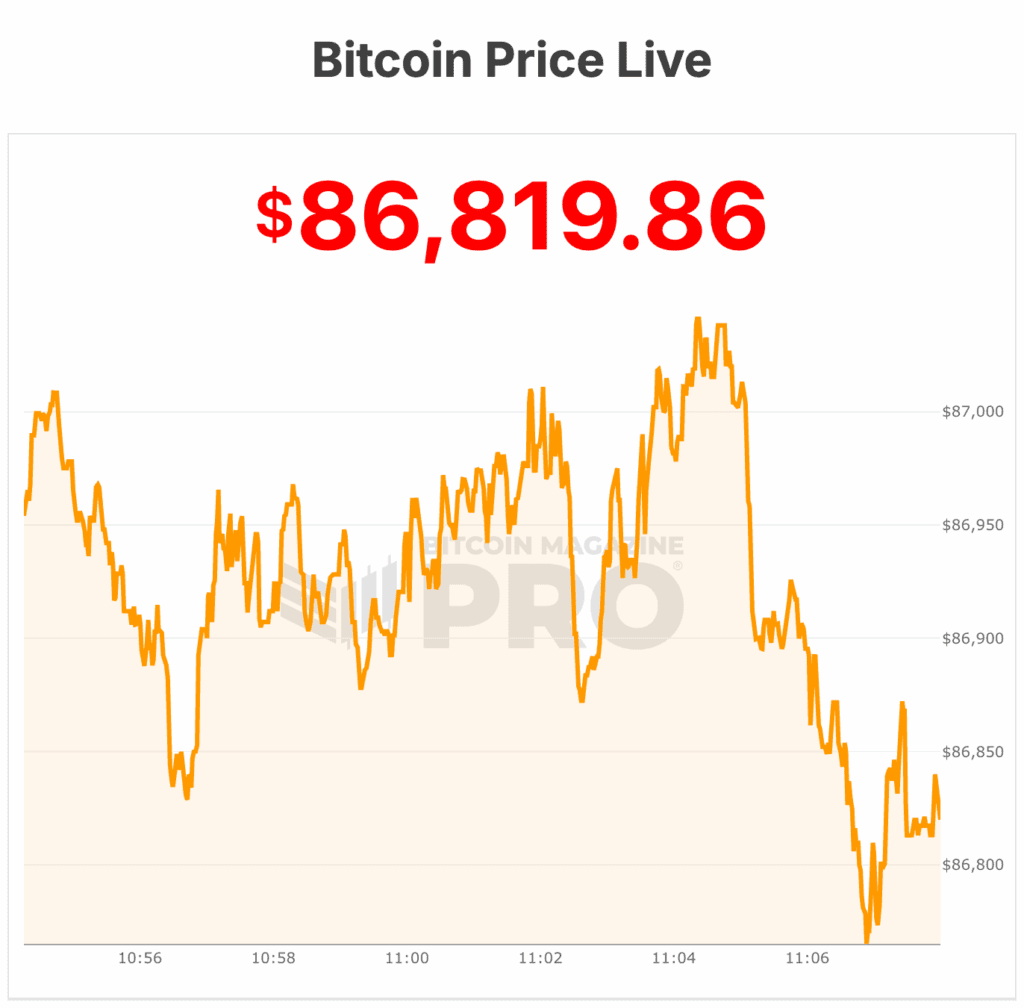

Bitcoin value is down greater than 30% from its October file and continues to leak decrease, slipping one other 1% in a single day to commerce close to $87,000 this morning. It’s the newest episode of a close to two-month-long drawdown that has caught merchants off guard.

And whereas the promoting has slowed, the temper throughout markets stays fragile.

The transfer displays a world risk-off tone. S&P 500 futures have been barely crimson after a robust rebound yesterday. Asia traded combined. Europe opened flat-to-lower. The bitcoin value adopted go well with, behaving extra like a high-beta tech asset than a macro hedge — a correlation that has solely strengthened in current weeks.

The slide places the Bitcoin value again close to ranges the place bulls say the subsequent battle can be fought. Analysts persistently spotlight the $80,000–$83,000 area as the road that should maintain. That space already saved Bitcoin twice this month, together with final week’s violent flush to $80,915. However every take a look at weakens the ground.

Whale exercise is sending combined indicators

New on-chain information is including one other wrinkle. Wallets holding not less than 100 BTC — usually considered as mid-tier whales — are rising once more after hitting a two-year low earlier this month. Santiment says these wallets have climbed by 0.47% since Nov. 11, equal to 91 new whale entities.

That’s a refined however notable shift. These holders are likely to scale in throughout deep corrections. Their return hints at early discount looking.

However the broader whale image is much less comforting. Wallets holding greater than 1,000 BTC proceed to shrink. The biggest whales — these with over 10,000 BTC — trimmed round 1.5% of their holdings in October.

Citi estimates the market now lacks the spot influx cushion usually required to stabilize costs. Of their view, roughly $1 billion in weekly inflows is required to carry the bitcoin value 4%. That demand merely isn’t there proper now.

Bitcoin value: Temporary rebounds, greater questions

The Bitcoin value clawed again to $86,000 over the weekend after final week’s crash, however the bounce felt shaky. Each restoration has been capped by promoting stress close to the mid-$80Ks. Earlier at this time, in Asia buying and selling hours, the Bitcoin value briefly touched above $89,000 earlier than slumping to $87,000.

That hesitation mirrors the broader macro setup. Fed Governor Christopher Waller backed a December fee lower, citing softening labor information. However he made clear the central financial institution stays totally data-dependent. Markets heard “possibly,” not “sure.”

Charge-cut optimism had been a serious engine for the Bitcoin value’s breakout above $100K earlier this yr. Now merchants are grappling with uncertainty.

In the meantime, institutional flows stay adverse. Funds proceed trimming publicity heading into year-end, and US regulatory drift is just not serving to. The Senate slowdown on digital-asset laws has dampened confidence simply as ETFs helped push new capital into the market.

Technicians eye $80,000 — after which $70,000

Technical analysts from Bitcoin Journal say Bitcoin’s construction is broken however not damaged. The break of the multi-week broadening wedge factors to a attainable retest of $70,000, even when the market manages a short lived rally first.

For now, the trail is straightforward: maintain above $84,000 and bulls hold an actual shot at retaking $91,400 and $94,000. Lose $84,000, and the market doubtless slides towards $75,000, with a break beneath that opening the high-volume assist zone at $72,000–$69,000.

Veteran analysts be aware that 30% drawdowns are routine for Bitcoin. Anthony Pompliano reminded CNBC viewers yesterday that the asset has endured 21 such drops prior to now decade. Seven have been deeper than 50%. Bitcoin’s long-term holders are likely to deal with these episodes as background noise — painful, however acquainted.

For now, merchants are watching the charts, the whales, the Fed, and their very own nerves. Bitcoin value sits at $86,819 — bruised, however not damaged — ready for its subsequent catalyst.