Bitcoin has nonetheless not grow to be overbought based on the Mayer A number of. Right here’s the extent BTC would wish to breech with a view to enter this territory.

Bitcoin Mayer A number of Has A Worth Of 1.37 Proper Now

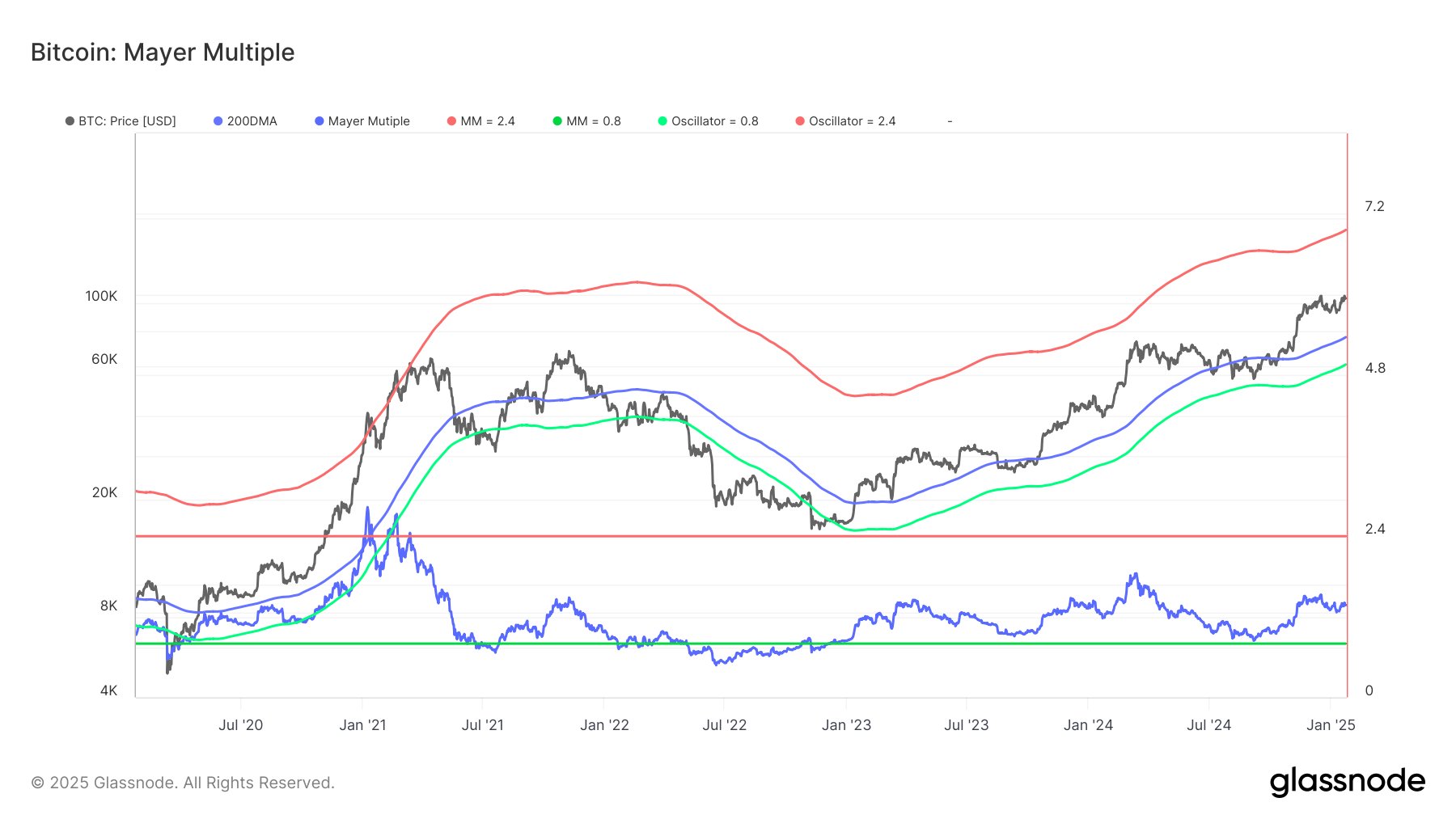

In a brand new put up on X, the analytics agency Glassnode has mentioned in regards to the newest development within the Mayer A number of for Bitcoin. The “Mayer A number of” right here refers to an indicator that retains monitor of the ratio between BTC’s spot value and its 200-day transferring common (MA).

As Glassnode explains,

The 200DMA is a well known device for gauging macro bull or bear bias. The Mayer A number of measures how far BTC is from this long-term common.

When the Mayer A number of has a price larger than 1, it means the value of the cryptocurrency is buying and selling above its 200-day MA. However, it being beneath the mark implies the asset is under this traditionally necessary degree.

Now, right here is the chart shared by the analytics agency, that reveals the development within the Bitcoin Mayer A number of over the previous few years:

As displayed within the above graph, the Bitcoin Mayer A number of has a price of 1.37 proper now, which implies that the asset has a notable distance over its 200-day MA.

Within the chart, Glassnode has additionally highlighted three strains the place the spot value of BTC would assume a Mayer A number of equal to a traditionally related worth. The inexperienced degree (backside) corresponds to the indicator assuming a price of 0.8.

BTC being beneath this degree has typically signaled oversold situations. The road is presently located round $60,000, which means that the asset must drop beneath this mark to reach on the bottoming zone.

The pink degree (prime) is situated at $181,000 proper now. At this value mark, the cryptocurrency’s Mayer A number of would attain a price of two.4. Going past this degree often implies that the asset is turning into overbought. “Though BTC is above its 200DMA, it’s fairly removed from the overbought territory,” notes the analytics agency.

Bitcoin must break the $181,000 degree if it has to cross above this degree within the present cycle. It solely stays to be seen, although, whether or not the asset would breach the extent on this cycle in any respect or if it could prime out earlier than it could occur.

The final line within the graph, the blue one within the center, is simply the 200-day MA of the asset. That’s, the road the place the Mayer A number of is precisely equal to 1. BTC dipped beneath this degree for some time in the course of the consolidation interval final 12 months.

BTC Value

On the time of writing, Bitcoin is buying and selling round $106,600, up virtually 2% within the final seven days.