Bitcoin is exhibiting indicators of restoration after enduring weeks of promoting stress that culminated in a pointy flash crash on October 10, when the worth briefly dipped to round $103,000. Since then, BTC has rebounded modestly, now testing resistance close to $111,000, a zone the place sellers have traditionally stepped in. Regardless of the bounce, market sentiment stays fragile, with merchants hesitant to name a transparent backside.

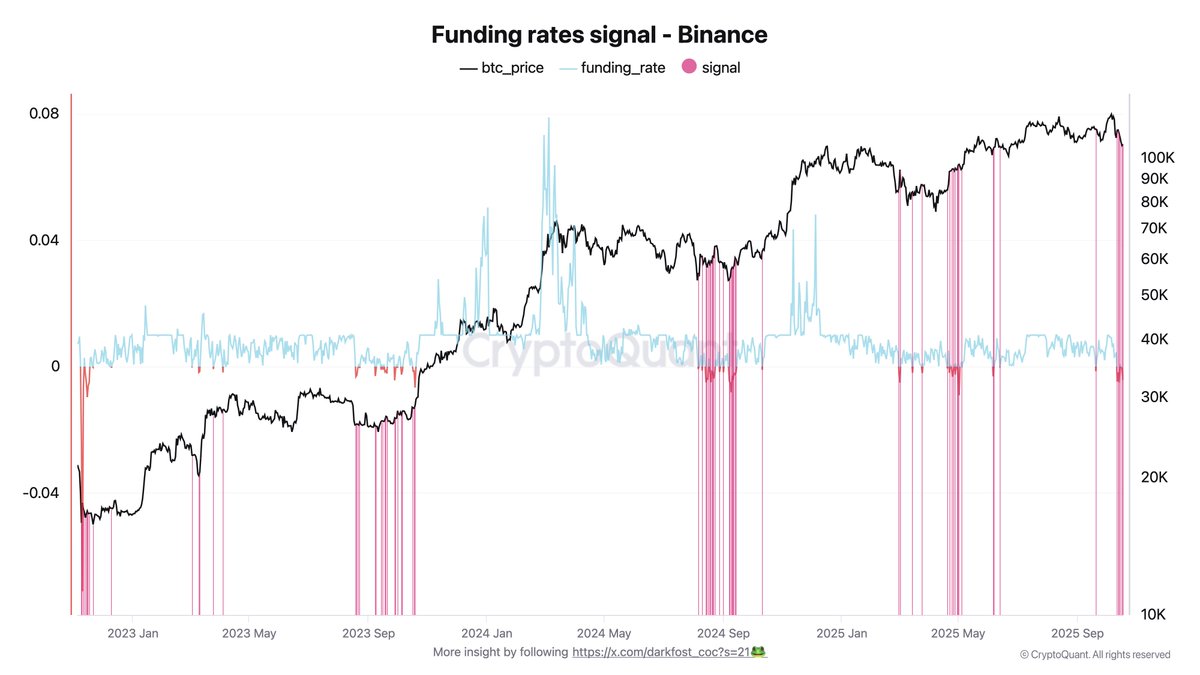

In keeping with high analyst Darkfost, Bitcoin could also be getting into a brand new part of disbelief — a stage typically seen on the finish of main corrections, when traders wrestle to belief any signal of restoration. This shift is changing into more and more evident within the derivatives market, notably by way of funding charges, which mirror dealer positioning and market bias.

On Binance, which nonetheless dominates world futures buying and selling quantity, funding charges have remained damaging for six of the previous seven days, presently sitting round -0.004%. This sustained bearish bias means that quick positions proceed to outweigh longs, as merchants stay cautious after the latest liquidation wave. Traditionally, such persistent disbelief and quick dominance have typically preceded sturdy quick squeezes or aid rallies.

Disbelief May Set The Stage for The Subsequent Huge Rally

In keeping with Darkfost, the present part of disbelief may paradoxically turn into the muse for Bitcoin’s subsequent main rally. When merchants stay overly bearish regardless of early indicators of restoration, the buildup of quick positions can create a setup for a robust quick squeeze. In such situations, even a modest upward transfer can drive quick sellers to cowl their positions, accelerating shopping for stress and fueling a fast worth breakout.

If the present uptrend continues to construct momentum, this wave of liquidations may push Bitcoin sharply greater. Darkfost factors to key liquidity zones round $113,000 and $126,000, each areas the place vital quick positions are presently concentrated. As these positions unwind, BTC may see a sequence response of compelled shopping for — a dynamic that has traditionally triggered explosive strikes.

Comparable patterns have unfolded earlier than. In September 2024, Bitcoin fell to $54,000 earlier than rebounding above $100,000 for the primary time, fueled by a large-scale quick squeeze. Once more, in April 2025, BTC surged from $85,000 to $111,000, and ultimately to $123,000, following the identical construction.

Darkfost suggests the market may now be getting into one other such part of disbelief, the place widespread skepticism masks underlying power. If historical past rhymes, this doubt-driven surroundings could as soon as once more remodel worry into momentum — setting the stage for Bitcoin’s subsequent main transfer greater.

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.