The Division of Justice has opened a prison investigation into Federal Reserve Chair Jerome Powell — and the bitcoin worth is reacting. The investigation is intensifying a months‑lengthy feud between the White Home and the U.S. central financial institution

In line with Powell, the DOJ served the Federal Reserve with grand jury subpoenas and threatened a prison indictment tied to his June 2025 testimony a few $2.5 billion plus renovation of Fed workplace buildings.

Powell characterised the transfer as politically motivated, claiming it mirrored strain from the Trump administration to chop rates of interest extra sharply than the Fed’s information‑dependent stance.

President Donald Trump has publicly criticized Powell’s efficiency and denied direct involvement within the DOJ motion, although he has reiterated his dissatisfaction with the Fed’s financial coverage. The widening dispute has rattled conventional markets, with U.S. inventory futures sliding and secure‑haven property like gold and silver surging to report ranges.

This episode represents considerably of an escalation in institutional tensions. Powell’s critics argue the DOJ’s motion is legitimate and undermines the Federal Reserve’s independence, whereas defenders of the Fed emphasize the significance of insulating financial coverage from politcs.

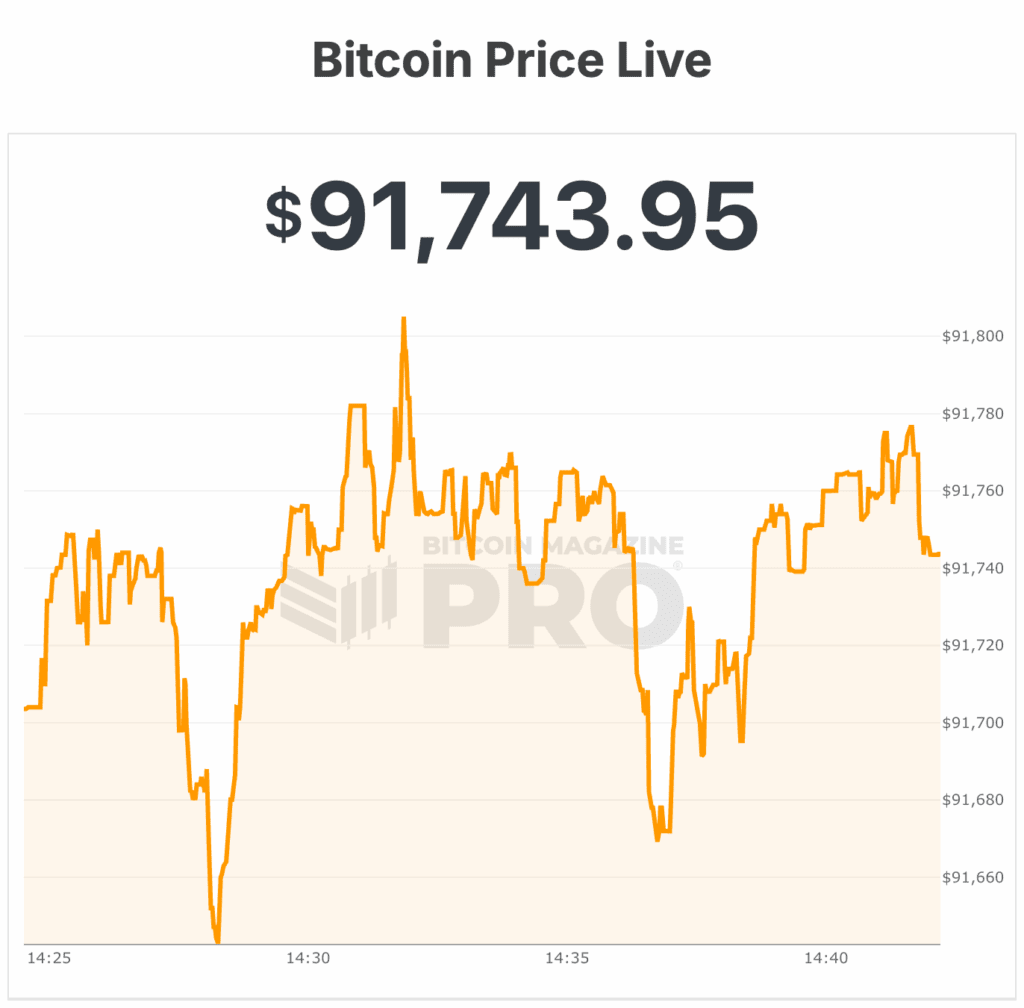

Bitcoin worth response

Bitcoin’s worth confirmed notable motion over the previous 48 hours following the information. Over the weekend and into Monday, the bitcoin worth was pretty stale however jumped to the $91,000–$92,000 vary, on the time of writing.

Bitcoin Journal Professional information signifies the Bitcoin worth reached an intraday excessive of roughly $92,400 between Sunday and Monday.

Throughout January 11–12, the Bitcoin worth posted intraday positive aspects of greater than 0.5% on each days, signaling a gradual upward pattern amid rising macroeconomic uncertainty.

Following the information, the bitcoin worth gave the impression to be behaving extra like safe-haven property than typical threat devices, with Bitcoin’s worth shifting independently of broader market weak point, suggesting merchants had been positioning the asset as a hedge amid issues over the Fed’s independence and U.S. financial coverage shifts.

From a longer-term perspective, Bitcoin stays properly under its report highs above $126,000 reached in early October 2025, having retraced considerably in latest months.

Through the first week of January 2026, BTC largely traded between $88,000 and $94,000, marking a consolidation vary following late‑2025 weak point.

The place does the bitcoin worth go from right here?

Recent Bitcoin Journal evaluation reveals that Bitcoin’s worth confronted resistance at $94,000 final week, failing to maintain positive aspects and shutting at $90,891. Sunday’s doji candle indicators indecision and a possible bearish reversal. Bulls seem weak, missing the momentum to interrupt by means of resistance, whereas bears have gained a slight edge heading into this week.

Key assist ranges are actually at $87,000 and $84,000. Bears will try to push the Bitcoin worth under $87,000, testing $84,000, and a break under might speed up a decline towards the low $70,000 vary.

Bulls could search power across the 0.618 Fibonacci retracement at $58,000 if helps fail. Resistance stays at $91,400 short-term and $94,000 long-term, with larger zones at $98,000–$103,500 and $106,000–$109,000.

This week, bears could strain Bitcoin towards $87,000, whereas bulls will battle to keep up this assist. A every day shut under $87,000 would endanger $84,000 assist, requiring important shopping for to carry.

Trying forward, worth could stay range-bound between $84,000 and $94,000, with neither bulls nor bears in agency management. A detailed above $94,000 might set off upward momentum, whereas a detailed under $84,000 might sign a deeper correction.

Total, market sentiment leans bearish, with volatility possible within the close to time period, in response to analysts.

The Bitcoin worth proper now’s $91,749, with a 24-hour buying and selling quantity of 48 B. BTC is 1% within the final 24 hours. It’s presently -1% from its 7-day all-time excessive of $92,356, and 2% from its 7-day all-time low of $90,129.

BTC has a circulating provide of 19,975,018 BTC and a max provide of 21,000,000 BTC. The worldwide Bitcoin market cap at this time is $1,832,317,782,220, a 1% change from 24 hours in the past.