Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Bitcoin (BTC) has surged 14.6% over the previous two weeks, rising from roughly $84,500 on April 18 to the mid-$90,000 vary on the time of writing. With this upward momentum, the main cryptocurrency seems to be setting its sights on a brand new all-time excessive (ATH), as a number of technical and momentum indicators trace at a rising bullish development.

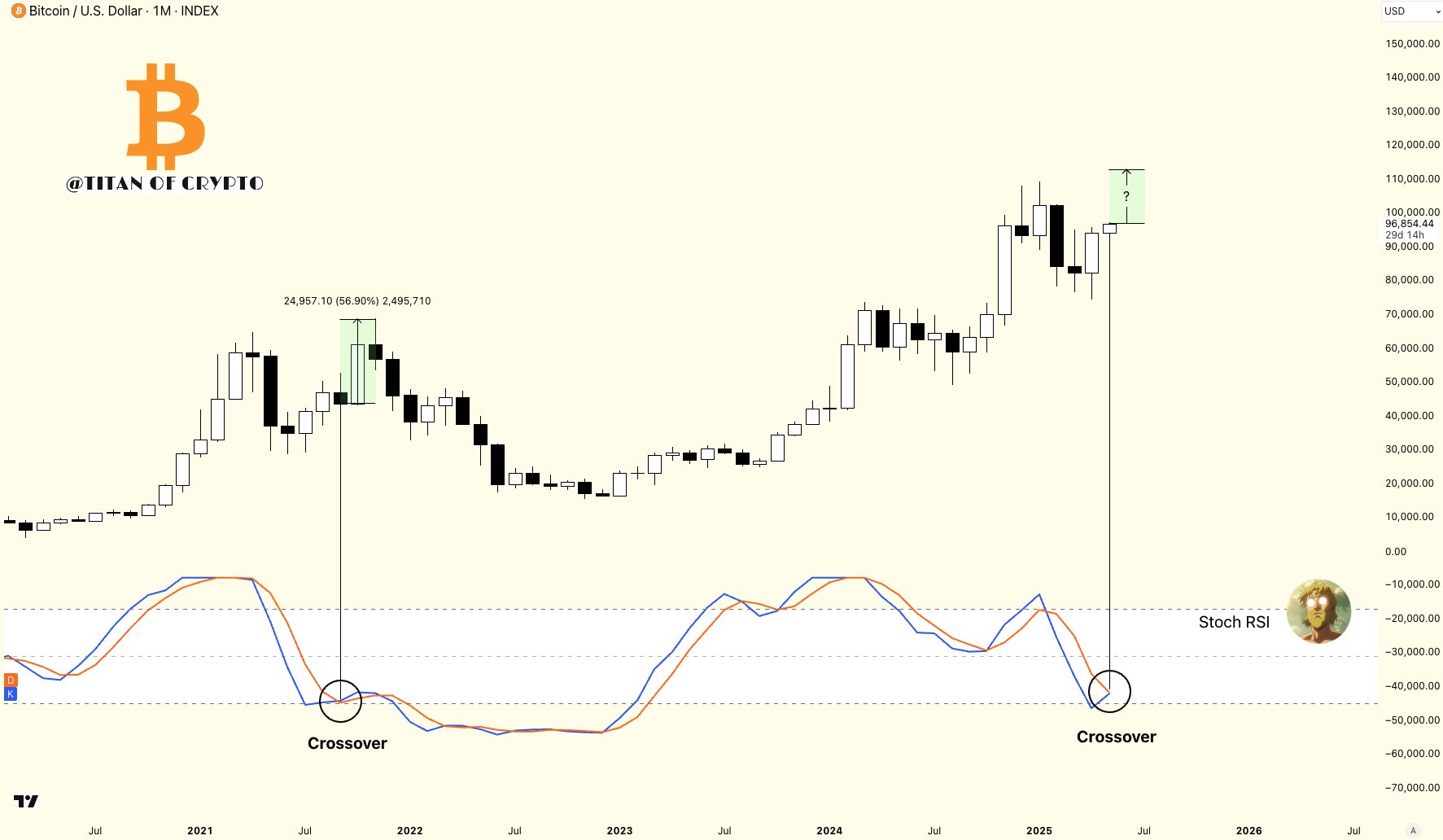

Bitcoin Month-to-month Stochastic RSI Turning Bullish

In a current put up on X, crypto analyst Titan of Crypto shared a BTC month-to-month chart indicating that the Stochastic Relative Power Index (RSI) is on the verge of a bullish crossover.

For the uninitiated, a Stochastic RSI bullish crossover alerts rising upward momentum and is commonly interpreted as a possible purchase sign or the beginning of a possible rally. Titan of Crypto added that if confirmed, the bullish crossover could provoke BTC’s subsequent leg up.

Associated Studying

For example, the analyst referred to BTC’s value motion on the month-to-month chart from again in Q3 2021. On the time, an identical bullish crossover within the Stochastic RSI preceded a 56.9% surge in Bitcoin’s value.

Nonetheless, Bitcoin should maintain above essential assist ranges to keep up this bullish construction. In a separate X put up, famend analyst Ali Martinez famous that BTC might re-test the $95,700 assist zone earlier than advancing towards the $100,000 milestone.

On the resistance facet, Martinez emphasised that $97,530 stays a “key degree to look at.” A profitable breakout past this threshold might pave the best way for BTC to revisit or surpass its earlier ATH. Because it stands, Bitcoin is buying and selling roughly 10% beneath its document excessive.

Analysts Predict BTC’s Subsequent Transfer

Crypto analyst Rekt Capital additionally weighed in on BTC’s potential trajectory. In an X put up printed yesterday, he urged that after BTC decisively breaks by way of the $97,000 to $99,000 zone, it might face rejection close to $104,500. Following that, holding the $97,000–$99,000 vary as assist can be essential for BTC to launch towards new highs.

Associated Studying

Equally, analyst Ted famous that BTC is presently buying and selling in a Wyckoff accumulation part. The analyst added that BTC’s slide beneath $76,000 in early April was seemingly the underside for this market cycle. He added:

Wanting on the Wyckoff accumulation sample, it looks as if the $96K-$99K degree might act as a resistance. I feel BTC might consolidate right here for just a few days, earlier than finally breaking to the upside.

Regardless of bullish momentum, some issues stay. Analysts warning that Bitcoin is unlikely to face a real provide shock within the rapid future, which might mood upside potential. At press time, BTC trades at $97,142, up 0.9% prior to now 24 hours.

Featured picture created with Unsplash, charts from X and TradingView.com