Bitcoin (BTC) is hovering round a precarious stage beneath the $100,000 psychological stage as provide in revenue simply crashed to a brand new 2025 low. Amid this decline, Glassnode analysts Chris Beamish, Antoine Colpaert, and CryptoVizArt spotlight a posh interaction of structural weak spot, cautious investor habits, and decreased institutional demand. Bitcoin additionally stays oversold; nevertheless, it has but to enter full capitulation. This means that value is fragile however not damaged, balancing between restoration and the danger of a deeper decline.

Bitcoin Provide In Revenue Crash Indicators Weak Demand And Worth

Bitcoin’s provide in revenue has fallen sharply, hitting its lowest stage of 2025 and reflecting the broader slowdown in market momentum. Glassnode analysts notice that this decline signifies fading demand and persistent promote stress because the BTC value consolidates close to $100,000, after falling 21% from its all-time excessive above $126,000.

Associated Studying

In keeping with the report, roughly 71% of Bitcoin’s provide stays in revenue, close to the decrease fringe of the everyday 70% – 90% vary seen in mid-cycle slowdowns. This drop marks the bottom chance stage of the yr, suggesting that BTC’s value stability and restoration could rely upon whether or not recent demand can return to the market within the coming weeks.

The evaluation additionally disclosed that Bitcoin has damaged beneath the Quick-Time period Holder’s value foundation of roughly $112,500, and is now struggling to get better, confirming that its earlier bullish part has ended. They are saying that the market has been unable to regain a strong footing for the reason that October 10 flash crash and reset, with costs hovering simply above the Energetic Investor’s Realized Worth at $88,500.

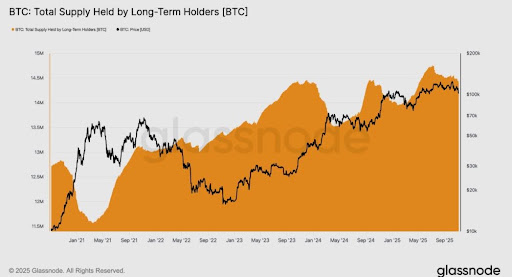

Moreover, on-chain information reveals that long-term holders are contributing to the bearish stress. Since July, Bitcoin’s whole provide has decreased from 14.7 million BTC to 14.4 million BTC, representing a web discount of roughly 300,000 cash. Glassnode analysts estimate that round 2.4 million BTC have been spent throughout this era, which is roughly 12% of its circulating provide.

Not like earlier available in the market cycle, these long-term holders at the moment are promoting into weak spot reasonably than energy, signaling fatigue and lowered sentiment, possible because of the constant market declines. Whereas the Relative Unrealized Loss stays reasonable at 3.1%, Glassnode analysts spotlight that the mix of declining profitability and regular long-term distribution leaves the Bitcoin value in a weak place close to $100,000.

Associated Studying

ETF Outflows And Unsteady Derivatives Deepen Market Warning

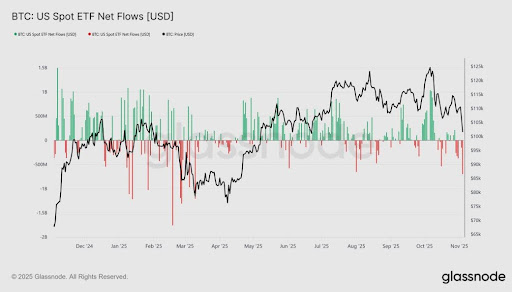

Along with the decline in Bitcoin’s provide in revenue, off-chain indicators additionally level to warning. Glassnode analysts notice that US Spot Bitcoin ETFs have seen web outflows between $150 million and $700 million per day over the previous two weeks, reversing the robust influx streak from September and early October. This slowdown displays a major decline in institutional urge for food, with capital rotating out of Bitcoin publicity as the value declines.

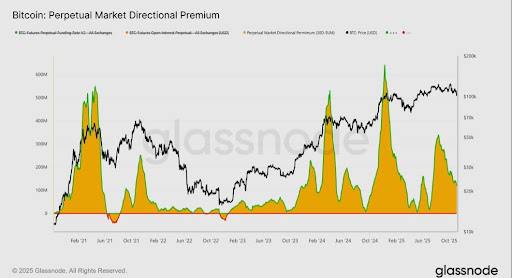

Bitcoin’s Cumulative Quantity Delta (CVD) has additionally turned damaging on Binance and main exchanges. In derivatives, analysts famous that the Perpetual Market Directional Premium has declined from $338 million in April to $118 million monthly, indicating that merchants are pulling again on threat and avoiding aggressive lengthy positions.

For now, Bitcoin stays in a fragile place, oversold however structurally intact. Glassnode specialists have acknowledged that the subsequent key check lies at $112,000 and $113,000, the place a sustained restoration would sign renewed demand, whereas additional weak spot may deepen the correction.

Featured picture created with Dall.E, chart from Tradingview.com