Arthur Hayes has issued a stark market warning: he sees a rising break up between his most popular threat gauge, Bitcoin, and the tech-heavy Nasdaq 100 as a sign that credit score stress could also be constructing underneath the floor.

Associated Studying

Hayes, a co-founder and former CEO of cryptocurrency change BitMEX, calls Bitcoin a “fiat liquidity hearth alarm” — an asset that reacts shortly when credit score situations change.

A Warning From Market Indicators

When two property that always moved collectively begin to pull aside, merchants take discover. Hayes believes {that a} hole like this deserves investigation as a result of it may level to hassle in financial institution stability sheets or within the circulation of lending.

He argues the transfer will not be about one inventory or one commerce; it’s concerning the plumbing of credit score and how briskly liquidity can dry up when issues flip.

How AI Job Cuts Might Ripple Via Credit score

Stories observe that corporations cited AI as a motive for 1000’s of layoffs in recent times, with an outplacement agency counting roughly 55,000 cuts in 2025 that have been tied to AI. A lot of that hit was inside tech.

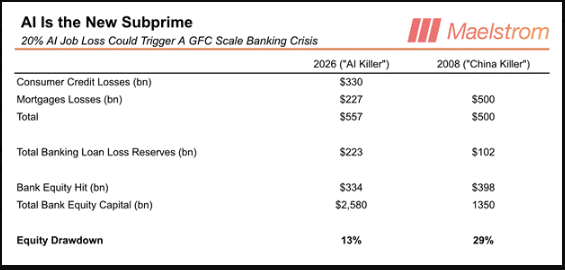

Hayes sketches a tough situation: a large drop in knowledge-worker employment would weaken mortgage and shopper credit score compensation, which may then shave financial institution fairness and tighten lending.

The numbers he presents are approximate and constructed on a number of assumptions, however they’re supposed to indicate how a shock to white-collar paychecks may cascade into the credit score system.

Expectations About Central Financial institution Motion

Hayes expects a coverage response if banks begin to fail and credit score freezes. He argues the Federal Reserve would step in with contemporary liquidity, and that more cash creation would observe — a transfer he says can be favorable for Bitcoin’s worth outlook.

That situation has been a recurring theme in his commentary; previous essays and posts have linked anticipated Fed liquidity to sharp rallies in crypto markets.

Altcoin Bets And Fund Positioning

His fund, Maelstrom, is alleged to plan staking or stablecoin deployments into privacy-focused and exchange-native performs as soon as liquidity coverage shifts happen, naming Zcash and Hyperliquid as examples. That sort of tactical stance is supposed to revenue from a short-term surge in threat property after a coverage pivot.

Associated Studying

A Measured View

This can be a dramatic chain of occasions: AI job losses result in credit score losses, which trigger financial institution stress, which forces the central financial institution to broaden cash provide, which lifts Bitcoin.

Every hyperlink is believable, however none is assured. A few of Hayes’ figures are tough estimates meant as an example threat quite than to behave as a exact forecast.

Market historical past reveals that central banks do generally step in, and that coverage strikes can energy asset rallies, however outcomes rely on timing, scale and public confidence — components which can be laborious to foretell prematurely.

Featured picture from Unsplash, chart from TradingView