Bitcoin surged previous the $120,000 mark, reaching an intraday excessive of $122,300 — simply shy of its all-time excessive at $123,000. The transfer marks a robust bullish continuation after weeks of upward momentum, fueling hopes amongst merchants {that a} new file might be imminent. Nevertheless, seasoned traders are approaching the rally with warning, warning that present value motion might characterize a aid rally earlier than one other consolidation part.

Associated Studying

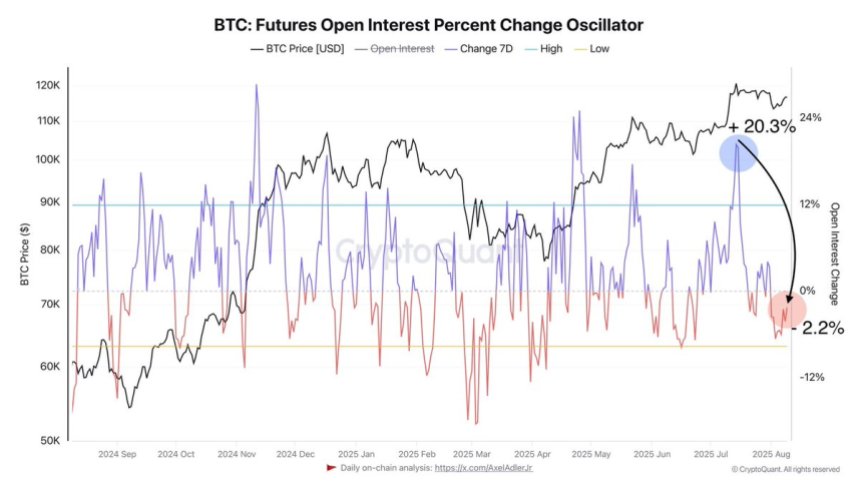

Contemporary knowledge from CryptoQuant provides a layer of complexity to the market outlook. After a pointy rise in common weekly open curiosity to over 20% — peaking on July 14 — the metric has since dropped considerably, now turning detrimental. This shift means that short-term threat urge for food has diminished, probably lowering speculative momentum within the close to time period.

Whereas open curiosity declines aren’t inherently bearish, they’ll point out a cooling part after durations of aggressive leverage. In some circumstances, such pullbacks in open curiosity, particularly when paired with elevated liquidations, have preceded engaging shopping for alternatives. For now, Bitcoin’s place close to file highs gives each promise and threat, with the following few classes prone to decide whether or not the market pushes increased or pauses for consolidation.

Open Curiosity Alerts Cooling Threat Urge for food

High analyst Darkfost has shared recent market insights, highlighting a notable shift in Bitcoin’s derivatives panorama. In response to his evaluation, the present weekly common for open curiosity change sits at -2.2%, marking a pointy reversal from the +20% ranges seen simply weeks in the past. This drop indicators that short-term threat urge for food amongst merchants has clearly diminished, with many members lowering leveraged positions after an prolonged bullish run.

Liquidations are a key issue on this growth. Darkfost factors out that when open curiosity experiences a pointy short-term drop alongside a spike in liquidations, it typically presents a window for worthwhile lengthy entries. This setup usually happens when overleveraged positions are worn out, permitting stronger fingers to build up at extra favorable ranges. Whereas not a exact purchase sign, it stays a priceless device for gauging market circumstances and figuring out probably favorable entry zones.

The present backdrop is especially intriguing as Ethereum pushes towards all-time highs, drawing elevated consideration to the broader crypto market. Bitcoin’s stability above the $120K stage, mixed with bettering sentiment throughout altcoins, units the stage for probably sturdy follow-through within the coming weeks. Nevertheless, merchants might be watching derivatives metrics carefully for indicators of renewed leverage or additional cooling earlier than committing to bigger positions.

Associated Studying

Bitcoin Assessments Key Resistance Simply Under All-Time Excessive

Bitcoin has surged to $121,337, marking a robust breakout from its latest consolidation part and pushing to its highest stage since setting the all-time excessive at $123K. The every day chart exhibits a decisive transfer above the $119K zone, confirming bullish momentum after holding assist on the 50-day shifting common close to $114,155.

This rally brings BTC inside putting distance of the $123,217–$124,000 resistance space, a vital zone that beforehand capped upside makes an attempt in July. A clear break and every day shut above this stage might open the door for a brand new all-time excessive, probably triggering additional upside momentum as merchants chase the breakout.

Associated Studying

With Ethereum nearing its personal file highs and altcoins displaying renewed power, Bitcoin’s efficiency within the coming classes might be pivotal for broader market sentiment. If BTC manages to safe a sustained transfer above $124K, it might gasoline a market-wide surge. Nevertheless, failure to interrupt increased may even see a interval of consolidation earlier than the following decisive transfer.

Featured picture from Dall-E, chart from TradingView