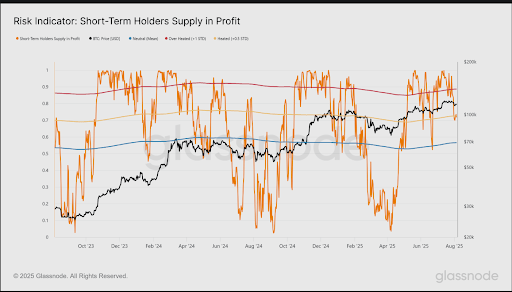

Onchain analytics platform Glassnode has revealed that the majority Bitcoin short-term holders are in revenue. This improvement has raised the opportunity of the flagship crypto dealing with one other sell-off from this class of holders, who could also be unable to carry throughout this era of sideways motion.

70% of Bitcoin Brief-Time period Holders Are in Revenue

A Glassnode report revealed that 70% of the Bitcoin short-term holders’ provide is in revenue regardless of the latest Bitcoin value pull-back. The platform famous that the deeper the correction, the extra their provide is more likely to fall into loss, a improvement which may have an effect on these holders’ confidence.

Associated Studying

The report additional said that, contemplating that the Bitcoin value is presently buying and selling inside a comparatively skinny air-gap, the promote strain is more likely to come from late-stage profit-taking, ought to this occur. For now, the promote strain from these Bitcoin short-term holders appears to be comparatively low.

Glassnode identified the share of spent quantity originating from Bitcoin short-term holders who had been in revenue to evaluate how a lot this corrective part has influenced these buyers. This metric measures the variety of not too long ago acquired cash which are taking revenue. The platform famous that the proportion of short-term holders spent cash taking revenue has cooled off, presently at 45%, which is a impartial place.

Glassnode said that this means that the market is in a comparatively balanced place, calming fears a couple of potential sell-off from Bitcoin short-term holders. In the meantime, the platform additionally alluded to the Bitcoin ETFs, which additionally create sell-side strain for the flagship crypto. These ETFs recorded a web outflow of 1,500 BTC on August 5, the most important wave of sell-side strain since April 2025.

The report famous that outflows from the Bitcoin ETFs have been comparatively transient occasions, with only some cases of an prolonged streak of every day outflows, which create sustained sell-side strain. Glassnode believes that keeping track of the ETF flows will assist to determine whether or not this newest outflow is only a repeat of the short-lived development or a shift in buyers’ sentiment.

$116,900 Is The Resistance Stage BTC Wants To Break Above

Glassnode indicated that the Bitcoin value wants to interrupt above the $116,900 stage decisively to construct any momentum for the following leg up. This stage serves as the price foundation of native high patrons who purchased BTC during the last month. The platform claimed {that a} sustained value transfer above this stage would sign that the demand aspect is regaining management.

Associated Studying

Moreover, it additionally provides early affirmation that the Bitcoin value has discovered dependable help and will proceed its transfer to the upside. However, if BTC stays under this stage for an extended interval, Glassnode remarked that it will increase the danger of a deeper correction. Bitcoin may drop towards the decrease certain of the air hole close to $110,000.

On the time of writing, the Bitcoin value is buying and selling at round $116,800, up over 2% within the final 24 hours, in accordance with information from CoinMarketCap.

Featured picture from Pixabay, chart from Tradingview.com