The bitcoin worth fell on Wednesday evening into Thursday, even after the U.S. Federal Reserve lowered rates of interest, as Fed Chair Jerome Powell signaled a cautious method heading into 2026.

On Wednesday, the Fed minimize its benchmark fee by 25 foundation factors to three.50%–3.75%, a transfer broadly anticipated by markets. Nevertheless, the 9–3 break up amongst Federal Open Market Committee (FOMC) members and Powell’s hawkish remarks in the course of the press convention tempered investor enthusiasm for danger belongings, together with cryptocurrencies.

One official favored a deeper 50-basis-point minimize, whereas two voted in opposition to any discount.

The Bitcoin worth briefly jumped over $94,000 however then dropped under $90,000 and stabilized round $89,730 on the time of writing.

Bitfinex analysts shared with Bitcoin Journal that the Fed’s unexpectedly hawkish tone stunned markets, inflicting a worth reversal and saved danger appetites in test.

The Fed’s up to date “dot plot” exhibits little consensus for greater than a single 25-basis-point minimize in 2026, with stronger progress forecasts and shifting tax coverage limiting near-term easing.

Timot Lamarre, director of market analysis at Unchained, wrote to Bitcoin Journal that “

There’s a lot to be bullish about within the bitcoin house – from Sq. facilitating bitcoin funds to massive establishments like Vanguard now permitting their purchasers entry to bitcoin ETFs to quantitative tightening coming to an finish.”

Lamarre mentioned that bitcoin’s latest worth actions present a spot between rising adoption and the worth improve that normally comes with larger demand.

Bitcoin worth decline and broader market pullback

Bitcoin worth’s latest pullback additionally displays broader market considerations. Know-how shares, together with Oracle, suffered after disappointing earnings and warnings about slower-than-expected AI-related earnings.

Oracle shares fell 11% in after-hours buying and selling following income and revenue forecasts under analysts’ expectations.

The Fed’s outlook for 2026 suggests just one extra fee minimize, fewer than markets had anticipated. Asian inventory markets declined, and U.S. fairness futures pointed decrease, whereas European buying and selling remained subdued.

Normal Chartered just lately revised its year-end Bitcoin forecast, reducing its goal from $200,000 to $100,000, citing a slowdown in company treasury shopping for and reliance on ETF inflows to assist future worth positive aspects.

Bernstein analysts just lately mentioned that they see a structural shift in Bitcoin’s market cycle, which means that the standard four-year sample has damaged. They forecast an elongated bull cycle pushed by regular institutional shopping for, which offsets retail promoting, and minimal ETF outflows.

The financial institution raised its 2026 worth goal to $150,000 and expects the cycle to peak close to $200,000 in 2027, sustaining a long-term 2033 goal of roughly $1 million per BTC.

In the meantime, JPMorgan stays bullish over the following yr, projecting a gold-linked, volatility-adjusted Bitcoin goal of $170,000 inside six to 12 months, factoring in market fluctuations and mining prices.

Analysts say Bitcoin’s decline after the Fed announcement displays a “promote the very fact” dynamic. “The market had totally priced within the minimize forward of time,” mentioned Tim Solar, senior researcher at HashKey Group. “Considerations over political and financial developments in 2026, mixed with potential inflation from AI-driven capital expenditure, are weighing on danger sentiment.”

Final week, Bitcoin worth noticed a unstable journey, dipping to $84,000 earlier than bulls pushed it as much as $94,000, then dropping barely under $88,000, and shutting the week at $90,429.

The market now faces key assist at $87,200 and $84,000, with deeper assist zones round $72,000–$68,000 and $57,700.

Resistance ranges stand at $94,000, $101,000, $104,000, and a thick zone between $107,000–$110,000, with momentum seemingly slowing above $96,000.

Usually, fee cuts result in bullish momentum, however the market could have already priced on this month’s fee minimize. The bitcoin worth has fallen roughly 28% since its October all-time excessive.

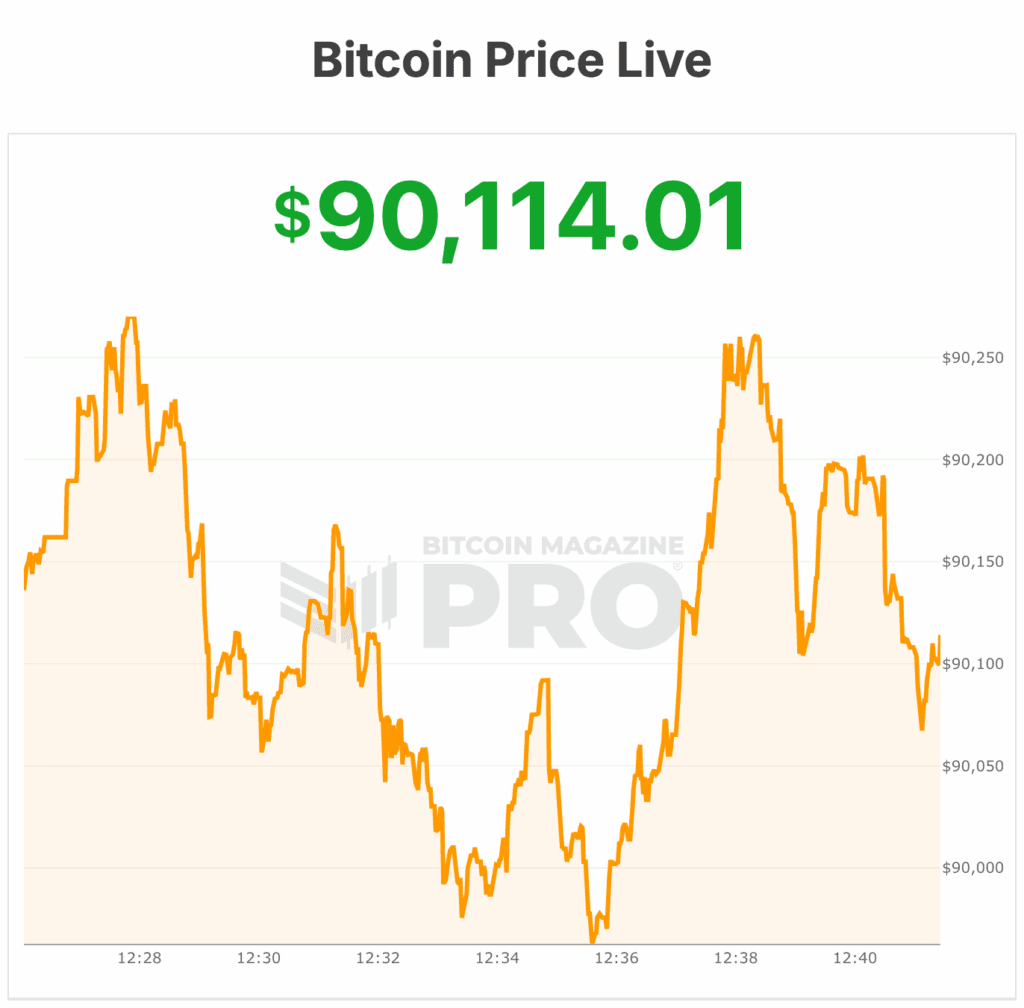

On the time of publishing, the bitcoin worth is at $90,114.