Bitcoin worth ripped increased above $90,000 on Wednesday, extending a pointy rally fueled by accelerating institutional demand and a brand new wave of Wall Avenue–engineered crypto merchandise.

The surge adopted contemporary disclosures exhibiting BlackRock growing its publicity to its personal spot Bitcoin ETF, and JPMorgan pitching a fancy, high-stakes structured be aware tied on to BlackRock’s IBIT fund.

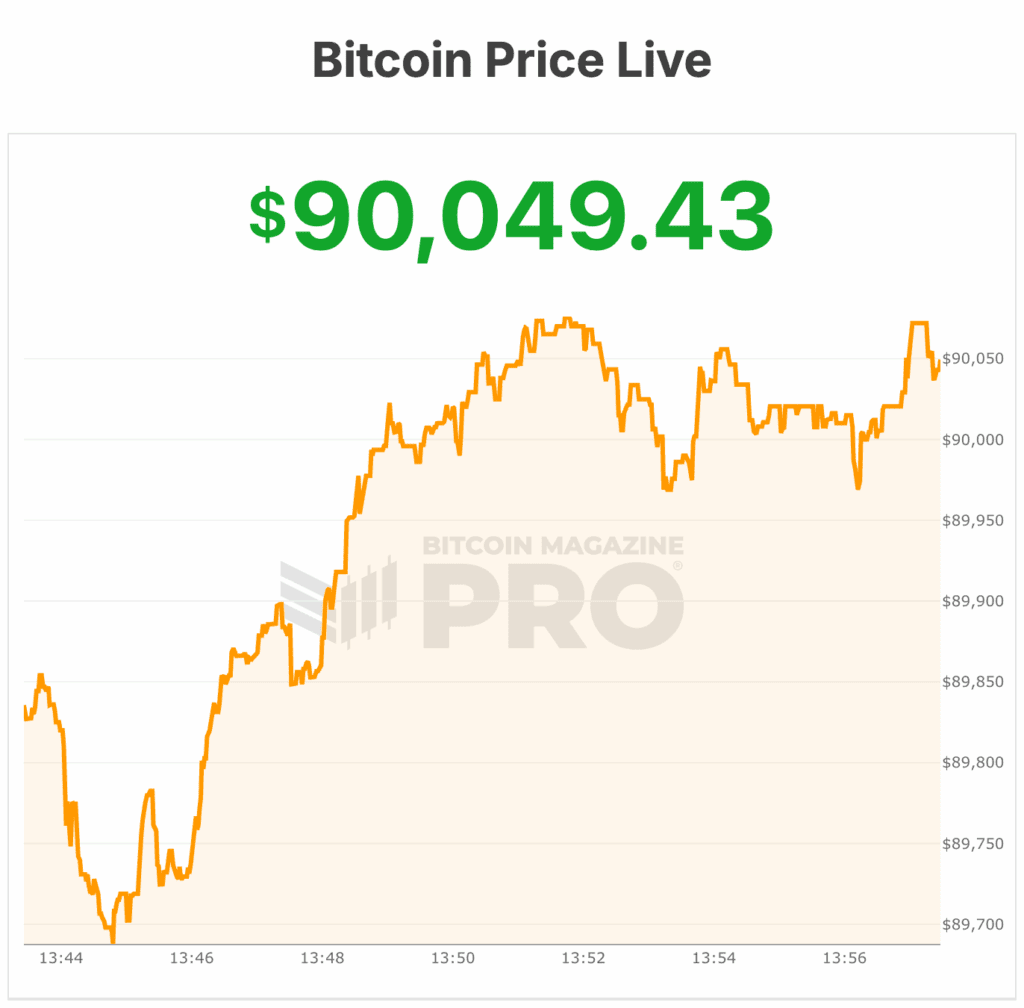

Bitcoin worth touched 24-hour lows of $86,129 earlier than rebounding above $90,300, persevering with a unstable upswing that has outlined the fourth quarter.

BlackRock’s newest regulatory submitting reveals the Strategic Earnings Alternatives Portfolio now holds 2,397,423 shares of IBIT, valued at $155.8 million as of September 30. That’s up 14% from June, when the fund reported 2,096,447 shares.

The regular buildup underscores how the world’s largest asset supervisor is utilizing its inside portfolios to deepen its Bitcoin-linked positions.

The strikes arrive as demand for structured crypto-linked investments heats up amongst main banks. JPMorgan’s newly proposed derivative-style be aware offers institutional shoppers a solution to wager on the longer term worth of Bitcoin by IBIT, at present the biggest Bitcoin ETF with practically $70 billion in property.

The product is uncommon — and aggressive. The be aware units a worth for IBIT subsequent month. If, one 12 months from now, IBIT trades at or above that worth, the be aware is robotically known as and buyers acquire a hard and fast 16% return.

If IBIT trades beneath the set degree in a 12 months, buyers keep within the product till 2028. Ought to IBIT exceed JPMorgan’s subsequent goal worth by then, buyers earn 1.5x their funding with no upside cap. If the Bitcoin worth skyrockets, the payouts observe.

There’s draw back safety, too. If IBIT finishes 2028 down not more than 30%, buyers obtain their full principal again. But when the ETF falls greater than 30%, losses match IBIT’s decline.

The construction combines a bond-like wrapper with derivatives publicity, a components FINRA classifies broadly underneath its “structured be aware” class. These notes mix a conventional safety with options-based payouts tied to a reference asset — on this case BlackRock’s Bitcoin ETF.

The pitch to establishments is straightforward: predictable returns if Bitcoin worth stalls subsequent 12 months, leveraged upside by 2028, and restricted long-term draw back. The tradeoff is equally clear: no curiosity funds, no FDIC insurance coverage, and the chance of dropping most or all principal.

Reporting from The Block helped with this text.

Bitcoin worth volatility

JPMorgan is specific concerning the stakes. Its prospectus warns that buyers “needs to be keen to lose a good portion or all of their principal quantity at maturity.” Volatility in Bitcoin, it provides, could also be excessive, and the notes stay unsecured obligations of the financial institution.

The financial institution’s newest transfer additionally highlights an ongoing shift in Wall Avenue’s tone towards Bitcoin. CEO Jamie Dimon as soon as mocked Bitcoin as “worse than tulip bulbs.” But JPMorgan is now engineering merchandise that rely on the digital asset’s long-term trajectory.

Morgan Stanley has been exploring related territory. Its personal IBIT-linked structured be aware drew $104 million final month. The financial institution’s two-year “twin directional autocallable” product provides enhanced payouts if IBIT rises or stays flat, and modest positive aspects if it falls as much as 25%. However as soon as losses exceed that degree, buyers take the hit with no cushion.

Analysts say these merchandise replicate a revival within the structured-notes market. Bloomberg reported the sector is recovering from a decade-long droop after the collapse of Lehman Brothers worn out billions tied to related devices.

The bitcoin worth has fallen greater than 30% from its October all-time excessive, slipping to round $87,000 as a virtually two-month drawdown retains markets on edge. Mid-tier whale wallets holding 100+ BTC are ticking increased — a possible signal of cut price looking — however bigger whale cohorts proceed to dump, contributing to weakened spot demand.

Analysts warn that the important thing $80,000–$83,000 help zone is being examined repeatedly, whereas Citi says the market lacks the inflows wanted to stabilize costs.

On the time of writing, the bitcoin worth is $90,049.