As the worth of Bitcoin pushes close to its all-time excessive, a number of areas involving the crypto king, particularly the Spot ETFs, are beginning to flip remarkably inexperienced as soon as once more. With the Spot ETFs recording bullish closes, this renewed momentum is starting to problem the spot market buying and selling.

Institutional Capital Flows Bolster Bitcoin Spot ETFs

The historic Bitcoin Spot Alternate-Traded Funds (ETFs) are returning to their bullish state because the market recovers. A current analysis by Darkfost, a market professional and CryptoQuant writer, reveals that BTC spot ETFs are rapidly gaining traction within the cryptocurrency funding market.

Whereas gaining severe traction, the BTC spot ETFs seem like difficult and closely drawing consideration away from direct spot market buying and selling. Such improvement implies that these merchandise could also be changing into the perfect gateway between conventional finance and digital property as a consequence of their regulated accessibility, institutional confidence, and rising inflows.

In accordance with the professional, the market is at present in a interval the place ETFs have gotten more and more standard in comparison with the spot market. That is altering the best way that institutional and particular person buyers are uncovered to Bitcoin, indicating a basic shift within the dynamics of the market.

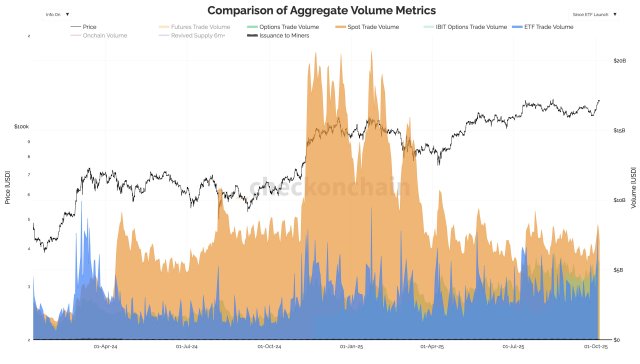

When analyzing buying and selling volumes, with out taking into consideration derivatives, the spot market continues to dominate by a large margin. Nevertheless, it’s clearly evident that ETF volumes are rising considerably. In consequence, Darkfost believes it’s extremely related to watch the ETF flows in these days.

Usually, volumes have ranged between $1 billion and $2.5 billion between Could 2024 and November 2024, excluding the preliminary launch interval of spot BTC ETFs. In the meantime, nowadays, they’re extra within the vary between $2.5 billion and $5 billion.

Darkfost highlighted that this improve in quantity might be as a result of sturdy growth of Bitcoin spot ETFs, particularly in america. With this development, ETF volumes are already catching as much as spot volumes, which could sign the beginning of a paradigm shift if the development retains getting stronger.

A Huge Vary Of Traders Flocking In

Within the midst of this paradigm shift, the professional said that ETFs have made cryptocurrency extra accessible to a wider vary of buyers, significantly within the US. Whereas ETFs could have taken away liquidity from the spot market, the funds have additionally absorbed a large portion of Bitcoin.

As ETFs are additionally well-structured devices for institutional buyers, these BTCs are nonetheless being traded like some other crypto asset, however underneath a distinct framework. One other essential facet highlighted by Darkfost is that these BTC holdings change into much less reactive.

This improvement is pushed by the truth that provide is at present managed by massive asset administration firms reminiscent of BlackRock and Constancy. As an alternative of utilizing Worry of Lacking Out (FOMO) or market panic, these firms handle primarily based on provide and demand dynamics. Within the meantime, Darkfost famous that each one of this helps the notion that there’s a vital shift happening within the Bitcoin market.

Featured picture from Pixabay, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.