After its newest halving occasion, Bitcoin despatched a optimistic sign all through the crypto market. Traditionally, this massive drop in provide has been related to notable worth features, which has impressed investor hope.

Associated Studying

The halving, which lower the speed at which new Bitcoins have been made, has really slowed the circulate of latest Bitcoins into the market. This sudden drop in provide, together with rising curiosity from establishments and wider use, is prone to push Bitcoin costs up.

Many traders are attentively observing these dynamics and anticipate the same development within the close to future; earlier halvings have typically adopted vital worth rebounds.

Bitcoin: Altering Investor Attitudes

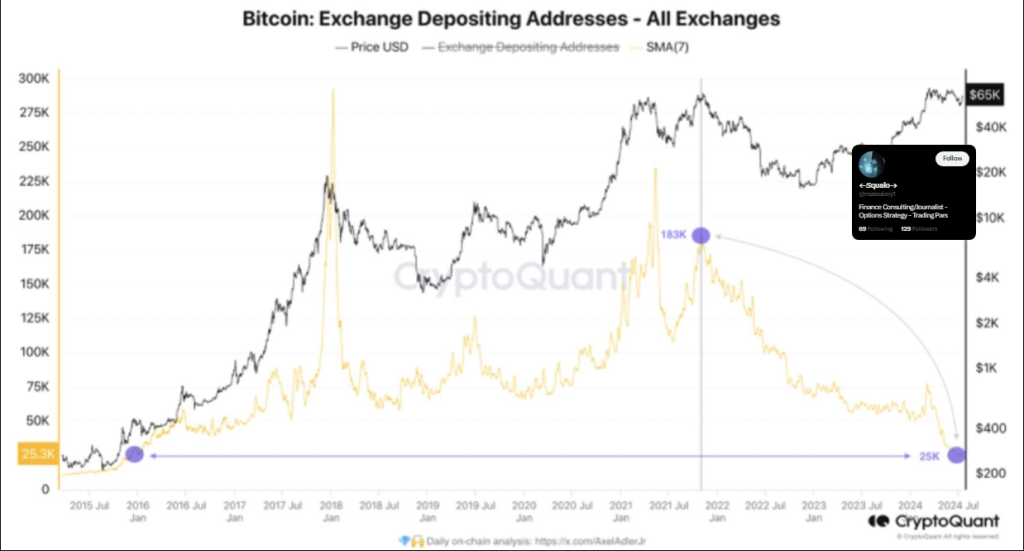

The substantial decline within the variety of new deposit addresses on cryptocurrency exchanges marks a transparent development within the Bitcoin market. Information from the well-known evaluation software CryptoQuant reveals that simply 25,000 relatively than 70,000 freshly registered Bitcoin deposits exist. This decline in promoting stress denotes a change in investor conduct in the direction of holding relatively than buying and selling their Bitcoin.

Buyers are unwilling to promote #Bitcoin

“A decreased willingness to promote property might result in a discount within the provide of Bitcoin available on the market, which, with regular or rising demand, could trigger worth will increase.” – By @AxelAdlerJr

Full put up https://t.co/HdipPeIh6h pic.twitter.com/jhNDHiSKst

— CryptoQuant.com (@cryptoquant_com) July 23, 2024

In keeping with CryptoQuant analyst AxelAdlerJr, this decline in promoting stress denotes a change in investor conduct in the direction of holding relatively than buying and selling their Bitcoin.

Such conduct reveals that the market is mature. As traders acquire extra religion in Bitcoin’s long-term worth, they commerce much less. They spend in a extra secure approach, which could make the market much less risky and extra secure. This development reveals that consumers are starting to see Bitcoin as an asset with worth, not only a technique to speculate, which is nice information for the cryptocurrency.

Institutional Confidence And Market Psychology

As an increasing number of funding corporations are pouring cash into Bitcoin, all the pieces has modified. Massive funding companies and institutional traders present the market legitimacy and safety, which might have an effect on how common people take into consideration investing. Massive gamers could encourage belief and long-term considering amongst smaller traders.

This dynamic is far enhanced by behavioral economics. The actions and confidence ranges of extra institutional traders coming into the market may have an effect on the sentiment of particular person traders. This phenomena can lead to a optimistic suggestions whereby rising confidence stimulates extra funding.

Associated Studying

One necessary statistic emphasizing this transformation in investor perspective is the declining deposit addresses. It implies that anticipating higher future costs, traders are much less able to promote their Bitcoin. Supported by each decrease provide and better demand from each institutional and particular person traders, this line of considering matches the rising conviction that the worth of Bitcoin will preserve rising.

Featured picture from Pixabay, chart from TradingView