The bitcoin value is coming off its worst week since February, sliding greater than 30% from final month’s highs and reopening an outdated query for buyers: why is that this taking place now? In keeping with Deutsche Financial institution, the sell-off isn’t pushed by a single catalyst however a mixture of market psychology, macro stress, and shifting investor conduct.

The financial institution factors first to a broader risk-off temper. Bitcoin is behaving much less like an unbiased financial asset and extra like an extended-duration tech inventory — shifting carefully with the Nasdaq-100 as buyers de-risk throughout the board. That correlation has tightened as macro uncertainty rises.

The second driver is the Federal Reserve. Jerome Powell’s current feedback threw chilly water on hopes for a assured December charge lower, although New York Fed President John Williams later softened the message. Larger-for-longer charges sap enthusiasm for speculative belongings, and the Bitcoin value response is not any exception.

Regulatory limbo is one other weight. Progress on the Digital Asset Market Readability Act has slowed within the Senate, muting institutional confidence simply as new gamers had been starting to enter the market.

In the meantime, institutional outflows are accelerating. A number of giant funds have been trimming positions by November, including mechanical promote stress. And long-term holders — some sitting on huge beneficial properties after a number of halving cycles — are taking earnings into year-end, additional amplifying draw back momentum.

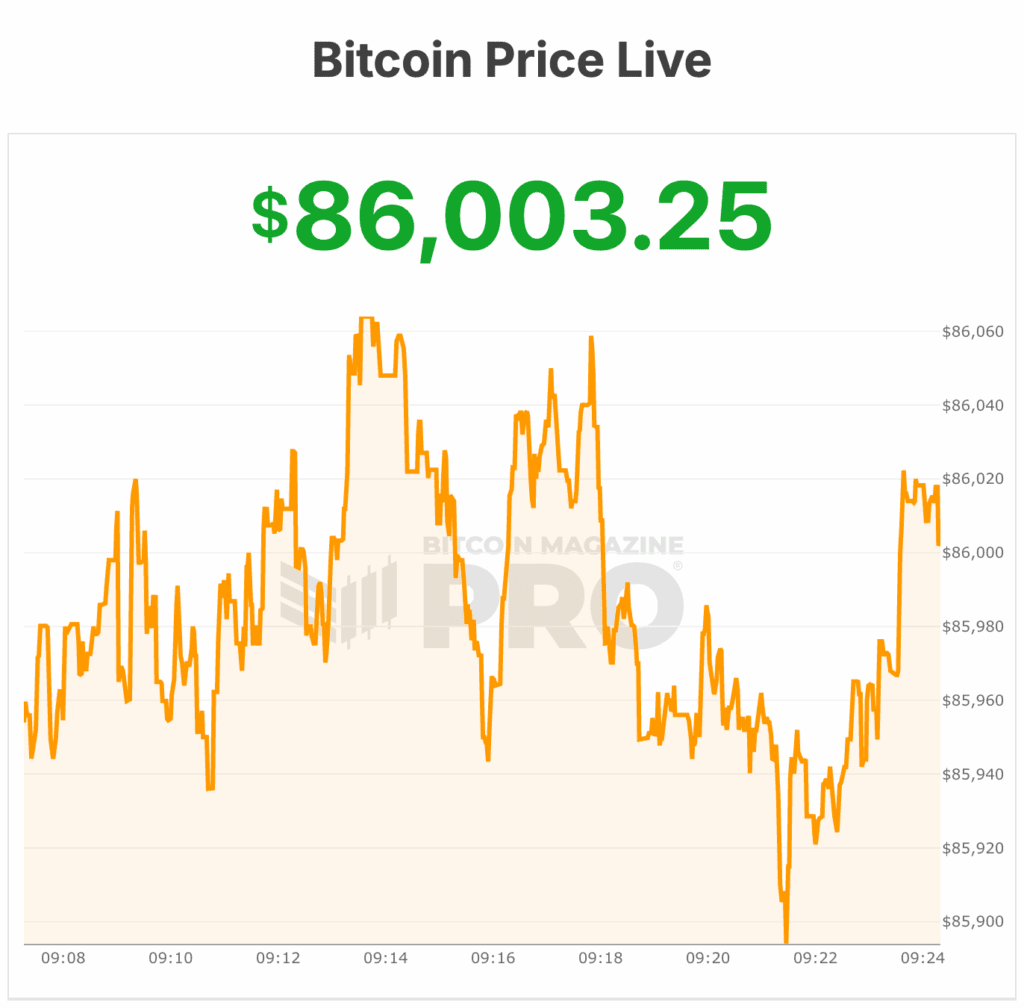

Bitcoin value traded close to $86,000 Monday morning after a modest weekend bounce, recovering from Friday’s shut round $84,53. The transfer raises an even bigger debate: is that this a wholesome correction or the beginning of one thing deeper?

Bitcoin value and the Fed: Waller desires to chop ruts

Fed Governor Christopher Waller added nuance to the macro image. He backed a December charge lower, citing weakening labor markets and secure inflation within the 2.4%–2.5% vary. However he warned that January can be “difficult,” emphasizing a strictly data-dependent, meeting-by-meeting strategy.

Waller additionally just lately met with Treasury Secretary Scott Bessent amid hypothesis a couple of potential Fed Chair nomination, noting that he helps persevering with press conferences — although their format could evolve.

Pompliano: Bitcoiners are constructed for this volatility

Anthony Pompliano provided a wider lens on CNBC this morning, arguing that the Bitcoin value drawdown is traditionally regular — nearly mundane — for seasoned holders. Over the past decade, Bitcoin has seen 21 drawdowns of 30% or extra, he stated, seven of which exceeded 50%. This stage of volatility would resemble “a worldwide monetary disaster yearly and a half” in conventional markets, however Bitcoin natives view it as routine.

The panic, he argued, is coming from newer Wall Avenue entrants who aren’t accustomed to such violent swings. Yr-end incentives, portfolio rotation, and fear-driven promoting are all contributing to the stress.

However with volatility compressing in comparison with previous cycles, Pompliano believes the present 35% pullback could symbolize a bottoming course of reasonably than a deep, 70–80% bear-market collapse.

Leverage has additionally reset, he famous, with open curiosity sharply decrease because the October liquidations. Mixed with excessive readings within the Worry and Greed Index, he argues the market is setting the stage for stabilization and a gradual grind greater.

Pompliano says he’s nonetheless accumulating, anticipating the Bitcoin value to keep up long-term annualized returns within the 20–35% vary—decrease than the final decade, however nonetheless stronger than equities.

Final Friday, the Bitcoin value entered one in every of its most fragile moments of the cycle, reflecting each value motion and on-chain information. It fell to $80,524 on Friday, its lowest since April, dropping over 35% from its all-time excessive and wiping out all year-to-date beneficial properties, dragging general market threat sentiment down.

Since then, the value rebounded to round $84,000, displaying excessive volatility. Glassnode information revealed realized losses spiking to ranges final seen throughout the November 2022 FTX collapse, with short-term holders—those that purchased inside 90 days—promoting closely. Realized-loss dominance surged into ranges sometimes related to panic.

On the time of writing, the bitcoin value is at $86,003.