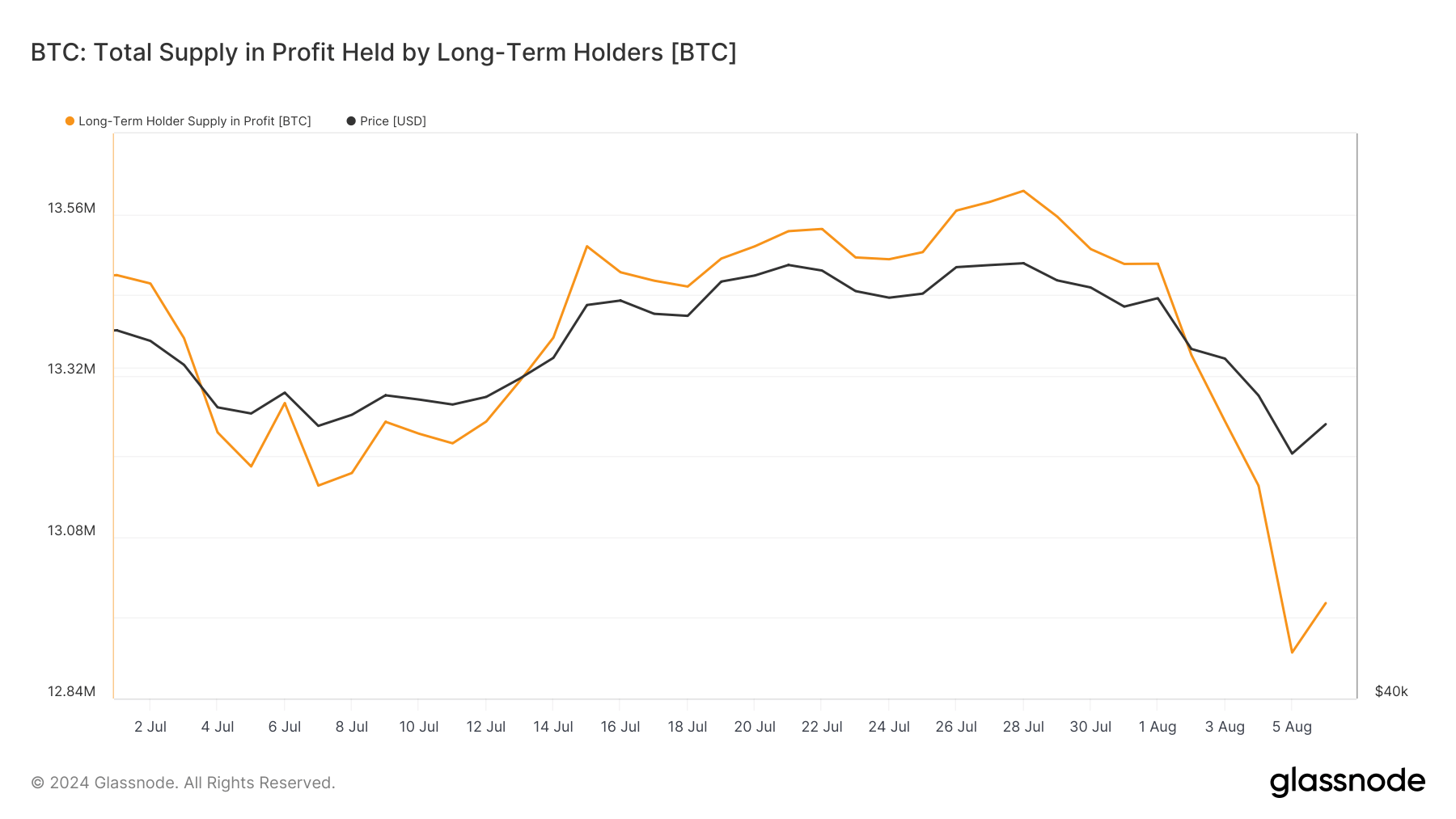

Lengthy-term holders additionally noticed losses, though considerably much less pronounced than their STH counterparts. Lengthy-term holder provide in revenue decreased from 13.486 million BTC to 12.908 million BTC between Aug. 1 and Aug. 5.

In the meantime, long-term holder provide in loss grew 148,601 BTC on Aug. 1 to 760,521 BTC on Aug.5, lowering barely to 704,926 BTC on Aug. 6. This gradual enhance signifies that even LTHs should not fully insulated from market volatility, although their broader time horizon presents some cushion.

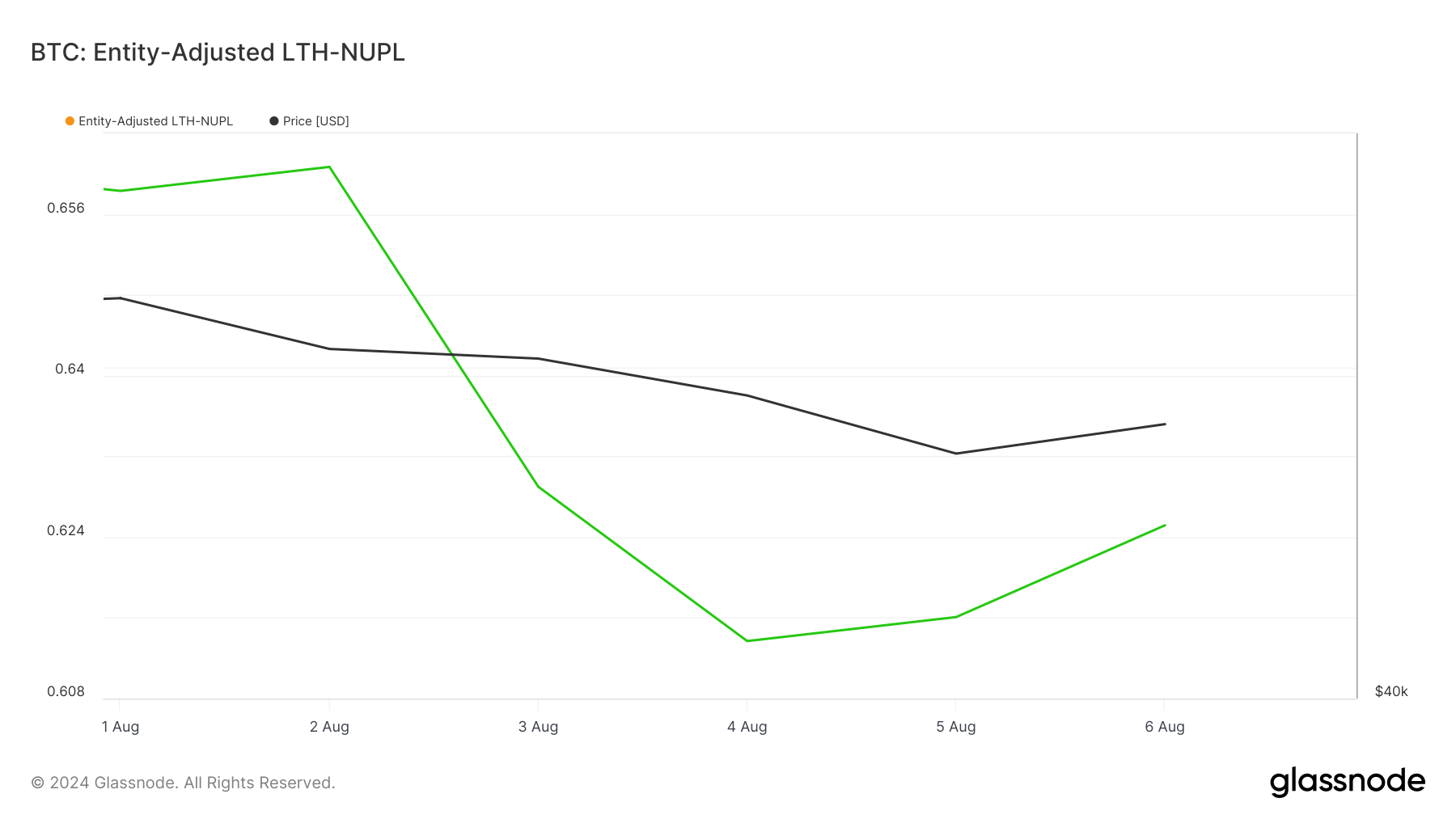

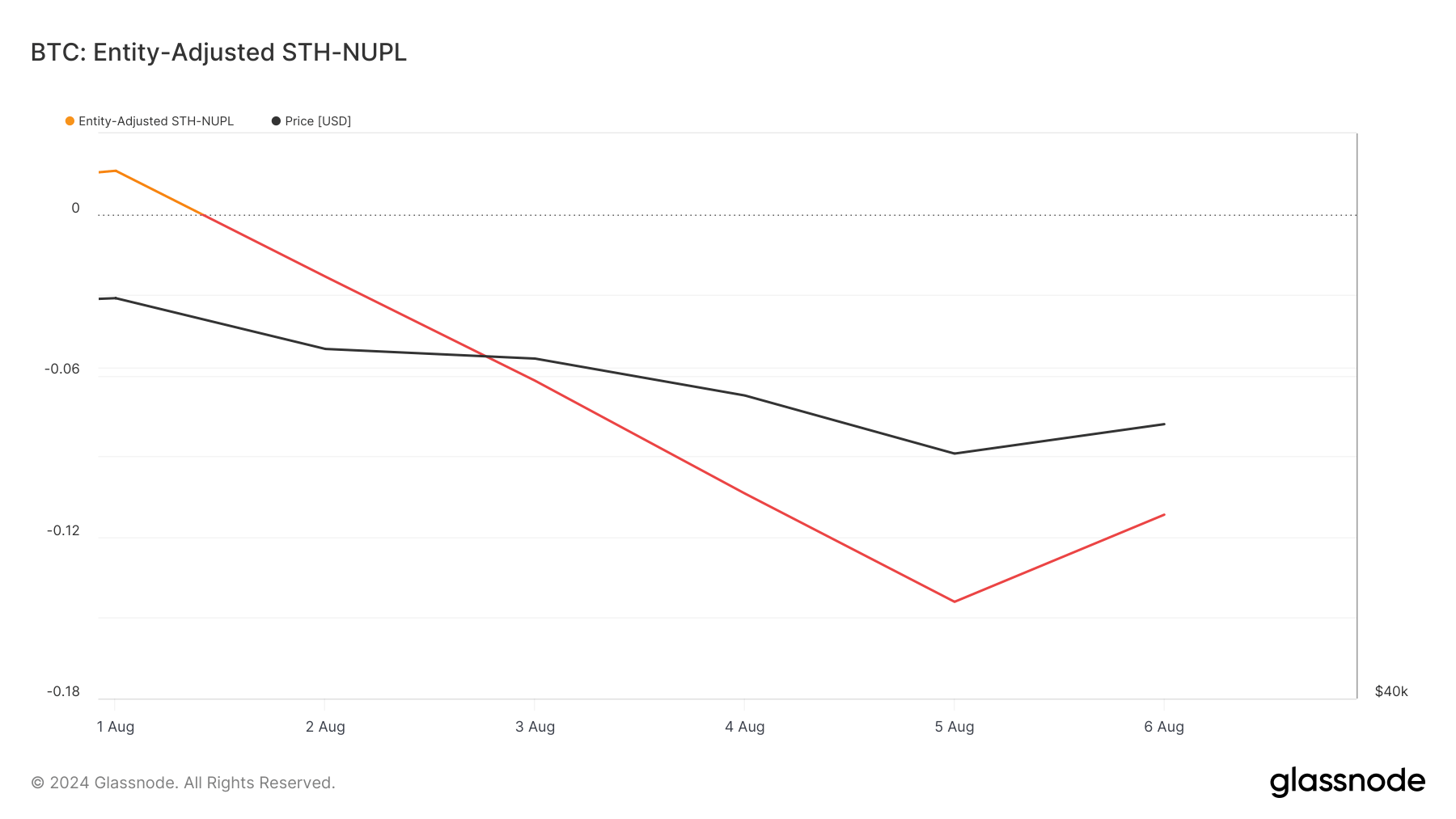

Trying on the entity-adjusted NUPL for long-term and short-term holders supplies a clearer and extra refined understanding of precise market revenue and loss. Earlier CryptoSlate evaluation discovered that entity-adjusted metrics, particularly NUPL, filter out non-economic transactions, which embrace inner transfers throughout the similar entity.

These inner actions can distort conventional metrics by creating the misunderstanding of heightened market exercise or profit-taking, resulting in an inaccurate illustration of market sentiment.

The present knowledge exhibits that the entity-adjusted LTH-NUPL has remained persistently above 0.5 all year long, reflecting a sustained perception amongst long-term holders in Bitcoin’s upward trajectory.

As of Aug. 6, LTH-NUPL stands at 0.625, indicating that long-term holders nonetheless have important unrealized earnings regardless of latest worth fluctuations.

Alternatively, the entity-adjusted STH-NUPL noticed considerably extra volatility, dropping into destructive territory in response to Bitcoin’s worth drop. As of Aug. 6, STH-NUPL is at -0.111.

Whereas short-term holders confronted substantial unrealized losses and reacted extra dramatically to cost drops, long-term holders maintained a comparatively steady outlook.

The submit Bitcoin volatility slashes unrealized earnings, STHs hit the toughest appeared first on CryptoSlate.