Bitcoin worth has began to indicate clear indicators of weak spot, and the current transfer again beneath six figures has pressured a reassessment of the near-term outlook. With a number of vital technical and on-chain ranges now misplaced, I’ve recalibrated my base case in order that the chance of retesting new all-time highs within the coming weeks has fallen beneath 50%. That may change rapidly if main ranges are reclaimed, however till then, the situations resemble a market shifting away from trending energy and towards a deeper corrective part.

Bitcoin Worth: Is “Shopping for The Dip” Nonetheless the Proper Transfer?

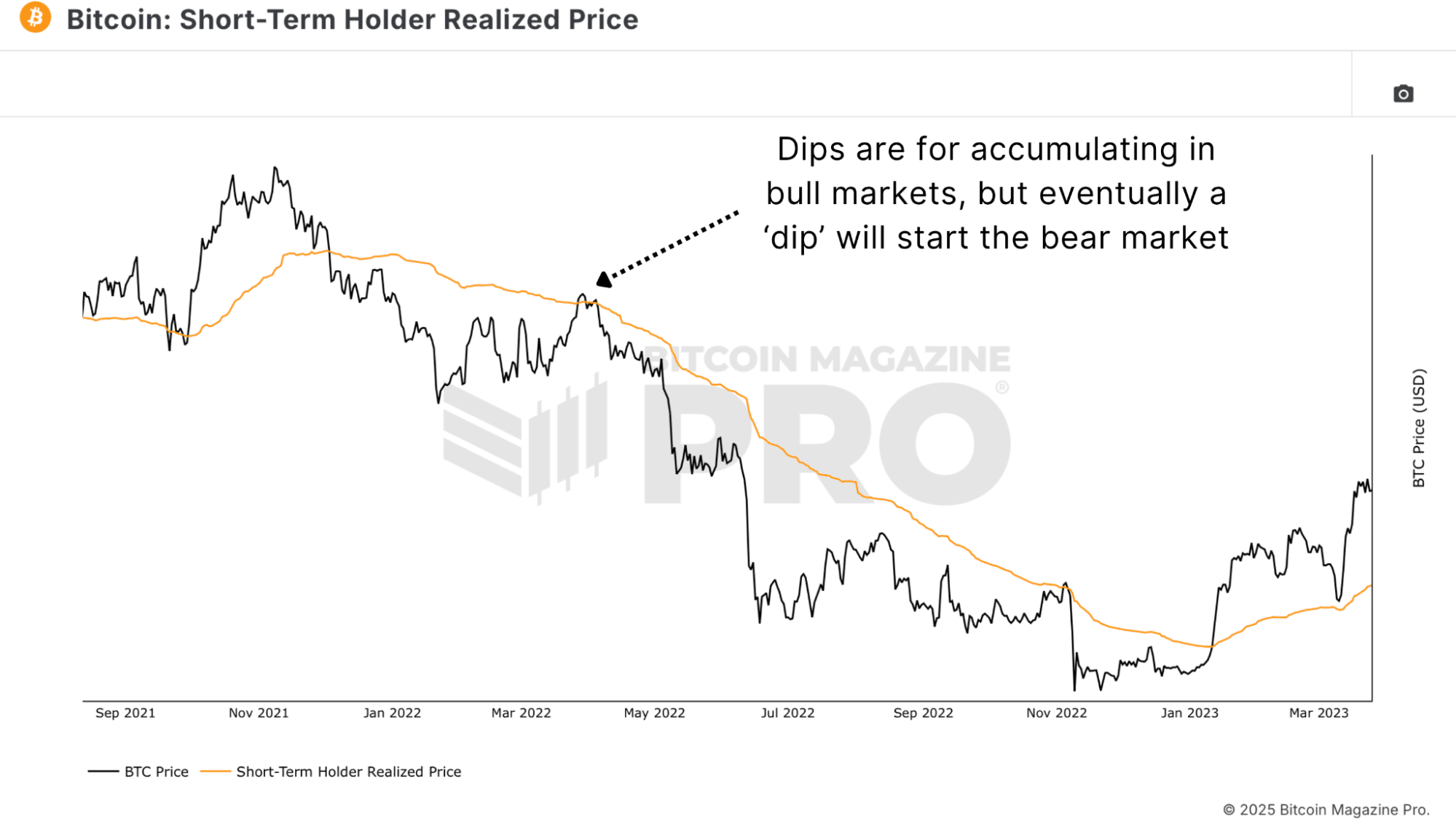

Bitcoin is already in a sizeable pullback, however shopping for each decline isn’t all the time the optimum method exterior of a confirmed bull development. In a bear-market atmosphere, what look like engaging dips can nonetheless result in considerably decrease costs. Quick-term rallies and sharp retracements are typical in downtrending markets, so reacting to knowledge quite than pre-emptively predicting a backside turns into much more vital.

This sample of a number of dips is obvious after we analyze the Quick-Time period Holder Realized Worth chart over the last cycle. Additionally it is clear to see how this metric acted as a key resistance all through this part, with sustained restoration solely skilled as soon as BTC reclaimed STH Realized Worth ranges.

There may be one caveat: if worth meaningfully reclaims key ranges, the whole image shifts. That’s why a small allocation on this dip could make sense, whereas holding off on additional shopping for till we see deeper macro confluence is a extra defensive method.

Black Friday Sale: 40% Off Annual Plans!

The BEST saving of the yr is right here. Get 40% off all our annual plans.

Unlock +100 Bitcoin charts.

- Entry Indicator alerts – so that you by no means miss a factor.

- Personal TradingView indicators of your favourite Bitcoin charts.

- Members-only Stories and Insights.

- Many new charts and options coming quickly.

All for simply $17/month with the Black Friday deal. That is our largest sale all yr!

Bitcoin Worth: Key Ranges You Should Watch Proper Now

The MVRV Z-Rating and the Bitcoin Realized Worth give a clearer sense of the place the broader market’s value foundation sits. The realized value foundation of the community at the moment clusters across the mid-$50,000s, however this determine continues rising every day.

The same narrative emerges from the 200-Week Shifting Common, as this additionally at the moment sits within the mid-$50,000. Traditionally, factors the place this metric meets worth have introduced robust long-term accumulation alternatives.

These ranges rise slowly every day, that means a possible backside may kind at $60,000, $65,000, or increased, relying on how lengthy Bitcoin spends trending downward. The vital level is that worth tends to emerge when spot worth trades near the typical historic value of the community, and confluence is offered from key ranges of purchase assist.

Bitcoin Worth: What Provide & Demand Indicators Are Actually Saying

Worth Days Destroyed (VDD) A number of stays an vital metric in figuring out stress factors amongst long-term and skilled holders. Very low readings counsel massive, outdated cash should not shifting, which has usually aligned with market bottoms. A pointy spike, nevertheless, can point out capitulation strain, which regularly accompanies or precedes important market turning factors.

Proper now, the metric continues rising as worth falls, suggesting many holders are distributing into weak spot. That’s not attribute of a cycle backside, the place pressured promoting is normally excessive and compressed into a brief window. At this stage, the market nonetheless seems to be unwinding quite than exhausting. Alongside this, Lengthy-Time period Holder Provide has been in a downtrend. Ideally, this stabilises and begins to extend once more earlier than calling any main backside, as bottoms kind when essentially the most affected person contributors start holding, not exiting.

Bitcoin Worth: What Funding Charges Reveal About Capitulation (Or Lack Thereof)

Intervals of peak concern have a tendency to indicate up clearly by heavy quick positioning, adverse funding as proven within the Bitcoin Funding Charges, and huge realized losses. These situations sign that weaker arms have capitulated, and stronger arms are absorbing that offer.

The market has not but proven the signature panic promoting and shorting usually related to main cyclical lows. With out stress in derivatives and with no rush of loss-taking, it’s tough to argue that the market has absolutely flushed out.

Bitcoin Worth: The Actual Ranges That Should Be Reclaimed to Kill the Bear Case

Suppose the bearish state of affairs is incorrect, which after all could be the popular final result. In that case, Bitcoin wants to start reclaiming key structural ranges, together with the $100,000 psychological zone, the Quick-Time period Holder Realized Worth, and the 350-day shifting common as depicted within the Golden Ratio Multiplier chart.

Non permanent wicks or single-day closes should not sufficient. Sustained closes above these ranges, together with energy in danger property globally, would counsel the development is shifting. However till that occurs, the info leans cautious.

Bitcoin Worth Outlook: Closing Ideas on Dip vs. New Bear Market

Since breaking beneath a number of vital ranges, the outlook has turn into extra defensive. There’s no structural weak spot in Bitcoin’s long-term fundamentals, however the short-term market construction doesn’t resemble a wholesome bull development.

For now, the really useful technique consists of not shopping for at each dip, ready for confluence earlier than heavy scaling in, respecting macro situations and ratio traits, and solely turning aggressive as soon as the market proves energy. Most buyers by no means determine the precise high or backside; the aim is to place close to areas of excessive chance with sufficient affirmation to keep away from months of pointless drawdown.

For a extra in-depth look into this matter, watch our most up-to-date YouTube video right here: My Bitcoin Technique Going Ahead

For deeper knowledge, charts, {and professional} insights into bitcoin worth traits, go to BitcoinMagazinePro.com. Subscribe to Bitcoin Journal Professional on YouTube for extra professional market evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. At all times do your individual analysis earlier than making any funding selections.