Este artículo también está disponible en español.

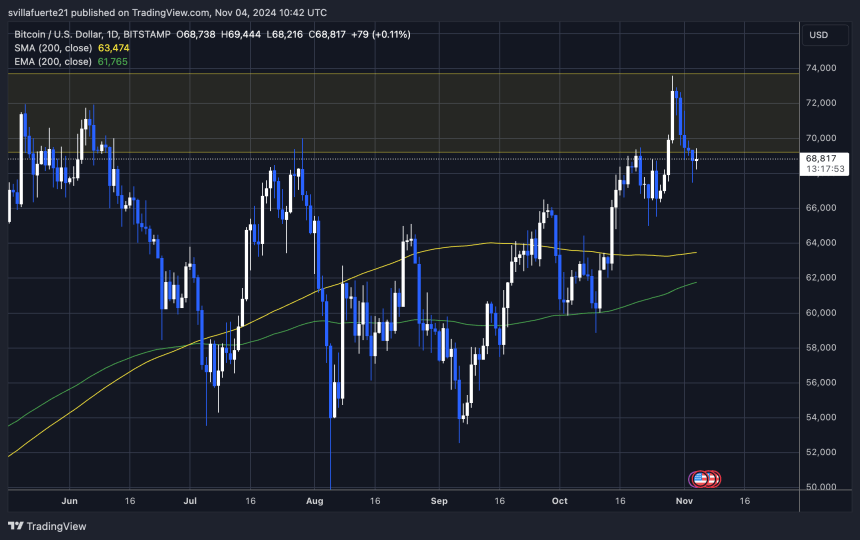

Bitcoin has confronted vital volatility and uncertainty because it approaches a pivotal week, with tomorrow’s U.S. election anticipated to play a key function in figuring out its value motion. BTC is holding regular above the $68,000 mark, a crucial stage that has shifted from resistance to a strong demand zone. Analysts see this stage as important for sustaining bullish momentum, particularly with high-stakes occasions on the horizon.

Key knowledge from Coinglass reveals a notable drop in Bitcoin’s open curiosity, suggesting that many traders are closing their positions amid the uncertainty surrounding the election and the Federal Reserve’s upcoming rate of interest determination on Thursday. This decline in open curiosity displays a cautious market stance as merchants anticipate the election consequence and its potential affect on broader monetary markets and Bitcoin’s trajectory.

Associated Studying

With BTC managing to carry above this demand zone, the approaching days can be essential for confirming its route. A sustained maintain might strengthen BTC’s outlook, setting it up for a possible breakout. Conversely, elevated promoting stress tied to market reactions might put this stage to the take a look at. The week forward might be a defining second for Bitcoin’s value motion as macro occasions unfold.

Bitcoin Buyers Getting ready For This Week

Bitcoin is gearing up for what might be probably the most defining week of this market cycle. Approaching all-time highs, BTC is going through heightened volatility as two crucial occasions unfold: the U.S. presidential election and the Federal Reserve’s determination on rates of interest.

These occasions are poised to affect Bitcoin and world monetary markets, doubtlessly shaping world commerce insurance policies and financial stability.

Latest knowledge from Coinglass highlights that traders are bracing for a turbulent week as open curiosity in Bitcoin dropped considerably, with many merchants opting to shut their lengthy and quick positions earlier than the election.

This retreat in open curiosity indicators warning, because the crypto market anticipates vital volatility stemming from the election outcomes and the Fed’s fee determination. Coinglass shared an evaluation on X, emphasizing that Bitcoin’s value might expertise excessive swings no matter who wins the election, likening it to a “wild rollercoaster.”

This week is essential for Bitcoin and the broader world financial system, with analysts suggesting that the election might set the tone for worldwide financial insurance policies and commerce relations within the years to come back. The Fed’s fee determination, scheduled simply days after the election, provides further uncertainty, because it might dictate financial coverage route and market liquidity.

Associated Studying

With BTC teetering close to historic highs, traders are carefully watching these occasions to study market route. Whether or not Bitcoin breaks to new heights or experiences a pullback largely will depend on the unfolding financial panorama. For now, Bitcoin stays on edge, with traders poised for every week that would outline its trajectory for the months forward.

BTC Testing Essential Liquidity

Bitcoin is buying and selling at $68,800 after falling wanting breaking its all-time highs final week. This week guarantees heightened unpredictability for BTC’s value motion, pushed by main occasions within the world financial system. Key ranges can be important to observe: if Bitcoin can preserve assist above $68,000, it is going to probably set the stage for an additional try and surge previous its report excessive.

Nevertheless, volatility might take a look at this assist, doubtlessly shaking out “weak palms” earlier than any vital upward momentum. Ought to BTC dip beneath $68,000, additional pullbacks might observe, permitting institutional patrons to build up earlier than a renewed push.

If Bitcoin efficiently breaks above its $73,794 all-time excessive, it is going to enter a value discovery section, the place the shortage of resistance can set off a rally fueled by FOMO (concern of lacking out) amongst traders. This upward momentum in a value discovery zone typically results in fast value will increase as extra patrons enter the market.

Associated Studying

As Bitcoin edges to this stage, market contributors stay watchful, anticipating a possible breakout that would redefine the broader market sentiment and set up new highs for the cycle.

Featured picture from Dall-E, chart from TradingView