On-chain knowledge reveals the Bitcoin short-term holders have been transferring massive quantities to exchanges at a loss following BTC’s bearish motion.

Bitcoin Brief-Time period Holders Are Taking part In Loss-Taking

In a brand new put up on X, CryptoQuant group analyst Maartunn has talked in regards to the response to the latest Bitcoin worth decline from the short-term holders (STHs).

The STHs confer with the BTC holders who bought their cash throughout the previous 155 days. Statistically, the longer an investor holds their cash, the much less probably they change into to promote them sooner or later. As such, the STHs with their comparatively low quantity of holding time are thought-about to signify the weak fingers of the market.

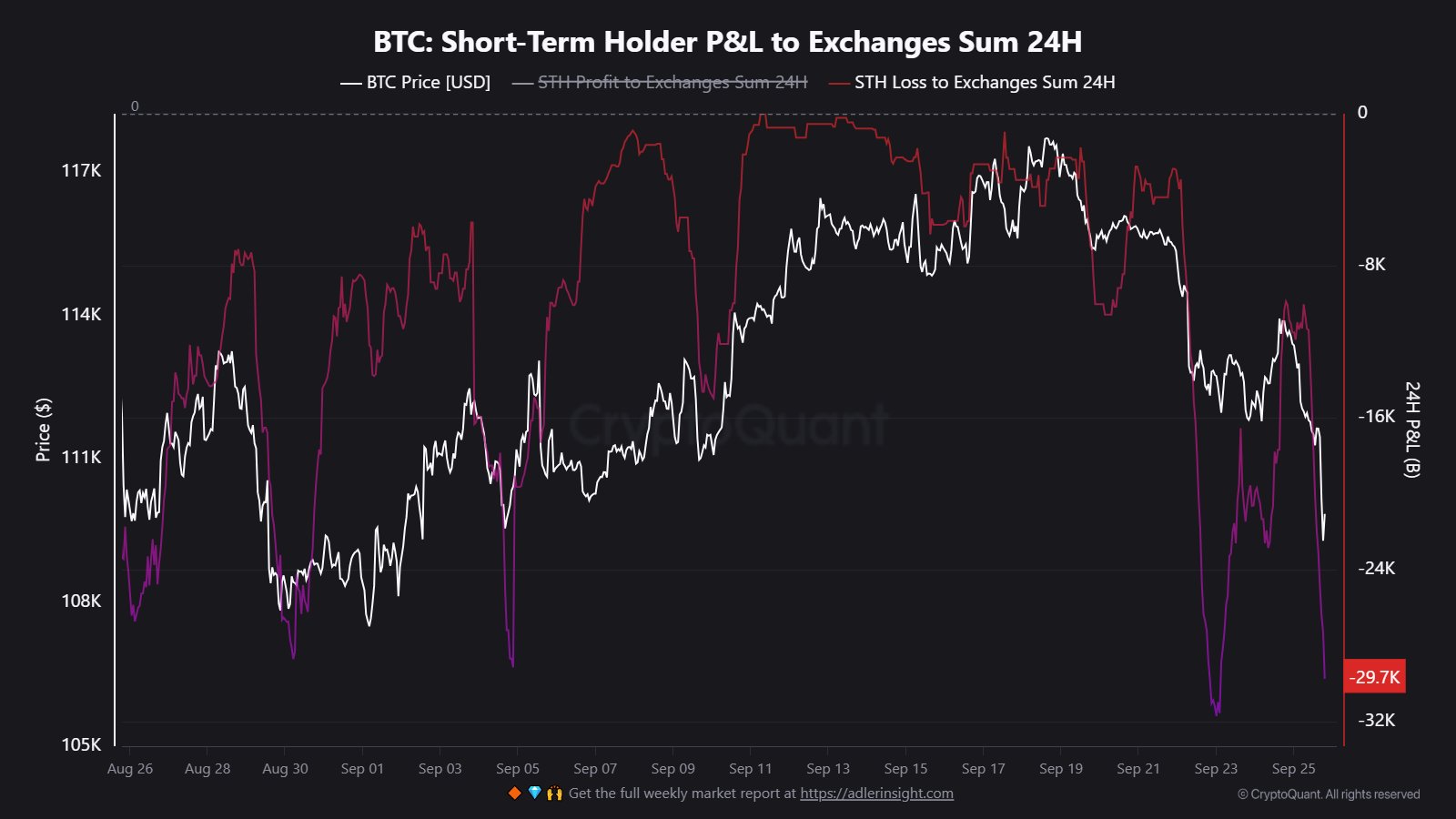

Like common, this cohort has additionally panicked within the face of the newest worth volatility. Beneath is the chart shared by Maartunn that reveals the pattern within the loss transactions made by the cohort’s members to wallets related with centralized exchanges.

Appears like the worth of the metric has witnessed two sharp spikes in latest days | Supply: @Maartun on X

From the graph, it’s obvious that the Bitcoin STHs deposited practically 32,000 BTC at a loss to exchanges in the course of the crash from earlier within the week. Usually, holders switch their cash to exchanges after they need to make use of one of many companies that they supply, which may embrace promoting.

Contemplating the character of the STHs, these loss deposits have been probably made with distribution in thoughts. Thus, these buyers reacted to the plummet by capitulating.

The most recent decline in BTC’s worth to ranges below $109,000 has been met with an identical response, with the 24-hour worth of the metric hitting the 29,700 tokens mark.

In whole, the STHs have participated in capitulation of greater than 60,000 BTC, price a whopping $6.5 billion, throughout these two loss-taking waves. “That’s a transparent signal of heavy stress throughout the market,” notes the analyst.

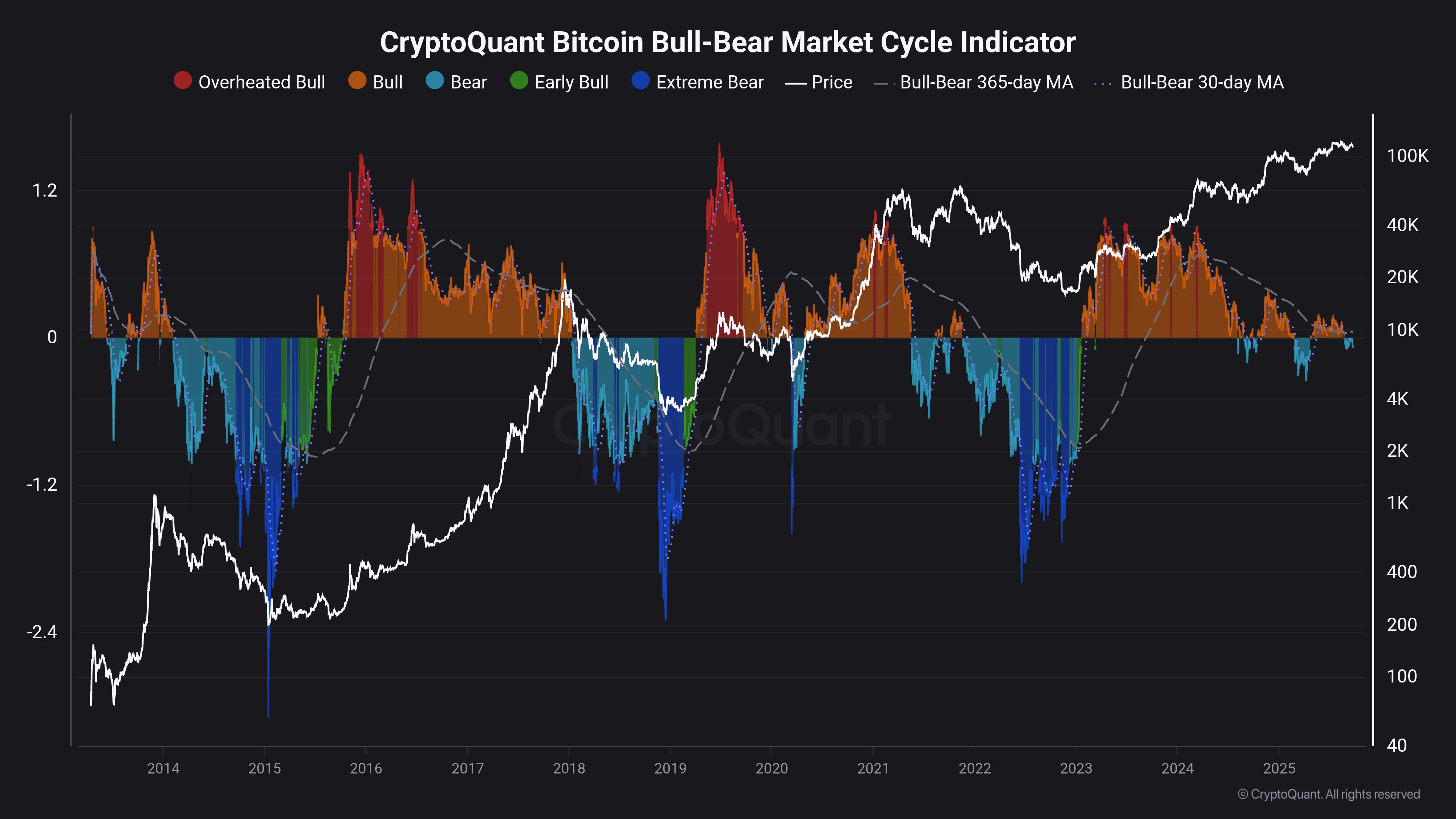

In another information, CryptoQuant’s Bitcoin Bull-Bear Market Cycle Indicator is flashing a “bear” sign for the cryptocurrency, as Maartunn has identified in one other X put up.

The information of the CryptoQuant BTC Bull-Bear Market Cycle Indicator over the previous decade | Supply: @JA_Maartun on X

The Bitcoin Bull-Bear Market Cycle Indicator makes use of the information of a number of in style on-chain metrics to find out what section of the cycle the asset is at present in. In line with the indicator, BTC is in a bearish section for the time being.

The 365-day shifting common (MA) of the metric has additionally been on the way in which down for some time now, which additionally doesn’t are typically a constructive sign. “Traditionally, most BTC positive factors occur when this metric is rising, not falling,” explains the analyst.

BTC Worth

Bitcoin has come all the way down to the $108,900 stage following a decline of greater than 5.5%.

The pattern within the worth of the coin during the last 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.