Este artículo también está disponible en español.

Whereas Bitcoin (BTC) fluctuates across the essential $100,000 worth stage, some buyers could search the perfect alternative to take earnings and exit the market. On this context, a CryptoQuant evaluation highlights a key BTC metric that may function a priceless device for crafting an exit technique.

Have Earnings In Bitcoin? Preserve An Eye On This Indicator

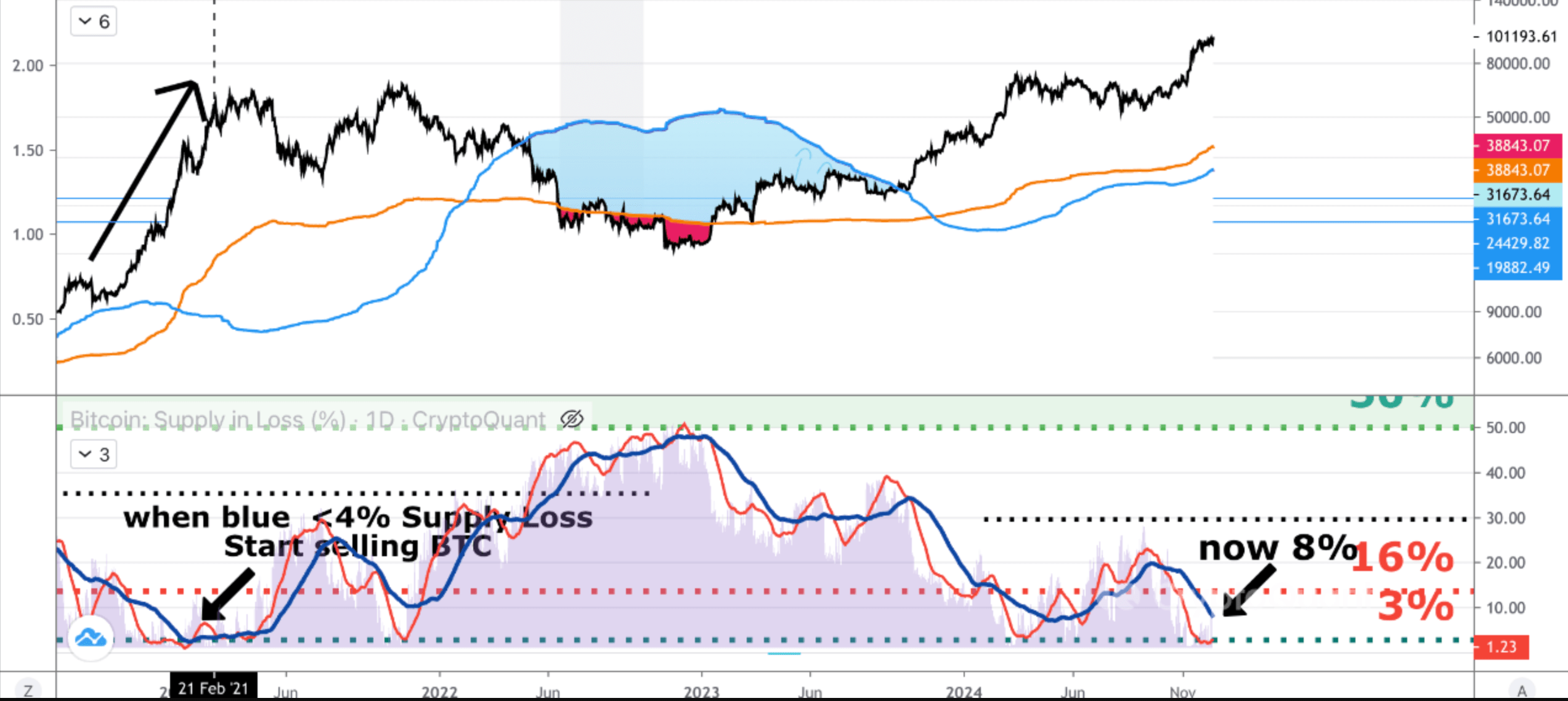

In a Quicktake weblog publish printed immediately, CryptoQuant contributor Onchain Edge shared insights into timing the sale of BTC through the present bull market. The analyst emphasised the significance of the Bitcoin provide in loss metric, noting its potential to sign when to begin exiting the market to protect earnings.

Associated Studying

For these unfamiliar with Bitcoin, the availability in loss measures the share of BTC held at a loss primarily based on its final moved worth. A low proportion of provide in loss sometimes signifies peak market euphoria and serves as a warning to safe earnings earlier than a bear market correction begins.

In keeping with the CryptoQuant evaluation, when BTC provide in loss drops under 4%, it alerts time for buyers to contemplate dollar-cost averaging (DCA) out of their BTC holdings and look ahead to the subsequent bear market lows. At present, the BTC provide in loss sits at 8.14%.

DCA is an funding technique the place buyers allocate a set amount of cash to an asset at common intervals, no matter its worth. This methodology helps cut back the impression of market volatility and lowers the typical price per unit over time. The analyst provides:

Why? Under 4% means lots of people are in a revenue that is the height bullrun part. Belief me you don’t need to be bagholding since you thought we are going to by no means see a bear market once more. Be fearful when others are grasping.

Analysts Assured Of Additional Upside In BTC Worth

Whereas monitoring the BTC provide in loss metric might help buyers safeguard their earnings, current forecasts from crypto analysts counsel there may nonetheless be room for additional upside earlier than this indicator turns into essential.

Associated Studying

In keeping with crypto analyst Ali Martinez, BTC types a traditional cup and deal with sample on the weekly chart. The premier cryptocurrency seems to be poised to interrupt out of the bullish formation, with targets as excessive as $275,000.

Equally, Donald Trump’s victory has introduced recent optimism within the crypto business. Within the lately concluded Bitcoin MENA convention in Abu Dhabi, Trump’s former marketing campaign chairman, Paul Manafort, famous that BTC buyers can “count on greater than $100,000” through the ongoing market cycle.

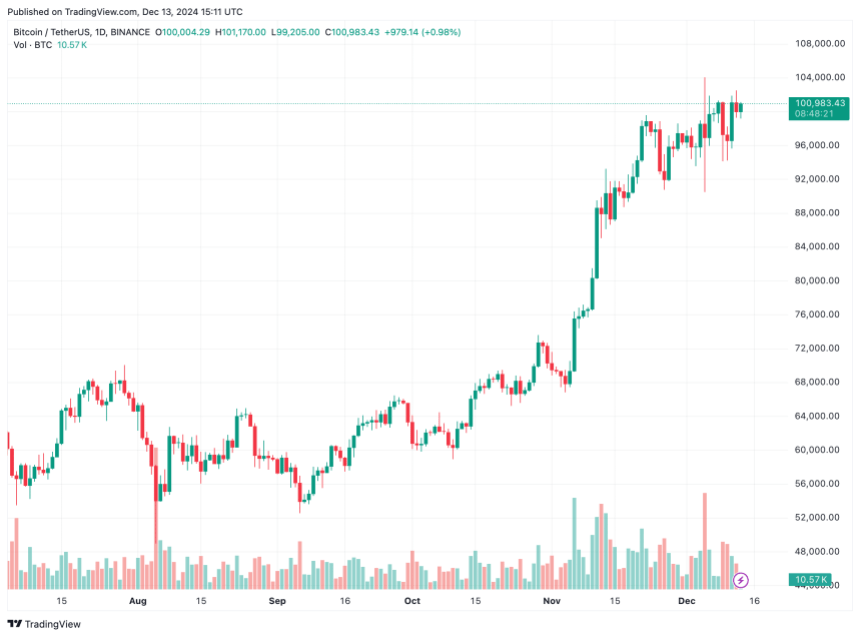

Different forecasts stay equally bullish. Tom Dunleavy, Chief Funding Officer at MV World, tasks BTC to succeed in $250,000, whereas Ethereum (ETH) may climb to $12,000 throughout this market cycle. BTC trades at $100,983 at press time, up a modest 0.1% prior to now 24 hours.

Featured picture from Unsplash, Charts from CryptoQuant and TradingView.com