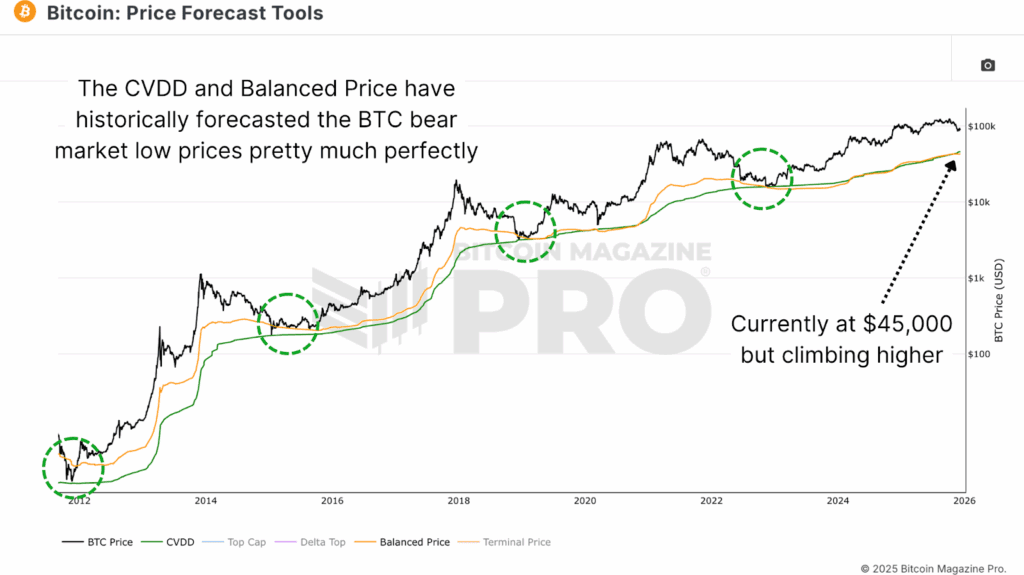

The Bitcoin Journal Professional Worth Forecast Instruments chart offers a complete framework for figuring out potential value flooring throughout bear cycles and forecasting upside targets primarily based on on-chain fundamentals and network-derived knowledge factors. By aggregating a number of metrics, this system has traditionally referred to as Bitcoin market cycle peaks and bottoms with exceptional accuracy. Can these instruments proceed to supply a foundation for dependable BTC value forecasting over the subsequent 12 months and past?

CVDD & Balanced Worth: Bitcoin Worth Cycle Low Indicators

The Cumulative Worth Days Destroyed (CVDD) metric has traditionally referred to as Bitcoin value cycle lows virtually to perfection throughout each cycle since Bitcoin’s inception. This metric begins with Coin Days Destroyed, a measure that weights Bitcoin transfers by the period they have been held earlier than motion. For instance, holding 1 Bitcoin for 100 days produces 100 coin days destroyed when transferred, whereas holding 0.1 Bitcoin for a similar end result requires 1,000 days of holding. Massive spikes point out that the community’s most skilled long-term holders are transferring important quantities of Bitcoin.

The CVDD takes this one step additional by measuring the USD valuation on the time of switch fairly than simply the coin days destroyed amount alone. This worth is then multiplied by 6 million to provide the ultimate metric. When examined throughout Bitcoin’s whole historical past, the CVDD has indicated bear market lows with accuracy extending throughout each cycle. Presently, the CVDD sits at roughly $45,000, although this degree tendencies upward over time because the metric naturally evolves with new transfers and Bitcoin’s value appreciation.

The Balanced Worth metric enhances this draw back projection by subtracting the Transferred Worth (its calculation methodology is defined later) from the Realized Worth, the fee foundation or common accumulation value for all bitcoin holders, offering one other traditionally correct bear cycle low sign.

Prime Cap, Delta Prime, & Terminal Worth: Bitcoin Worth Cycle Peak Alerts

The Prime Cap metric begins with the all-time common cap, the cumulative sum of Bitcoin’s market capitalisation divided by the variety of days Bitcoin has existed. This all-time weighted shifting common is then multiplied by 35 to provide the Prime Cap. Traditionally, this metric has been remarkably correct for calling bull market peaks, although in current cycles it has exceeded precise value motion, at present projecting to a seemingly unattainable ~$620,000.

The Delta Prime refines this strategy by utilizing the realized cap. The realized cap at present stands at roughly $1.1 trillion. Delta Prime is calculated by subtracting the common cap from the realized cap and multiplying by 7. This metric has been correct traditionally, although it was barely off in the course of the 2021 cycle, and it’s trying extra possible that it’s going to not be reached within the present cycle, at present sitting at roughly $270,000.

The Terminal Worth metric offers one other layer of sophistication. It calculates the Transferred Worth, the sum of Coin Days Destroyed divided by the Circulating Bitcoin Provide, and multiplies this by 21 (the utmost Bitcoin provide). This produces a value degree primarily based on the elemental assumption of whole community worth distributed throughout all 21 million Bitcoins. Traditionally, the Terminal Worth has been probably the most correct top-calling instruments, marking earlier cycle peaks practically to perfection. This metric at present sits at roughly $290,000, not too far above Delta Prime’s present worth.

Bitcoin Cycle Grasp: Aggregated Bitcoin Worth Honest Worth Framework

Integrating all these particular person metrics right into a unified framework produces the Bitcoin Cycle Grasp chart, which mixes these on-chain forecast instruments for confluence. This has helped to determine the place Bitcoin could also be in a cycle, both near bull or bear market highs, or oscillating round its ‘Honest Market Worth’.

Analyzing the previous two cycles demonstrates the utility of this framework. When Bitcoin trades above the Honest Market Worth band, bull markets have traditionally entered exponential progress phases. When beneath this band, Bitcoin usually alerts bear market situations the place defensive positioning and aggressive accumulation grow to be applicable methods.

Projecting Bitcoin Worth Ahead: 2026 Cycle Eventualities

By extracting uncooked knowledge from the value forecast instruments and projecting the slope of each the CVDD and Terminal Worth ahead to the top of 2026, two situations emerge. The CVDD, which has moved at a predictable price of change over the previous 90 days, initiatives to roughly $80,000 by December 31, 2026. This degree may symbolize a possible bear cycle flooring, although Bitcoin has already traded beneath this degree throughout current downward strikes, suggesting present costs might already provide compelling worth.

The Terminal Worth, extrapolating its present upward pattern, may attain over $500,000 by the top of 2026, although this projection may solely be a sensible consequence with a bullish macro surroundings with important liquidity injections and broad realization of Bitcoin’s elementary worth proposition.

These Bitcoin value forecast instruments, formulated utilizing on-chain elementary and network-derived knowledge factors fairly than psychological ranges or conventional technical evaluation relevant to equities and commodities, have traditionally supplied distinctive accuracy in calling market cycle peaks and bottoms. Forecasting primarily based on their present values suggests a possible bear cycle flooring within the $80,000 vary by the top of 2026, with upside targets probably reaching over $500,000, relying on macro situations and capital flows.

Whereas these projections symbolize extrapolations of present tendencies fairly than certainties, the historic accuracy and on-chain basis of those metrics warrant critical consideration. Traders and merchants ought to proceed monitoring each the uncooked value forecast instruments and the aggregated Bitcoin Cycle Grasp framework to determine truthful valuation ranges, excessive overvaluation warnings, and engaging accumulation zones throughout the present cycle. Nevertheless, all projections change day by day as new knowledge emerges, making reactive evaluation superior to long-term prediction.

For a extra in-depth look into this matter, watch our most up-to-date YouTube video right here: Bitcoin: Utilizing On-Chain Knowledge To Worth & Predict The Worth

For deeper knowledge, charts, {and professional} insights into bitcoin value tendencies, go to BitcoinMagazinePro.com. Subscribe to Bitcoin Journal Professional on YouTube for extra professional market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding selections.