The bitcoin value continued its robust run this week, breaking out of a multi‑week buying and selling vary and climbing properly above key psychological ranges as market individuals digest macroeconomic knowledge and new institutional curiosity.

The bitcoin value hit an eight-week excessive and triggered roughly $700 million in brief liquidations, per Bitcoin Journal Information. Polymarket now estimates a 73% probability that Bitcoin will attain $100K in January.

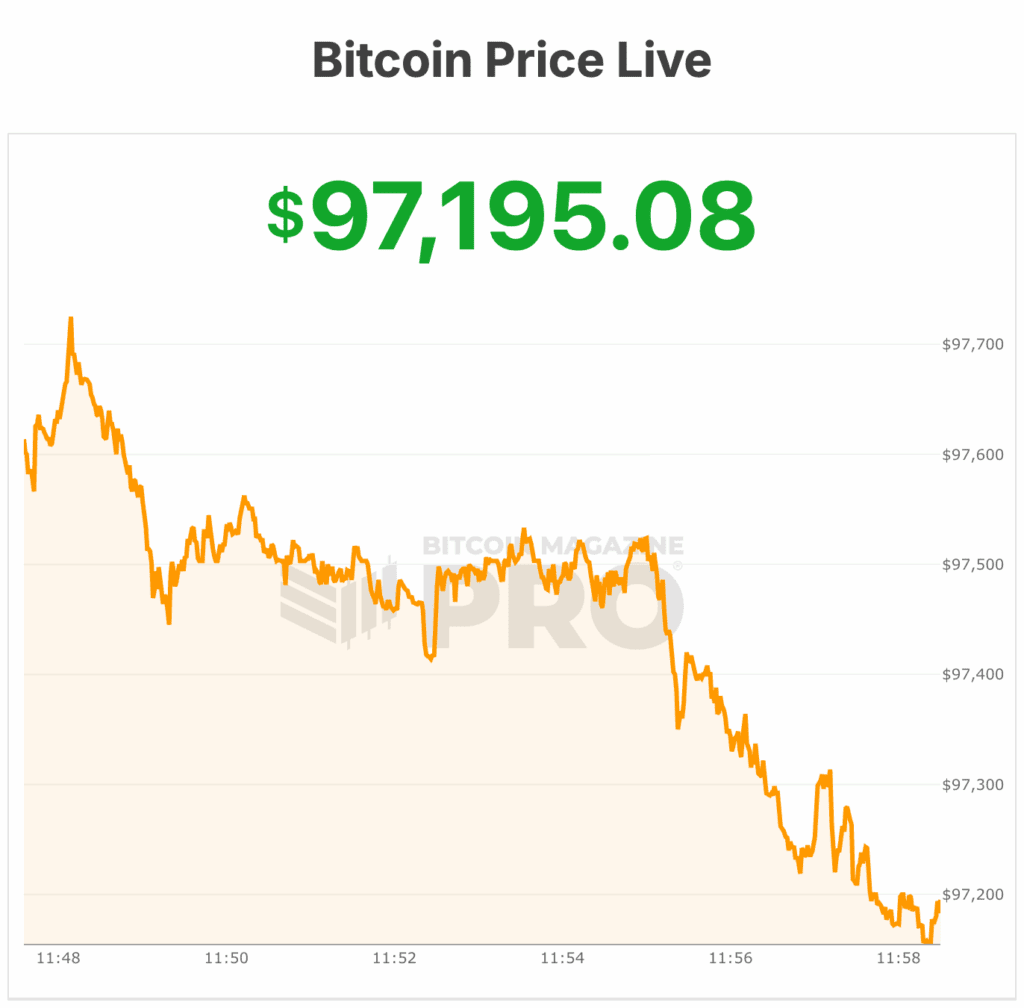

After buying and selling comparatively sideways close to the low‑$90,000 or decrease for the final two months, the bitcoin value started gaining traction over the weekend, in the end surging above $97,000 on the time of writing. That is its finest degree in additional than two months.

The rally, which has endured by means of January 14, displays a convergence of technical, macro, and sentiment drivers which have reignited bullish conviction throughout crypto markets.

This squeeze helped propel the Bitcoin value by means of resistance and towards contemporary highs, triggering liquidations of speculative quick bets and amplifying volatility.

Technically, Bitcoin’s reclaim of the $94,000–$96,000 zone has been broadly interpreted as a breakout from its current consolidation vary.

Macro financial indicators which are fueling bitcoin

The timing of Bitcoin’s rally coincides with some pivotal financial developments.

The U.S. Shopper Worth Index (CPI) report launched on January 13 confirmed inflation moderating — a consequence that eased fears of additional aggressive financial tightening and boosted “danger‑on” sentiment (suppose bitcoin) in international markets.

Whereas shares and conventional danger property reacted modestly, Bitcoin’s sensitivity to macro cues was evident as buyers sought different shops of worth and progress publicity. Secure inflation numbers have additionally alleviated issues about elevated actual yields, which traditionally problem non‑yielding property like Bitcoin.

With inflation extra contained than feared, merchants and buyers seem extra prepared to allocate capital to crypto, additional underpinning the rally.

One other notable improvement on the earth is the continuing unrest in Iran that has intensified this week as nationwide protests towards financial collapse and authorities repression raged amid a close to‑whole web blackout, with authorities signaling quick‑observe trials and potential executions of detainees.

The disaster has amplified geopolitical danger, driving conventional markets into secure‑haven property and sparking heightened volatility.

In digital markets, Bitcoin has proven resilience and renewed investor curiosity, with BTC climbing regardless of broader danger‑off sentiment.

Additionally this week, the Division of Justice opened a prison investigation into Federal Reserve Chair Jerome Powell, sending ripples by means of markets — together with Bitcoin.

The investigation stems from Powell’s June 2025 testimony on a $2.5 billion Fed constructing renovation, which he says is politically motivated amid strain from the Trump administration over rates of interest.

The escalating feud between the White Home and the Fed has shaken U.S. markets, boosting secure‑haven property like gold and bitcoin.

New institutional demand is boosting the bitcoin value

Past technical components and macroeconomic knowledge, institutional demand has resurfaced as a reputable driver of bullish momentum.

Spot Bitcoin ETFs recorded notable inflows over the previous days — with figures suggesting the most important web inflows since late 2025 — signaling renewed curiosity from lengthy‑time period capital allocators and monetary advisors.

Moreover, main company Bitcoin holders have contributed to the narrative. Technique Inc., a broadly adopted holder of Bitcoin, introduced an enormous $1.3 billion acquisition of BTC within the days main as much as the worth surge.

What comes subsequent for bitcoin value

Regardless of the robust advance, there’s robust resistance close to the $97,000–$100,000 vary that will pose a check for bulls, per Bitcoin Journal Information.

The market’s potential to carry these features and proceed absorbing inflows might be vital in figuring out whether or not the Bitcoin value can lengthen this rally additional into the weekend and additional into 2026.

Market sentiment — usually measured by metrics just like the Concern & Greed Index — is climbing away from excessive concern and towards extra optimistic territory, although it has not but reached ranges sometimes related to blow‑off tops.

On the time of writing, the bitcoin value is close to $97,200, up over 4% within the final 24 hrs.