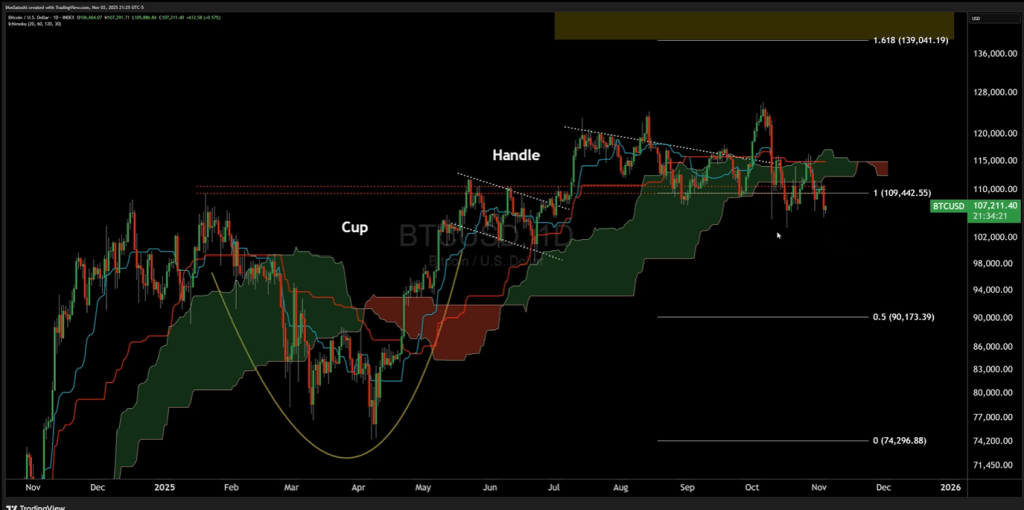

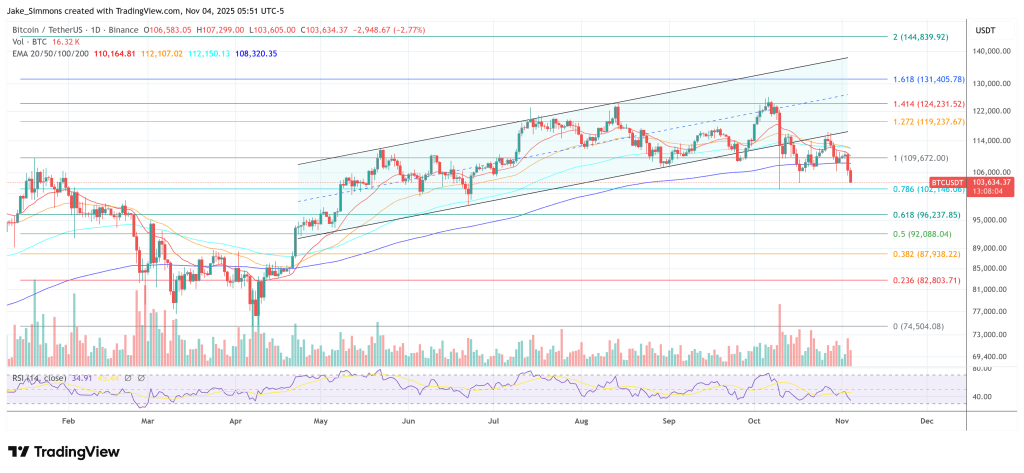

Bitcoin’s technical construction stays decisively detrimental and can keep that approach “till” a key resistance degree is reclaimed, in response to veteran analyst Josh Olszewicz in his newest video printed in the present day. Pointing to the Ichimoku Cloud and a stack of pattern indicators, Olszewicz stated, “Under the cloud we’re bearish, above we’re bullish. We’re presently under… [and] totally bearish on value and the expectation is decrease lows.”

The fulcrum, in his view, is a reclaim of roughly $115,000. “I don’t actually have something bullish to say right here in any respect till we’re again above $115,000 on BTC and $4,200 on ETH,” he stated, including that Ethereum’s setup is relatively much less detrimental—buying and selling “within the cloud,” with what he nonetheless characterizes as “actually not a protracted entry sign.”

For Bitcoin, he flagged a confluence of bearish cues: a bearish Chikou span on the weekly, moving-average crosses to the draw back, and head-and-shoulders patterns each at bigger and smaller scales. Whereas he acknowledged a attainable “falling channel” and even a broader “megaphone” that might complicate sample reads, Olszewicz underscored directional threat within the close to time period: “If I had been to randomly get up and see value at $103k, $102k, that may not shock me right here,” even warning that “it’s attainable we flirt with… under $100,000.”

The deterioration in derivatives premia underscores that message, he argued. “In the event you take a look at the idea on CME we’re making multi-month lows right here… you go to ETH [and it’s] additionally making important lows. So there’s actually no froth on this market based mostly on premiums.” Spot movement doesn’t assist both: “On BTC we’ve nonetheless received folks sending a whole lot of hundreds of thousands to exchanges seemingly on daily basis… my guess is they’re [selling] since you don’t ship cash to an alternate for enjoyable.”

Macro Headwinds For Bitcoin

Past crypto-native indicators, Olszewicz tied the setup to a macro regime shift that has turned unhelpful on the margins. He highlighted a still-ongoing US authorities shutdown as a possible kink in liquidity transmission—“perhaps when the federal government comes again… the pipes begin transferring once more”—and warned of rising near-term volatility round a knowledge drought: “We do have ADP employment on Wednesday… very, very intently paid consideration to as a result of there’s a information drought on employment numbers.”

Associated Studying

Since final week’s FOMC, he famous, rate-cut odds tightened materially “after Powell talked about a remark in regards to the fog. Acquired to decelerate on the fog, he says,” with threat belongings reacting poorly: “Equities didn’t like that… crypto actually didn’t like that.”

He additionally flagged the inflation now-casting combine as a swing issue. “Trueflation [is] ticking increased constantly… you don’t wish to be on this place the place we’re slicing into rising inflation,” he cautioned, whereas contrasting that with the Fed’s nowcast, which “doesn’t look as dire.”

A CPI headline starting with a ‘3’ can be problematic in his view: “I think if we do get a 3 deal with on headline CPI, markets aren’t going to love that.” Below the hood, he pointed to falling gasoline and used-car prints and easing rents as disinflationary, however referred to as out sticky elements like insurance coverage.

Liquidity optics stay blended: the reverse repo facility has seen periodic end-month spikes but is “operating on fumes,” and, crucially, the long-observed hyperlink between international liquidity gauges and BTC “has not reconnected in any regard since Might, June, July.”

Greenback energy is a further strain level. “The greenback continues to look good, continues to push increased… and this chart seems phenomenal… an actual downside” for Bitcoin if that uptrend persists, he stated. In traditional cross-asset distinction, he described the 60/40 US bonds/fairness combine as technically constructive—“above the cloud, bullish TK cross, bullish cloud”—and famous that threat proxies like high-yield credit score are diverging from the S&P 500, which he reads as in keeping with crypto’s underperformance: “With BTC struggling, you see riskier components of the market additionally pulling again to a larger diploma than equities.”

Equities Want To Stay Sturdy

In equities, he argued there’s “nothing to quick” on the key indices proper now—“SPY… seems nice,” with the Nasdaq and semis echoing the identical message—creating an ungainly asymmetry for BTC: “If Bitcoin can’t discover its approach when the SPY and the Q’s appear like this, we’re actually in hassle as a result of if this does reverse, that’s going to take BTC with it virtually actually.”

Associated Studying

On crypto-equity linkages, Olszewicz noticed that miners have outperformed for causes outdoors of Bitcoin’s fundamentals: “In the event you take a look at the Bitcoin miners, these have been bullish. Why? Due to AI and never due to Bitcoin… anyone following that story has achieved very properly this yr.” He prolonged the warning to different high-beta tech themes—quantum names “look very drained… increasingly more like a head and shoulders”—whereas acknowledging particular person standouts like Palantir, which he stated is “breaking out of its personal cup and deal with,” even when near-term value motion was uneven after hours.

The broader market psychology, in his view, is formed by cycle age and wealth preservation. “A thousand days from the underside, increasingly more individuals are simply saying, okay, that is sufficient… in the event that they’re wealthy, they wish to keep that approach… it makes some sense to take a bit of bit off the desk.” Till the technicals change, he sees no motive to drive trades: “Truthfully, not a lot, in all probability simply sit round and acquire some money. Watch for these A-plus setups to emerge.”

The set off for a regime shift is unambiguous in his framework. As he put it on the outset, “Under the cloud we’re bearish… not a bullish expectation.” The situation for flipping that view is equally clear: “Again above $115,000 on BTC and 4,200 on ETH,” or, on this headline phrases, reclaim the extent—or stay “totally bearish.”

At press time, BTC traded at $103,634.

Featured picture created with DALL.E, chart from TradingView.com