Bitcoin value hovered close to $93,000 on Tuesday because the market continued to reel from skinny liquidity, cascading leverage, and rising bearish conviction throughout key technical ranges.

The Bitcoin value traded close to $94,000 at noon, up 1% previously 24 hours, with a hefty $111 billion in buying and selling quantity. The asset now sits 1% beneath its weekly excessive of $93,669 and 4% above its weekly low of $89,368.

Bitcoin’s circulating provide stands at 19,950,440 BTC, inching nearer to its 21 million onerous cap, whereas its international market cap ticked 1% increased to $1.85 trillion, based on Bitcoin Journal Professional information.

However sentiment is something however buoyant. With volatility rising and liquidity thinning, even modest flows are pushing the market round.

“Markets are nonetheless feeling the impression of the October 10 liquidation occasion,” Nicolai Søndergaard, Analysis Analyst at Nansen, wrote to Bitcoin Journal. “Market depth has fallen by roughly 30% since then, which suggests even modest promoting stress can transfer costs sharply. That’s basically why Bitcoin slipped beneath $90,000 at the moment. When liquidity is that this skinny, it takes far much less capital to push the market in both route, and while you layer leverage on high, volatility turns into inevitable.”

What Søndergaard is pointing to is the wave of liquidations triggered after a contemporary bout of commerce jitters set off a historic rush to unwind bitcoin lengthy positions. Buyers shed roughly $19 billion in leveraged bets throughout main exchanges in lower than a day — with some estimates placing the entire nearer to $30 billion.

On that day, the bitcoin value dropped over 10%. It marked the biggest bitcoin liquidation occasion on file.

Søndergaard added that choices information reveals a “non-negligible” likelihood of a dip towards the mid-$80,000 vary, although a bounce or stabilization close to present ranges seems extra possible.

Some long-term traders see alternative within the chaos: “In case your goal is to save lots of within the hardest cash humanity has ever recognized, you’ll be able to stack 25% extra bitcoin than you have been in a position to only a month in the past,” wrote Timot Lamarre, Director of Market Analysis at Unchained, to Bitcoin Journal.

Bitcoin value: Bearish construction dominates

The broader market temper turned sharply unfavourable after Bitcoin value’s decisive break beneath $96,000, a stage analysts at Feral Evaluation and Juan Galt had flagged for weeks as vital weekly assist. Analysts warn that “with the value closing so low, we must always not anticipate a lot of a bounce at this stage, if any.” Resistance above $94,000 is “thick now,” they stated, with sellers ready at each main value shelf.

A heavy-volume assist zone sits at $83,000–$84,000. One other key space sits at $69,000–$72,000, marking the highest of the 2024 consolidation vary. A slide into the mid-$80Ks can be turning into extra believable if volatility spikes once more.

Upside situations stay difficult. Even a shock quick squeeze, they wrote, would face “the equal of a brick wall” between the bitcoin value of $106,000 and $109,000. Solely a weekly shut above $116,000 would pressure a reconsideration of the bear pattern — an consequence they name unlikely.

The bitcoin value has now fallen greater than 25% from its October peak. That decline has triggered contemporary debate over whether or not the 2025 cycle high is already behind us. Traditionally, the September–December window hosts main cycle highs. This 12 months’s construction suits the sample — however with a twist: the highest might have arrived early and with much less pressure than anticipated.

A late-cycle peak in Q1 2026 stays doable. With equities exhibiting early indicators of fatigue and liquidity draining from danger markets extra broadly, they argue that “little hope stays for any significant rally or new highs” within the close to time period.

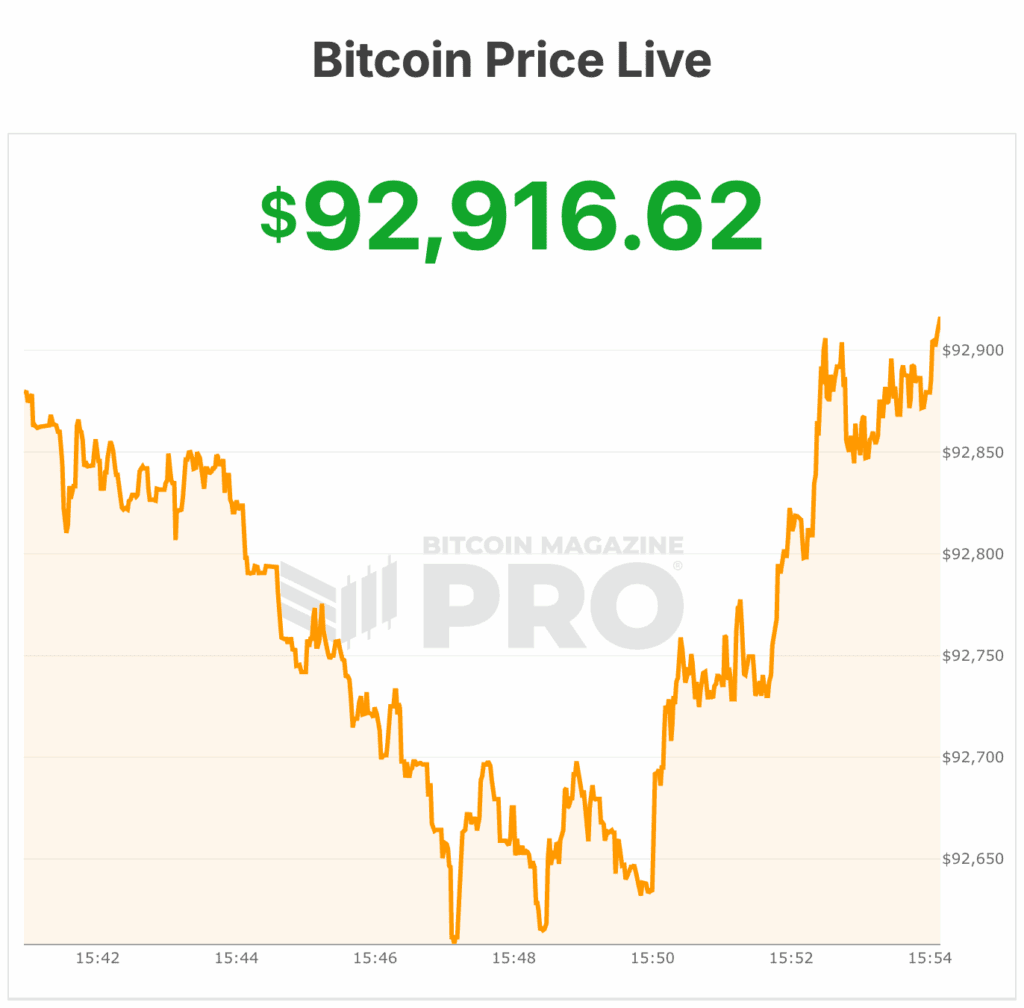

On the time of writing, the bitcoin value is 92,916. It’s 24-hour lows is $89,183 based on BM Professional information.