Este artículo también está disponible en español.

Bitcoin mining agency MARA – previously referred to as Marathon Digital – has introduced the acquisition of a further 703 BTC. This buy will increase the corporate’s whole cryptocurrency holdings to 34,794 BTC.

MARA’s Bitcoin Holdings Surge To 34,794 As CEO Shares Bullish Outlook

In an announcement made yesterday on X, MARA, one of many world’s main Bitcoin mining firms, revealed it had acquired 703 BTC at a mean worth of $95,395. This brings the agency’s whole Bitcoin purchases for November to six,474 BTC, following final week’s acquisition of 5,771 BTC.

Associated Studying

The newest buy has elevated the agency’s whole digital asset holdings to 34,794 BTC, valued at roughly $3.3 billion at present market costs. Moreover, the agency disclosed that its year-to-date (YTD) BTC yield per share stands at 36.7%.

Earlier this month, MARA raised $1 billion by issuing 0% convertible senior notes due in 2030. A portion of the $200 million funds was used to purchase again a few of its 2026 notes. The agency has additionally reserved $160 million from the proceeds, aspiring to deploy it for future Bitcoin purchases if market costs grow to be favorable.

As reported yesterday, MARA CEO Fred Thiel – in an interview with CNBC – remarked that extra institutional buyers are occupied with BTC, hoping {that a} Donald Trump administration will result in favorable cryptocurrency laws within the US.

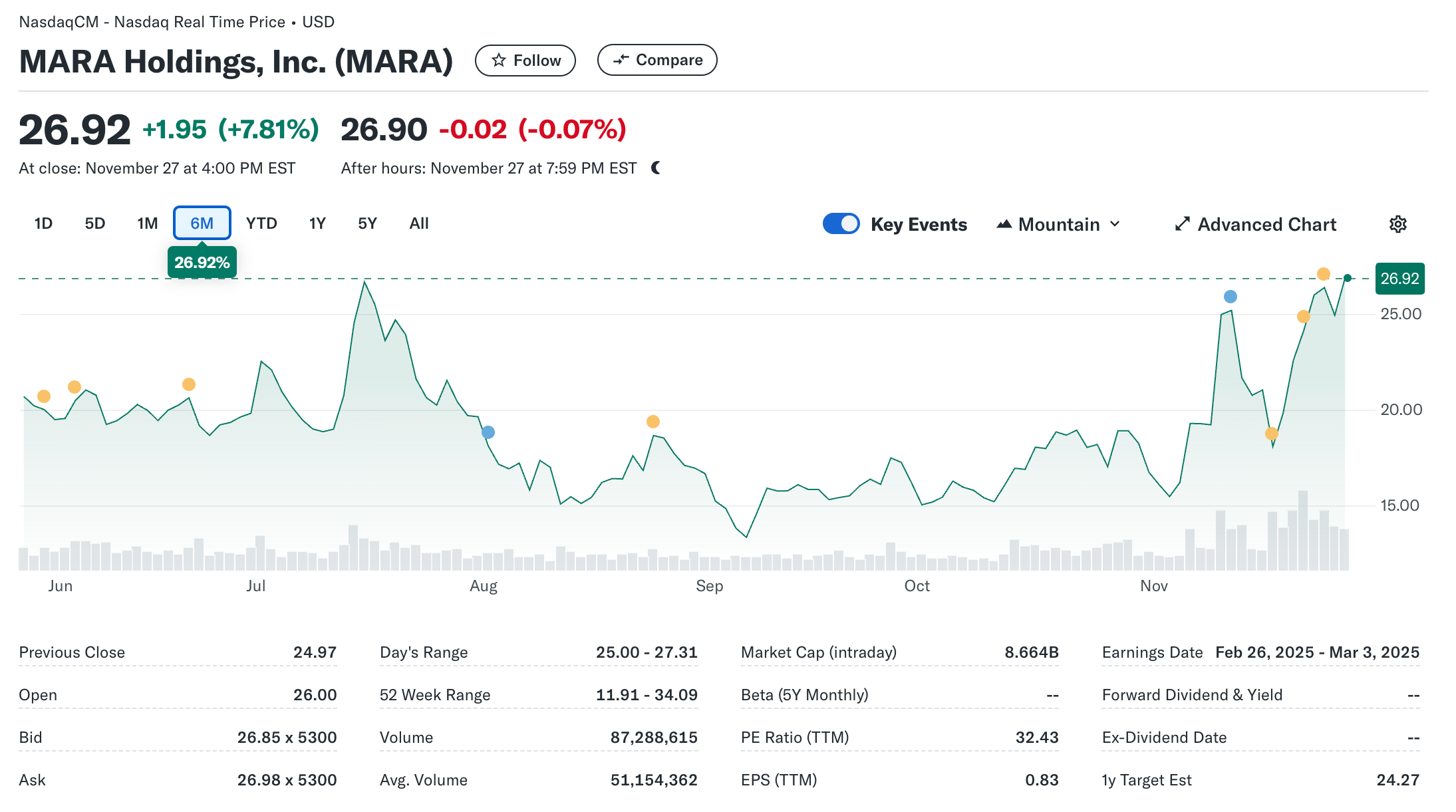

MARA inventory closed at $26.92 on November 27, recording a rise of seven.81% for the day. Within the final six months, the share worth has elevated by 26.92%, coinciding with rising optimism towards digital belongings as market sentiment improves with modifications in authorities administration.

Company Strikes May Push Bitcoin Past $100,000

MARA’s aggressive Bitcoin acquisition technique mirrors that of MicroStrategy, which has the biggest Bitcoin holdings globally. Beneath Michael Saylor’s management, MicroStrategy has spent billions on Bitcoin purchases this month, totaling $4.6 billion and $5.4 billion in back-to-back weeks.

Associated Studying

As President-elect Trump’s January twentieth inauguration date approaches, many firms worldwide are warming as much as including BTC to their steadiness sheets. Most lately, Canada-based on-line video-sharing platform Rumble earmarked $20 million for future BTC purchases. Equally, Japanese early-stage funding agency Metaplanet’s whole BTC holdings lately crossed 1,000 BTC.

The race for amassing as a lot BTC as doable has sparked some enthusiasm amongst crypto analysts who foresee the digital asset breaching the $100,000 milestone early subsequent 12 months. BTC trades at $95,615 at press time, up 1% previously 24 hours.

Featured picture from Unsplash, charts from Yahoo! Finance and Tradingview.com