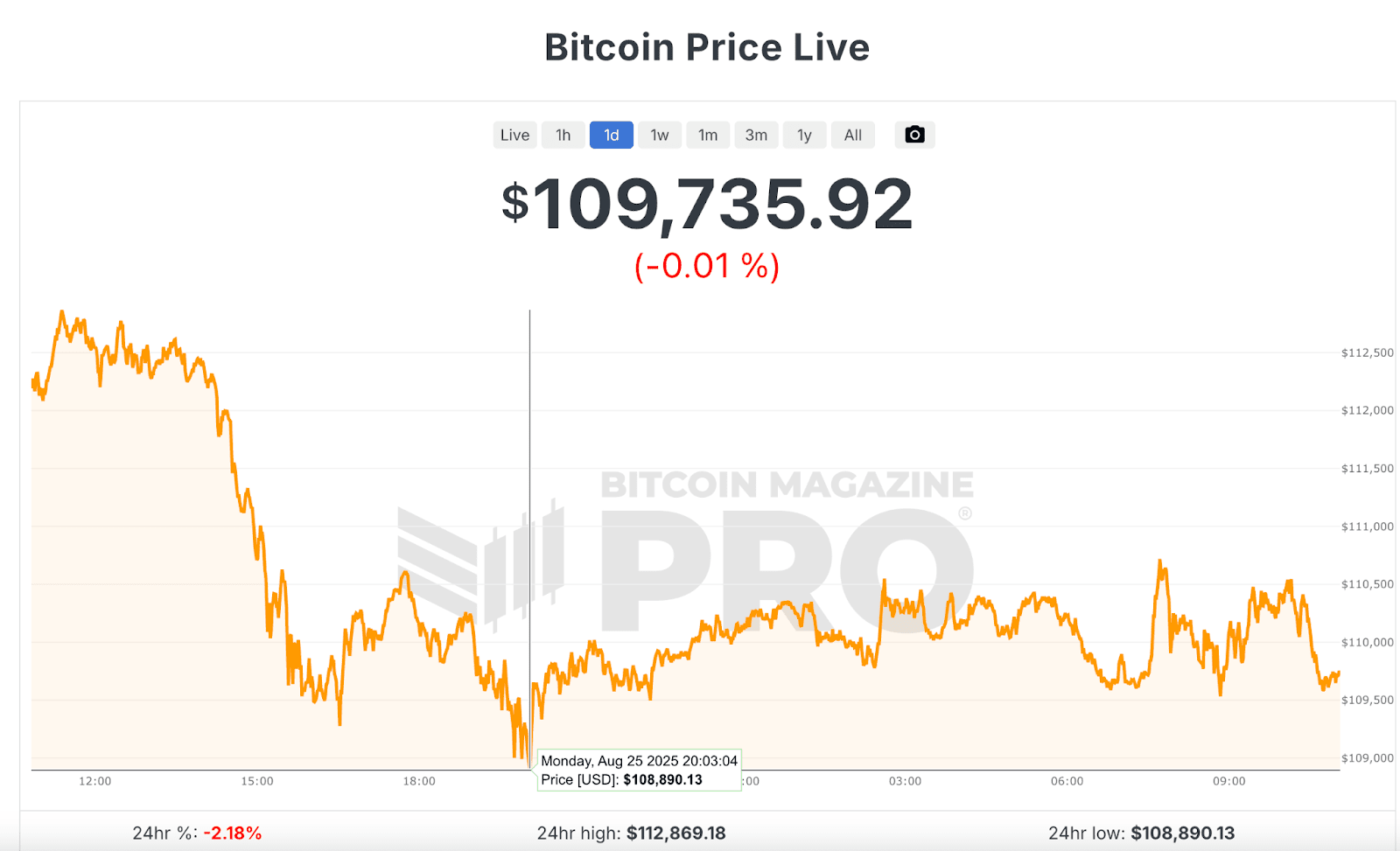

The value of Bitcoin has plunged beneath $110,000 up to now 24 hours, marking certainly one of its steepest corrections in weeks. In line with knowledge from Bitcoin Journal Professional, the world’s largest cryptocurrency dropped to $108,890 and stays beneath the $110,000 threshold on the time of writing. The decline represents a pointy sell-off from simply final Friday, when Bitcoin traded as excessive as $117,000, earlier than tumbling to $109,894 over the weekend.

The downward momentum was accelerated by an enormous whale sale. Over the weekend, a single Bitcoin holder offloaded 24,000 BTC value greater than $2.7 billion, sparking further promoting stress and driving the worth decrease. The big transaction prompted heightened volatility and weighed closely on market sentiment.

Regardless of the sharp transfer down, sentiment has not but tipped absolutely into worry. The Bitcoin Worry and Greed Index, a extensively watched market sentiment device, at the moment sits at 48/100, which is categorized as “impartial” however hovers simply above “worry.”

The Worry and Greed Index is a device that helps traders and merchants analyze the Bitcoin and Crypto market from a sentiment perspective. It identifies the extent to which the market is turning into overly fearful or overly grasping. Therefore why it’s known as the Worry and Greed Index.

Bitcoin Journal Professional explains that the Index helps traders separate their feelings from broader market reactions, providing insights into when belongings could also be overbought or oversold. Scores close to zero replicate “excessive worry,” whereas scores near 100 characterize “excessive greed.” With Bitcoin at the moment at 48, sentiment is edging towards concern however has not but absolutely entered bearish territory.

In the meantime, underlying community fundamentals stay robust regardless of value weak spot. Bitcoin’s hash charge—a measure of the overall computational energy securing the community—is approaching a brand new file excessive. The present each day worth stands at 909,080,589 Th/s, simply shy of the all-time excessive of 1,084,828,947 Th/s set on August 4 when Bitcoin was buying and selling at $115,149.

Lengthy-term holders could discover reassurance in historic profitability knowledge. Bitcoin Journal Professional notes that holding Bitcoin has been worthwhile for 99.1% of its existence:

- Variety of worthwhile days: 5,437

- Whole variety of days tracked: 5,487

- % of worthwhile days: 99.1%

Whereas the current drop beneath $110,000 has rattled short-term merchants, Bitcoin’s observe file and community power recommend resilience. Buyers will probably be carefully watching whether or not the Worry and Greed Index shifts additional into worry territory, and if whales proceed to unload massive holdings, probably including extra turbulence to the market within the coming days.