Este artículo también está disponible en español.

A current Quicktake evaluation on the on-chain analytics platform CryptoQuant highlighted how Bitcoin’s short-term holders’ (STH) behaviour is much like that of 2019. This evaluation comes as Bitcoin stays beneath $60,000, persevering with the bearish September pattern.

Peak In Bitcoin’s Quick-Time period Holders Related To 2019 Construction

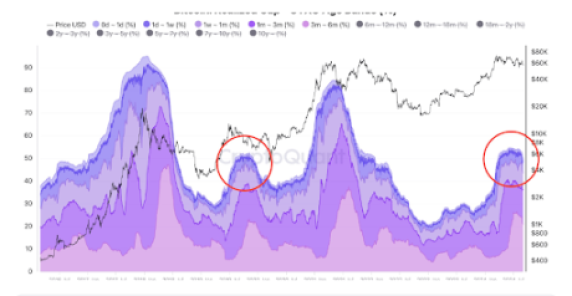

CryptoQuant contributor Avocado_onchain famous that there had been a “small peak” in Unspent Transaction Outputs (UXTOs) beneath six months, which resembles an identical construction noticed in 2019. The analyst defined that these UXTOs beneath six months are new traders (or short-term holders) who entered the market round March of this 12 months when Bitcoin’s worth hit a new all-time excessive (ATH).

In line with the analyst, the declining proportion of those UXTOs means that these traders have both exited the market attributable to Bitcoin’s uneven worth motion since March or have held and now transitioned to long-term holders (UTXOs of six months and above).

The accompanying chart confirmed {that a} related construction occurred across the halving occasion in 2019 when Bitcoin additionally reached an area excessive. After that, Bitcoin’s worth cooled off and took nearly 490 days to hit a brand new ATH, though Avocado_onchain famous that there was additionally the affect of the COVID-19 pandemic.

This improvement undoubtedly gives insights into what Bitcoin traders might count on from the flagship crypto in the long run, though its worth stays uneven. Avocado_onchain remarked that he’s assured about Bitcoin’s long-term upward pattern. Nevertheless, within the brief time period, he believes will probably be clever for traders to “mood expectations and intently monitor the market.”

In the meantime, though the analyst admitted that there is no such thing as a clear set off for a Bitcoin breakout, he famous that the inflow of capital from new traders has traditionally been very important for Bitcoin’s worth will increase. Bitcoin hit a brand new ATH in March following the launch of the Spot Bitcoin ETFs, which launched new cash into the Bitcoin ecosystem.

Bitcoin Appears To Proceed Bearish September Pattern

Bitcoin seems to be to proceed its bearish September pattern this 12 months, with the flagship crypto already down by over 4% because the month started. Traditionally, September is thought to be a bearish month, as knowledge from Coinglass reveals that Bitcoin has suffered a month-to-month loss in six out of the final seven September, relationship again to 2017.

Associated Studying

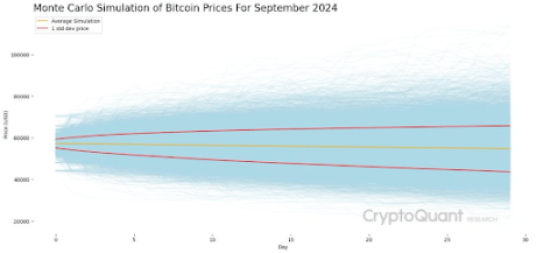

Following his simulation of Bitcoin’s worth for this month, CryptoQuant’s Head of Analysis, Julio Moreno, talked about that, on common, the flagship crypto might finish the month at $55,000. Moreno had earlier talked about {that a} drop beneath $56,000 for Bitcoin places the crypto liable to a deeper worth correction and coming into a protracted bearish section.

For now, the crypto group hopes that the US Federal Reserve will lower charges at its subsequent FOMC assembly, which is scheduled for September 17 and 18. A fee lower is believed to be one that would set off Bitcoin’s worth and result in a profitable breakout above $60,000.

On the time of writing, Bitcoin is buying and selling at round $56,400, down over 4% within the final 24 hours, in keeping with knowledge from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com