Bitcoin Value Weekly Outlook

Properly, that escalated rapidly! The bitcoin value simply melted throughout the $70,000s and $60,000s final week, however lastly discovered its footing at $60,000. The bulls battled again from down there to push the worth again as much as $71,700 earlier than it moved again barely to shut the week out at $70,315. The bears coated lots of floor to the draw back final week, so the bulls will attempt to get again some floor this week. Count on $60,000 assist to carry at the very least into this week.

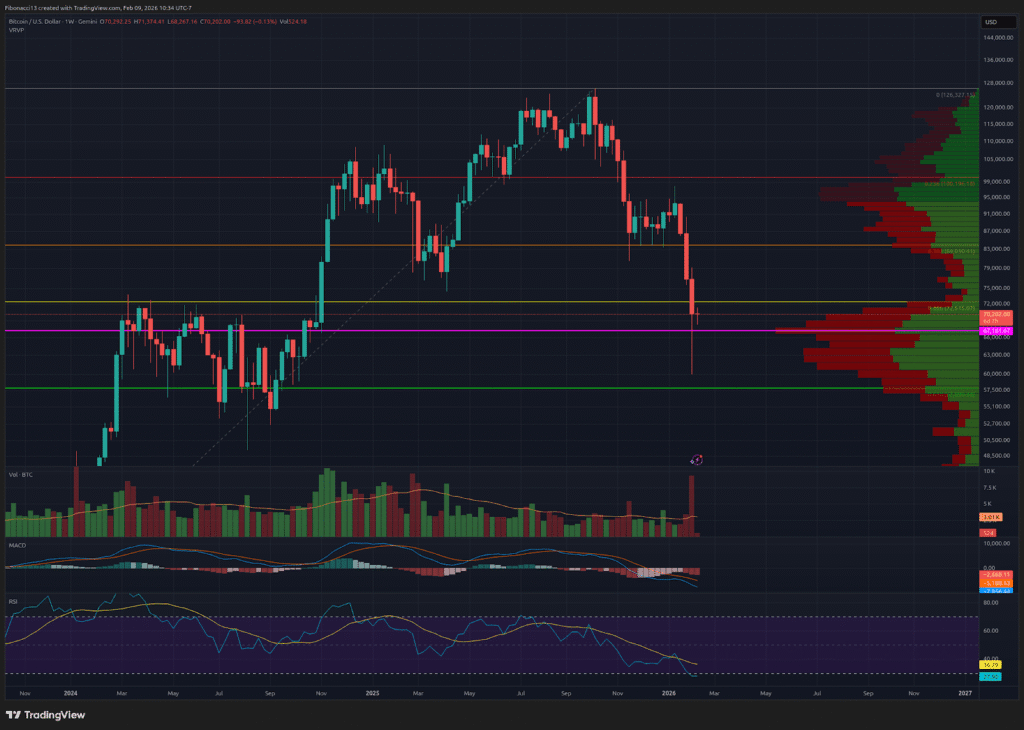

Key Assist and Resistance Ranges Now

With such an enormous transfer down final Thursday, we might want to discover new resistance ranges to observe going ahead. Over the quick time period, $71,800 is a degree to observe after the worth rejected there Friday into Saturday. Above right here, we now have the 0.382 Fibonacci retracement from the most recent transfer down, sitting at $74,500. If the worth can handle to climb above this degree, $79,000 needs to be a powerful resistance. $84,000 sits firmly above this degree and needs to be very sturdy resistance going ahead.

Wanting beneath, the bulls will look to carry $65,650 with a view to attempt to put within the reversal right here. $63,000 sits just under right here as assist. Subsequent, we now have $60,000 as newfound assist simply above the 0.618 Fibonacci retracement at $57,800. Arguably, the true assist sits at $57,800 right here and was barely front-run at that $60,000 low. If this degree is misplaced, we are going to look all the best way right down to $44,000 for assist, then $39,000 on the 0.786 Fibonacci retracement beneath right here.

Outlook For This Week

The MRI Indicator gave us a purchase sign on Friday final week on the each day chart off of the $60,000 low. The transfer was sturdy from that degree, so the bulls must attempt to capitalize on this bounce to proceed the momentum into this week. This sign can produce a full reversal, however usually solely leads to a 1 to 4 candle correction of the development. So if the bulls can hold the push larger going into Wednesday, we could also be a sustainable reversal on the each day chart, which may try and reclaim the $80,000 degree.

Market temper: Bearish – The worth misplaced lots of floor final week. The bears are in management. Interval.

The subsequent few weeks

The bears took the worth down one other large leg final week. Weekly RSI hit oversold ranges and produced an enormous bounce. After such a big drop and such an enormous bounce again from $60,000, the worth ought to stay constrained inside a spread right here for at the very least the following few weeks. Don’t count on to see any value motion above $80,000 or beneath $60,000 for the following few weeks.

Terminology Information:

Bulls/Bullish: Patrons or traders anticipating the worth to go larger.

Bears/Bearish: Sellers or traders anticipating the worth to go decrease.

Assist or assist degree: A degree at which the worth ought to maintain for the asset, at the very least initially. The extra touches on assist, the weaker it will get and the extra doubtless it’s to fail to carry the worth.

Resistance or resistance degree: Reverse of assist. The extent that’s prone to reject the worth, at the very least initially. The extra touches at resistance, the weaker it will get and the extra doubtless it’s to fail to carry again the worth.

Oscillators: Technical indicators that change over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low degree (usually representing oversold circumstances) and a excessive degree (usually representing overbought circumstances). E.G., Relative Power Index (RSI) and Transferring Common Convergence-Divergence (MACD).

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the pace of the worth and adjustments within the pace of the worth actions. When RSI is over 70, it’s thought of to be overbought. When RSI is beneath 30, it’s thought of to be oversold.

Fibonacci Retracements and Extensions: Ratios primarily based on what is named the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio relies on the constants Phi (1.618) and phi (0.618).

Momentum Reversal Indicator (MRI): A proprietary indicator created by Tone Vays. The MRI indicator tracks purchaser and vendor momentum and exhaustion, offering indicators to point when to count on momentum to fade and speed up.