Bitcoin slipped 12% from its all-time excessive of $108,353, erasing beneficial properties from the second week of December. As Christmas nears, crypto merchants ponder whether or not the market will see a “Santa Claus” rally this 12 months.

A CoinGecko report states that eight of ten occasions between 2014 and 2023, crypto markets rallied across the Christmas holidays. Bitcoin’s current worth decline has quashed hopes of a Santa rally this 12 months, and declining institutional funding influx has dampened the sentiment additional.

Will crypto markets see a Santa rally in 2024?

A “Santa Claus” rally refers to cost beneficial properties in crypto within the final 5 buying and selling days of the 12 months and the primary two buying and selling days of the next 12 months, in accordance with a CoinGecko report. The efficiency of the crypto market is, due to this fact, key through the one-week timeframe from December 27, 2024, to January 2, 2025.

Bitcoin’s decline from its all-time excessive has raised issues amongst BTC merchants, and hopes of a Santa Claus rally have dimmed this cycle. Between 2014 and 2023, crypto markets rallied post-Christmas.

Crypto markets skilled a pullback as an alternative of a rally, thrice out of ten previously decade with a correction as steep as 12.12% pre-Christmas, through the ICO bubble of 2017.

As BTC hovers round $97,000 on Tuesday, December 24, a pre-Christmas rally appears unlikely. BTC may acquire post-Christmas if there’s a revival in institutional curiosity within the largest cryptocurrency.

Crypto’s complete market capitalization, excluding Bitcoin, began its restoration this week. The each day chart reveals bullish indicators that assist a thesis of beneficial properties available in the market cap of altcoins, making it probably that alts observe a rally post-Christmas or throughout the first two buying and selling days of 2025.

Bitcoin This fall 2024 worth efficiency

Bitcoin quarterly returns information from Coinglass reveals over 50% beneficial properties in This fall each in 2024 and 2023, as of December 24. It’s necessary to notice that the bull runs in 2020, 2017, and 2013 ended with almost 480%, 215%, and 168% beneficial properties in BTC in This fall.

Bitcoin’s efficiency this quarter has been lackluster, and there may be little proof to assist prolonged beneficial properties within the first two buying and selling days of 2025. Institutional curiosity in BTC is slowing down, decreasing capital inflows, and that is evident from internet outflows of Bitcoin Spot ETFs.

With Bitcoin’s This fall efficiency underneath the median of 54.80%, it’s much less probably that the token will retest its all-time excessive earlier than the top of the 12 months.

Prime 50 altcoin efficiency

The altcoin season index on Blockchaincenter.internet helps consider the efficiency of the highest 50 altcoins over a interval of 90 days.

The index reads 49 on a scale of 0 to 100, which means the worth efficiency of the highest 50 altcoins is lagging behind when in comparison with Bitcoin’s yield for holders in the identical time interval.

Whereas 49 means it isn’t the altcoin season but, it reveals almost 50% of the altcoins have outperformed Bitcoin previously 90 days.

Trump impact, South Korea and Asian affect this cycle

Bitcoin costs proceed to say no, whilst U.S. President-elect Donald Trump has appointed a 3rd pro-crypto candidate. Trump nominated Stephen Miran to be Chair of his Council of Financial Advisers. Miran is a recognized crypto advocate and one other pro-crypto appointment made by the incoming President.

Beforehand, Trump appointed pro-crypto candidate Paul Atkins to go the Securities and Change Fee and tech investor David Sacks as synthetic intelligence and crypto czar. Whereas these appointments are anticipated to steer crypto in the direction of constructive regulation within the U.S., Bitcoin worth continues to slip.

Knowledge from Statista reveals that South Korea is estimated to be the third largest cryptocurrency market on the earth and exchanges in Korea account for over 9% of the worldwide commerce quantity as of 2021. The Korean Gained ranks among the many high 5 traded currencies towards Bitcoin, per the information.

South Korea delayed its crypto taxation till 2027 and adopted a pro-crypto strategy, paving means for constructive developments in Asia and for Bitcoin merchants in Korea.

Michael Saylor-led MicroStrategy’s blueprint to carry Bitcoin on its stability sheet has impressed a wave of adoption throughout Asia. Per an Asia Categorical report, Chinese language selfie app developer Meitu invested in 31,000 ETH and 940 BTC within the spring of 2021. Japanese agency Metaplanet is accumulating BTC by the dips and now holds 1,142 BTC, as of December 19.

With giant firms including Bitcoin to their stability sheet, Asia is in focus this cycle in driving BTC adoption and its institutionalization.

Key ranges to observe over the vacations

Bitcoin derivatives merchants are bullish on BTC beneficial properties throughout exchanges, Binance, OKX and Deribit. The lengthy/quick ratio exceeds 1 throughout the change platforms and BTC noticed a spike in open curiosity, signaling larger relevance and demand amongst merchants.

Over $38 million in Bitcoin quick positions had been liquidated previously 24 hours, as bullish sentiment prevails.

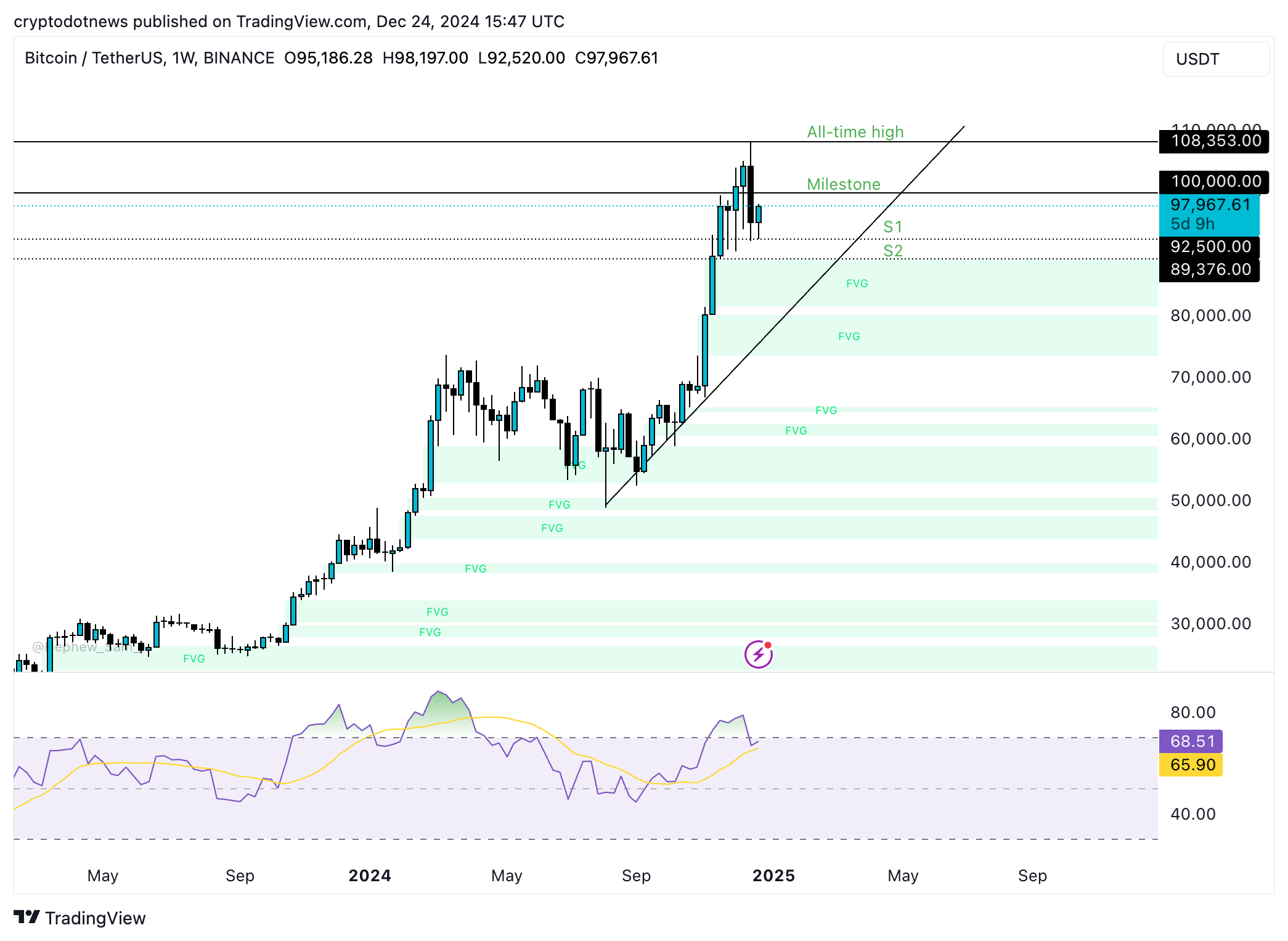

Key ranges to observe through the holidays:

- Assist at $89,376 and $92,500: A each day candlestick shut under the $89,376 degree may set off a breakdown of key helps and sign that sellers are prepared to tug BTC to the decrease boundary of the imbalance zone on the weekly worth chart at $81,500. This might end in cascading liquidations and a steep sell-off in crypto.

- Resistance on the $100,000 milestone: A each day candlestick shut above this degree brings the brand new all-time excessive above $108,000 again in play because the goal. BTC may prolong its beneficial properties and retest its all-time excessive, figuring out the cycle high.

Irrespective of the present sentiment amongst merchants, Bitcoin stays extremely unstable, and the important thing ranges present steerage as merchants navigate holiday-induced volatility within the crypto market.

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.