Bitcoin is at the moment holding above the $115,000 degree after setting a brand new all-time excessive of roughly $123,000 final Monday. The value construction stays firmly bullish, with consumers nonetheless in management, however rising indicators recommend the potential for a short-term correction. Momentum has slowed, and the market is getting into a consolidation part as merchants reassess danger.

Associated Studying

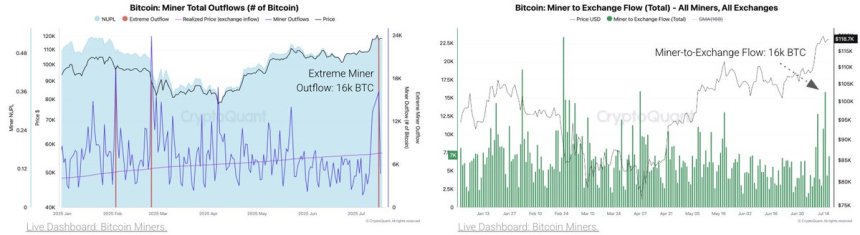

In line with new knowledge from CryptoQuant, Bitcoin miner promoting has surged sharply. On July 15, the identical day Bitcoin reached its newest peak, day by day BTC inflows to exchanges jumped from 19,000 BTC to 81,000 BTC — a transparent signal that main holders, together with miners and whales, took benefit of excessive costs to dump belongings. Notably, miner outflows spiked to 16,000 BTC, the very best day by day degree since April, and practically all of it was despatched on to exchanges.

These inflows recommend a shift in sentiment amongst massive gamers, elevating the likelihood of elevated provide stress within the quick time period. Whereas the broader development stays intact, and fundamentals like long-term holder exercise are nonetheless sturdy, the spike in change deposits is a traditional sign to observe. Whether or not this results in a deeper pullback or just a wholesome reset will probably be determined within the coming days.

Miners Take Income As Bitcoin Hits All-Time Excessive

Recent knowledge from CryptoQuant reveals that Bitcoin miners have resumed aggressive promoting conduct as BTC reached a brand new all-time excessive of ~$123,000. On July 15, miner outflows spiked to 16,000 BTC — the very best single-day complete since April 7. This degree of exercise represents what analysts at CryptoQuant describe as an “excessive outflow,” indicating that miners seized the chance to take income at elevated costs.

The miners despatched practically all of the BTC they withdrew from their wallets on to centralized exchanges. This reinforces the interpretation that the transfer was not merely a strategic reallocation however an lively determination to promote into market power. Such conduct usually alerts rising warning amongst miners, who might count on both near-term value exhaustion or are merely capitalizing on favorable situations after months of holding.

Miner conduct has lengthy been considered as a number one indicator of potential market shifts. When outflows rise — significantly to exchanges — it tends to precede elevated volatility or short-term tops. Whereas the broader Bitcoin development stays bullish and investor demand stays sturdy, this wave of miner promoting injects a dose of uncertainty.

Associated Studying

BTC Consolidates Under ATH After Explosive Rally

The day by day chart of Bitcoin (BTC/USD) exhibits value consolidating in a decent vary between $115,730 and $123,230 after reaching a brand new all-time excessive. This zone is now performing as a short-term channel, with consumers defending the $115K space whereas dealing with resistance round $123K. The newest day by day candle exhibits low volatility, suggesting indecision amongst merchants as Bitcoin pauses after its current breakout.

Quantity has tapered off following an enormous spike that coincided with the all-time excessive breakout, a possible sign of exhaustion or decreased participation from massive consumers. The 50-day easy shifting common (SMA) at $108,796 stays nicely under the present value, confirming the bullish momentum remains to be intact, however any breakdown under the $115K degree may carry the 50-day SMA into focus as a possible help.

Associated Studying: All 40K Remaining Bitcoin From The 80K Whale Simply Moved: $4.75B In One Pockets Now

Thus far, the development construction stays bullish, however with a rising variety of analysts pointing to miner gross sales and whale exercise, merchants are intently monitoring value motion for indicators of a pullback or renewed breakout. If BTC can reclaim $123,230 with quantity, the subsequent leg up may comply with. Till then, this consolidation might function a wholesome cooldown earlier than the subsequent main transfer.

Featured picture from Dall-E, chart from TradingView