Bitcoin is buying and selling round key ranges after reclaiming the $115,000 mark, with bulls firmly in management regardless of ongoing consolidation under the $120,000 threshold. The pattern stays bullish, supported by regular shopping for curiosity and powerful technical positioning.

Associated Studying

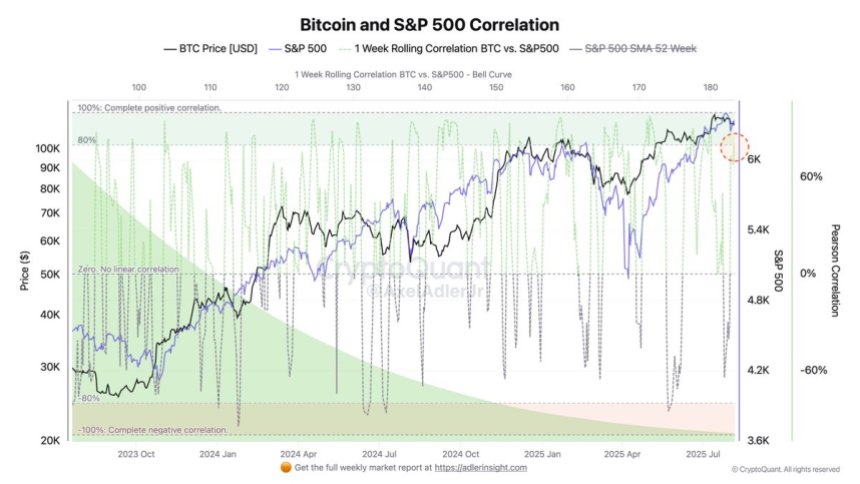

Key knowledge exhibits that the correlation between Bitcoin and the S&P 500 has surged to 80%. On this high-correlation regime, a continued rally in US equities may present Bitcoin with a tailwind towards new highs, whereas an fairness pullback may amplify draw back volatility.

With the S&P 500 presently in a bullish part, BTC seems to be monitoring the identical trajectory. Nonetheless, market watchers warning that such excessive correlation ranges are sometimes short-lived and liable to sharp reversals. For now, merchants are intently monitoring each fairness and crypto charts, understanding that any shift in danger urge for food throughout conventional markets may shortly ripple into Bitcoin’s worth motion.

S&P 500 Correlation Strengthens Bitcoin’s Macro Hyperlink

Based on prime analyst Axel Adler, the latest 80% correlation between Bitcoin and the S&P 500 underscores how deeply macroeconomic forces are influencing the crypto market. On this setting, key drivers equivalent to rate of interest expectations, liquidity circumstances, and the broader risk-on/risk-off sentiment are immediately transmitted to BTC’s worth motion.

Beneath this regime, a sustained restoration in US equities will seemingly present a supportive backdrop for Bitcoin. Conversely, if inventory markets expertise a downturn, the destructive sentiment may shortly spill over into the crypto house, amplifying sell-offs and triggering broader market weak point.

Adler factors out that the present studying relies on a 1-week rolling correlation metric, which is inherently risky. Traditionally, such correlation spikes are not often sustained for lengthy durations. The current degree, whereas important, is unlikely to carry for various weeks earlier than reverting towards its imply.

Regardless of the short-term nature of this spike, the analyst emphasizes that the expansion of crypto adoption within the US—from institutional merchandise like ETFs to company treasury allocations—units the stage for a bullish long-term outlook. Nonetheless, merchants should stay aware that macroeconomic downturns, tightening liquidity, or shifts in Federal Reserve coverage may quickly reverse market sentiment.

Associated Studying

Bitcoin Worth Evaluation: Bulls Defend Key Help

Bitcoin (BTC) is buying and selling round $116,565, holding regular after reclaiming the $115,724 assist degree, which coincides with a key horizontal zone from late July. On the 4-hour chart, BTC lately broke above the 50-day, 100-day, and 200-day SMAs, signaling short-term bullish momentum. These transferring averages, now converging close to $116,000, may act as a powerful assist cluster if examined once more.

The fast upside goal stays the $122,077 resistance, final examined in mid-July. Nevertheless, BTC has confronted promoting stress close to $117,000, indicating short-term consolidation earlier than a doable push larger. Quantity has tapered barely after the breakout, suggesting that consumers might have contemporary momentum to maintain the transfer.

Associated Studying

If BTC holds above $115,724 and the transferring common cluster, bulls may try a breakout towards the $118,000–$122,000 zone. Nevertheless, rejection would possibly set off a retest of $115,724, with a deeper pullback.

Featured picture from Dall-E, chart from TradingView