Bitcoin merchants started 2026 on a optimistic notice, snapping up choices bets that concentrate on a worth rally into six digits.

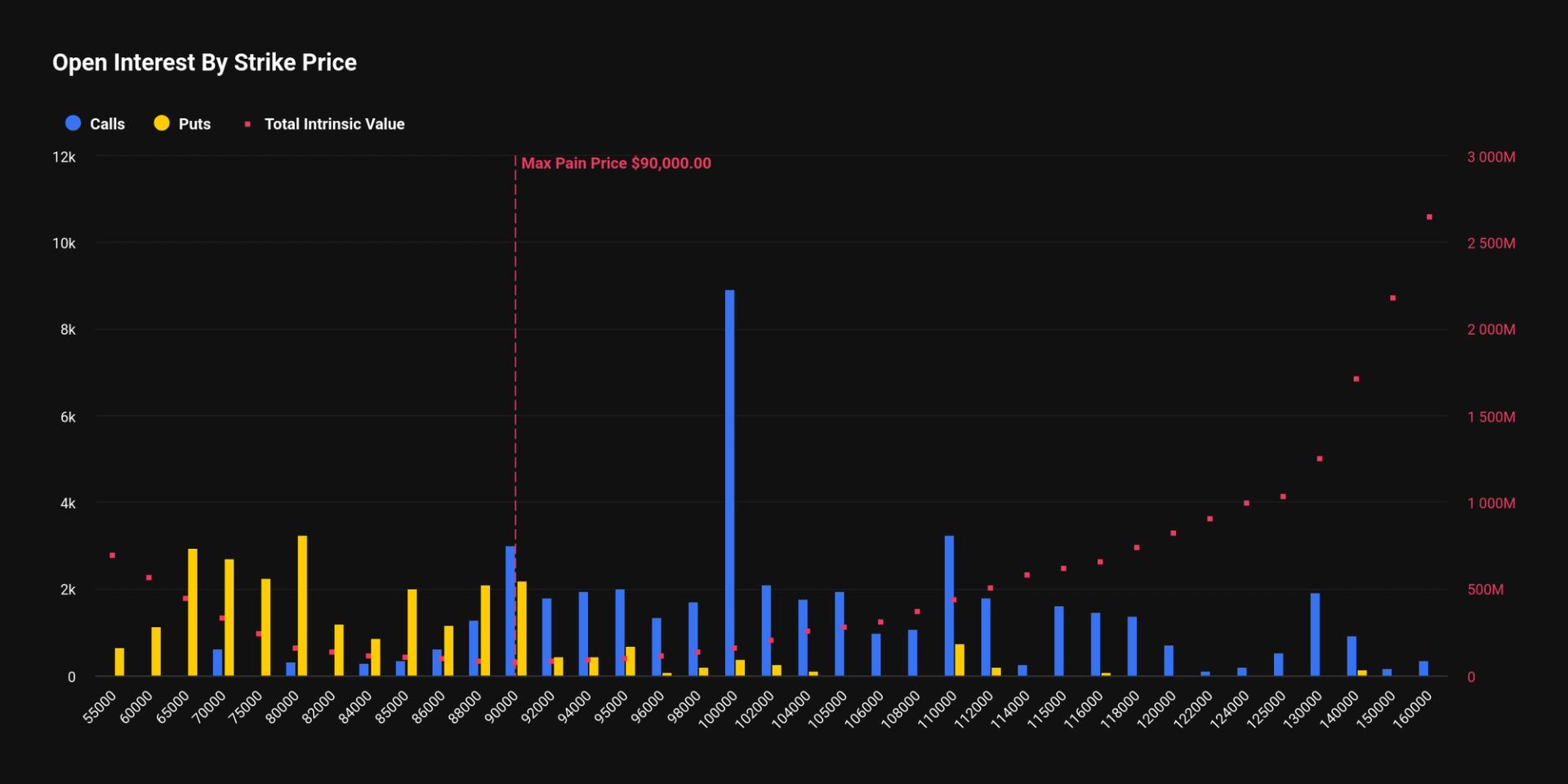

Since at the very least Friday, there was a notable improve in investor curiosity within the $100,000 strike January expiry name choice listed on Deribit, the world’s largest crypto choices alternate by quantity and open curiosity.

A name choice provides the purchaser the proper, however not the duty, to buy the underlying asset at a predetermined worth at a later date. The $100,000 name choice represents a guess that bitcoin’s worth will rally above that stage on or earlier than the expiry of the contract.

“Circulation stays dominated by rolls, with a notable uptick in curiosity across the 30 Jan 100k calls,” Jasper De Maere, desk strategist at Wintermute.

Prior to now 24 hours alone, the variety of energetic or open contracts in that exact choice has elevated by 420 BTC, based on knowledge supply Amberdata. That equates to a notional open curiosity progress of $38.80 million, probably the most amongst all January calls and throughout all platform-wide expiries on Deribit, the place one choices contract represents one BTC.

The choice just lately boasted a complete notional open curiosity of $1.45 billion, with January expiry accounting for $828 million alone, based on knowledge supply Deribit Metrics.

The upside positioning aligns with the bullish sentiment that dominated most of 2025, when merchants chased name choices at strikes from $100,000 to $140,000.

Demand for these bullish choice performs may surge additional if BTC’s worth rally extends past $94,000, based on QCP Capital. The cryptocurrency has risen round 5% within the first 5 days of the 12 months, briefly topping $93,000 at one level early Monday.

“Put up-[December] expiry positioning has shifted. BTC perpetual funding on Deribit has jumped above 30%, signaling sellers are actually brief gamma to the upside. This dynamic was evident as spot pushed by means of 90k, triggering hedging flows into perpetuals and near-dated calls,” QCP Capital mentioned final week.

“A sustained transfer above 94k may amplify this impact,” the agency added.