Bitcoin has confronted considered one of its most risky weeks in current historical past, plunging to $103,000 on Friday in a dramatic 15% drop that erased billions in market worth inside hours. The sudden sell-off triggered widespread liquidations throughout the crypto market, wiping out leveraged positions and sparking panic amongst merchants. Nevertheless, value motion is now exhibiting early indicators of restoration, with some analysts suggesting that this sharp correction may pave the best way for a stronger, extra sustainable uptrend.

Based on a current report from CryptoQuant, this occasion marks one of the vital extreme market resets ever recorded, with potential ripple results anticipated to form value conduct for months to come back. Following Bitcoin’s peak final week, open curiosity — a measure of futures market exercise — dropped sharply by $12 billion, from $47 billion to $35 billion. This represents one of many largest contractions in derivatives positioning seen in recent times.

Such large deleveraging traditionally precedes a more healthy market construction, as extreme hypothesis is flushed out. Whereas volatility stays elevated, the mixture of decreased leverage and renewed inflows from stablecoin reserves may place Bitcoin for a gradual restoration — if demand holds regular and consumers regain confidence within the coming classes.

Market Reset Clears the Path For Bitcoin

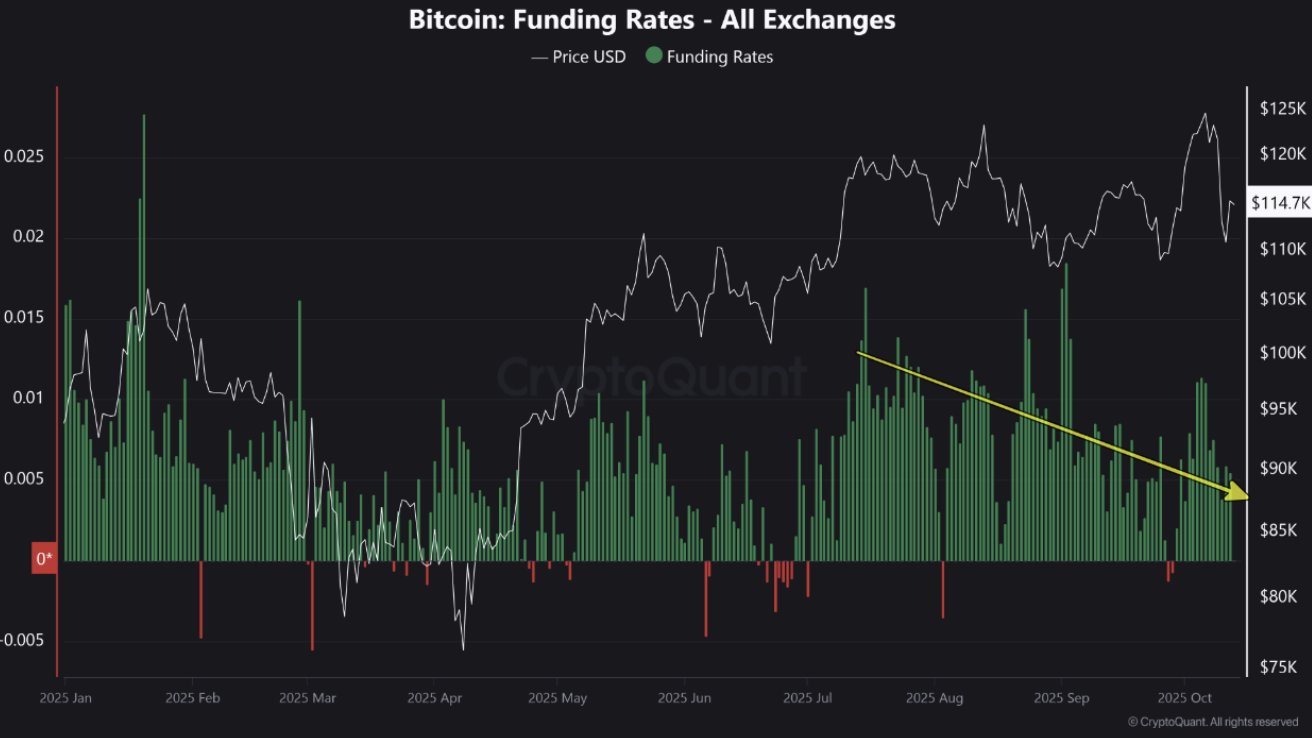

The CryptoQuant report highlights a notable shift in Bitcoin’s market construction following Friday’s large correction. Funding charges, which had been declining steadily for months, briefly turned destructive in the course of the capitulation occasion — a transparent signal that merchants flipped bearish in panic. Nevertheless, these charges have since normalized to modestly constructive ranges, indicating that sentiment is stabilizing and short-term hypothesis is being changed by extra balanced positioning.

One other key metric, the Bitcoin Estimated Leverage Ratio (ELR), additionally dropped considerably after reaching ranges not seen since 2022. This sharp discount factors to a widespread deleveraging throughout derivatives markets, as overexposed merchants had been pressured to unwind positions. Such occasions usually act as a “reset” for market well being, flushing out extreme leverage and setting the stage for extra sustainable development.

In the meantime, the Bitcoin Stablecoin Provide Ratio (SSR) fell to its lowest level since April. This decline implies that stablecoin liquidity — or the potential shopping for energy sitting on the sidelines — has risen considerably relative to Bitcoin’s market capitalization. Traditionally, when stablecoin liquidity will increase after main sell-offs, it usually alerts an accumulation section that precedes restoration.

BTC Makes an attempt Restoration After Sharp Correction

Bitcoin is exhibiting indicators of stabilization after its steep decline to the $103,000 degree on Friday. The each day chart reveals that BTC has rebounded sharply, at present hovering round $115,000. This restoration means that consumers are stepping in round key demand zones, defending the 200-day shifting common — a traditionally crucial degree for sustaining long-term bullish momentum.

Regardless of the bounce, Bitcoin stays under the $117,500 resistance, a degree that beforehand acted as robust assist. Bulls should reclaim and shut above this zone to substantiate a continuation towards $120,000 and probably retest the $125,000 vary. Till then, the value stays inside a consolidation section following an excessive liquidation occasion.

The shifting averages (50-day and 100-day) present a near-term bearish crossover danger, reflecting the market’s cautious tone. Nevertheless, the fast rebound from final week’s capitulation signifies robust underlying demand and the potential for a better low formation — a constructive technical signal.

If BTC manages to carry above $112,000 and regain $117,500, momentum may shift again in favor of consumers. Conversely, failure to maintain these ranges may expose the market to a different retest of decrease helps round $108,000.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.