Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

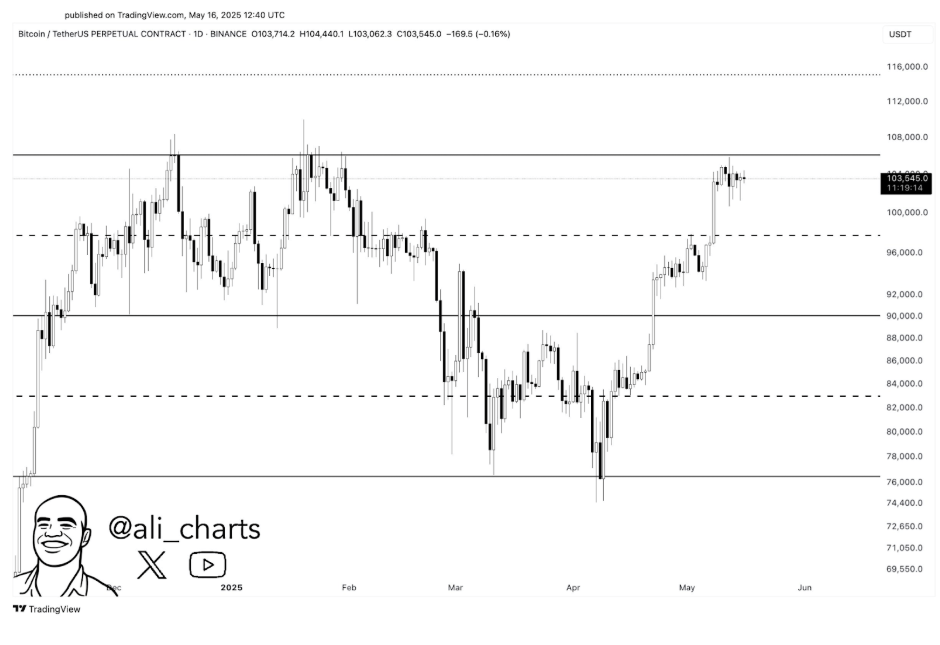

After a strong rally earlier this month, Bitcoin’s worth motion has stalled simply above $103,000 and has been caught in a decent consolidation vary for over the previous week. The every day chart exhibits constant resistance simply above $107,000, with the newest candles forming in a compressed horizontal band, indicating indecision and low momentum.

Associated Studying

This worth habits could possibly be seen as a pause earlier than the following leg increased. Nonetheless, it may be a entice that might trigger a reversal in direction of $98,000.

Day by day Shut Above $107K A Clear Breakout Sign

Bitcoin’s present consolidation across the $103,000 worth stage has dragged on for over every week, and an eventual breakout may occur into any route. In a latest submit on social media platform X, crypto analyst Ali Martinez famous the significance of a every day shut above $107,000 for a bullish Bitcoin.

His chart illustrates that worth has approached this threshold a number of instances since December 2024 however didn’t maintain a detailed on the every day timeframe. This, in flip, has led to the formation of a horizontal barrier simply beneath $108,000. Notably, even Bitcoin’s all-time excessive of $108,786 on January 20 failed to shut above the $107,000 worth stage on that day.

In keeping with Martinez, a confirmed shut above this stage may open the door for additional upside motion towards new all-time highs. Nonetheless, till this threshold is decisively cleared, Martinez warns that merchants ought to be cautious and keep away from forcing positions.

Picture From X: @ali_charts

Potential Bitcoin Entice Setup And Liquidity Sweep To $98K

A separate technical breakdown by crypto analyst TehThomas, revealed on TradingView, presents a much more cautious outlook for Bitcoin. Equally, the analyst famous that Bitcoin has spent greater than eight days locked in a slim vary between roughly $100,000 and $105,800.

In keeping with his liquidity-based framework, this vary is probably going getting used as a entice to ask each lengthy and brief merchants into untimely breakout trades. His 4-hour candlestick timeframe chart exhibits a transparent consolidation block, with worth failing to flee both finish, and liquidity pooling above $105,800 in addition to beneath $100,000.

TehThomas believes the equal highs close to $105,800 are performing as bait for breakout longs. He expects Bitcoin to briefly sweep these highs, solely to trigger a quick and decisive transfer downwards into the decrease demand zone between $98,000 and $97,500.

This zone, marked as a big unmitigated truthful worth hole and golden pocket stage on his chart, is the place he expects the worth to react subsequent, as soon as the liquidity on either side is taken.

Picture From TradingView: TehThomas

Nonetheless, this brief setup in direction of $98,000 could be invalidated if the Bitcoin worth manages to carry above $105,800 and exhibits a continued robust quantity and follow-through.

Associated Studying

On the time of writing, Bitcoin was buying and selling at $103,914, down by 0.06% up to now 24 hours.

Featured picture from Unsplash, chart from TradingView