On-chain knowledge exhibits the Bitcoin Realized Cap Progress indicator has continued to say no not too long ago, an indication new capital inflows lack momentum.

Bitcoin Realized Cap Progress Has Been Heading Down Lately

As defined by CryptoQuant group analyst Maartunn in a brand new submit on X, the Bitcoin Realized Cap Progress has been trending decrease not too long ago. The “Realized Cap” is an on-chain capitalization mannequin for BTC that calculates its whole worth by assuming the worth of every particular person token is the same as the spot worth at which it was final transacted on the blockchain.

That is not like the same old market cap, which merely calculates the whole valuation of the asset by multiplying the variety of tokens in circulation with the present spot worth, contemplating the newest worth of the cryptocurrency to be the one worth for all cash.

Briefly, what the Realized Cap represents is the quantity of capital that the Bitcoin buyers as an entire used to buy the asset’s provide. Alternatively, the market cap is the worth that the buyers are carrying within the current.

The Realized Cap itself isn’t the indicator of curiosity within the present dialogue, however fairly the Realized Cap Progress, measuring the 365-day adjustments occurring within the Realized Cap.

Adjustments within the indicator naturally mirror the quantity of capital exiting or getting into the cryptocurrency. In different phrases, the Realized Cap Progress accommodates details about the asset’s netflow.

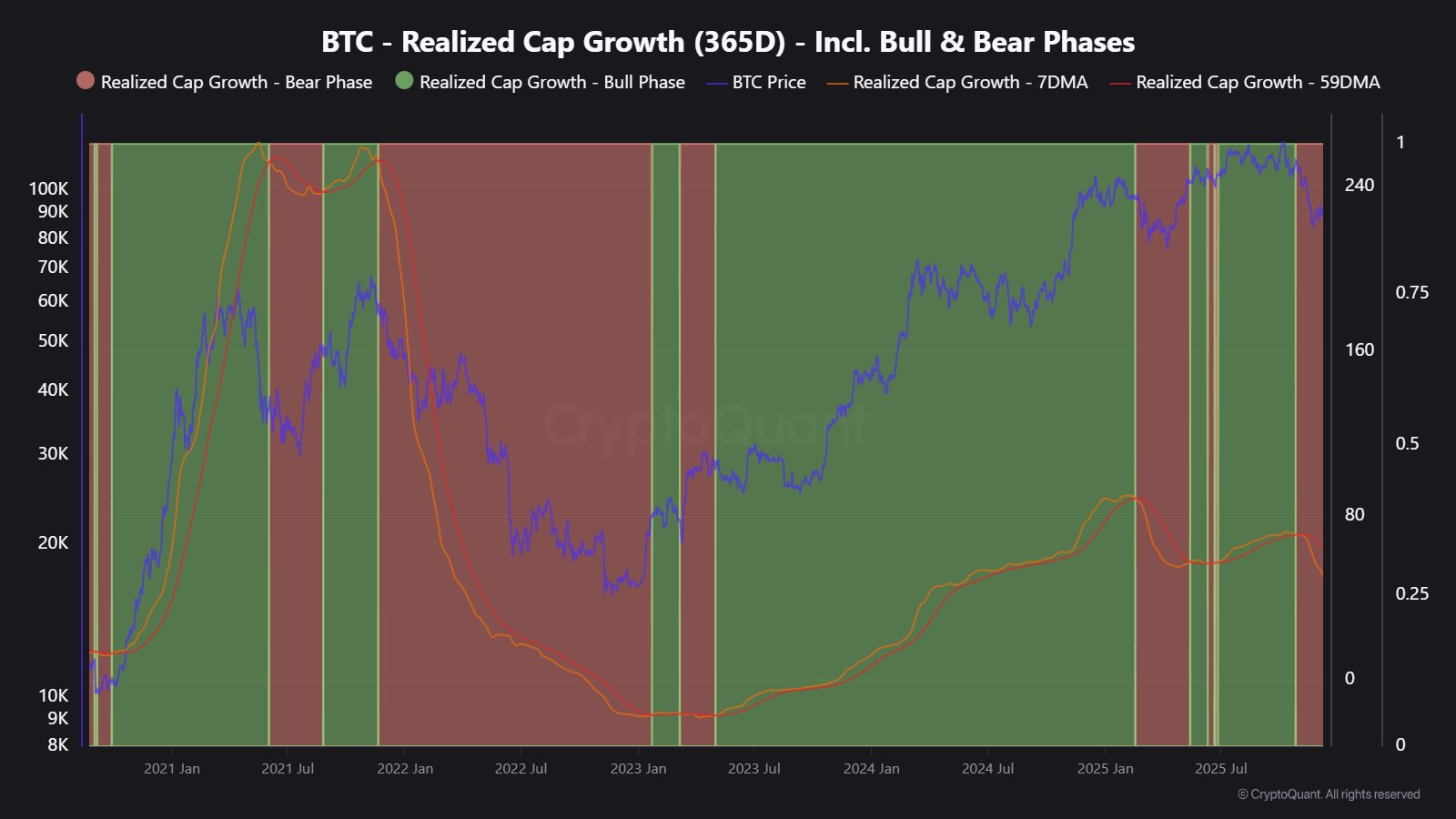

Now, right here is the chart shared by Maartunn that exhibits the development within the 7-day and 59-day shifting averages (MAs) of the Bitcoin Realized Cap Progress over the previous couple of years:

As displayed within the above graph, the Bitcoin Realized Cap Progress has witnessed each its 7-day and 59-day MAs reverse down not too long ago, with the previous line crossing underneath the latter.

The development signifies that development within the Realized Cap has been slowing down through the current market downturn. “This implies Bitcoin is missing momentum from new price foundation inflows,” famous the analyst.

With the 7-day MA falling under the 59-day MA, the indicator is now flagging the present market to be in a “bear section.” The final time this sign maintained for an prolonged length was alongside BTC’s decline over the primary few months of 2025. It now stays to be seen how lengthy momentum from new capital inflows will keep weak for Bitcoin this time round.

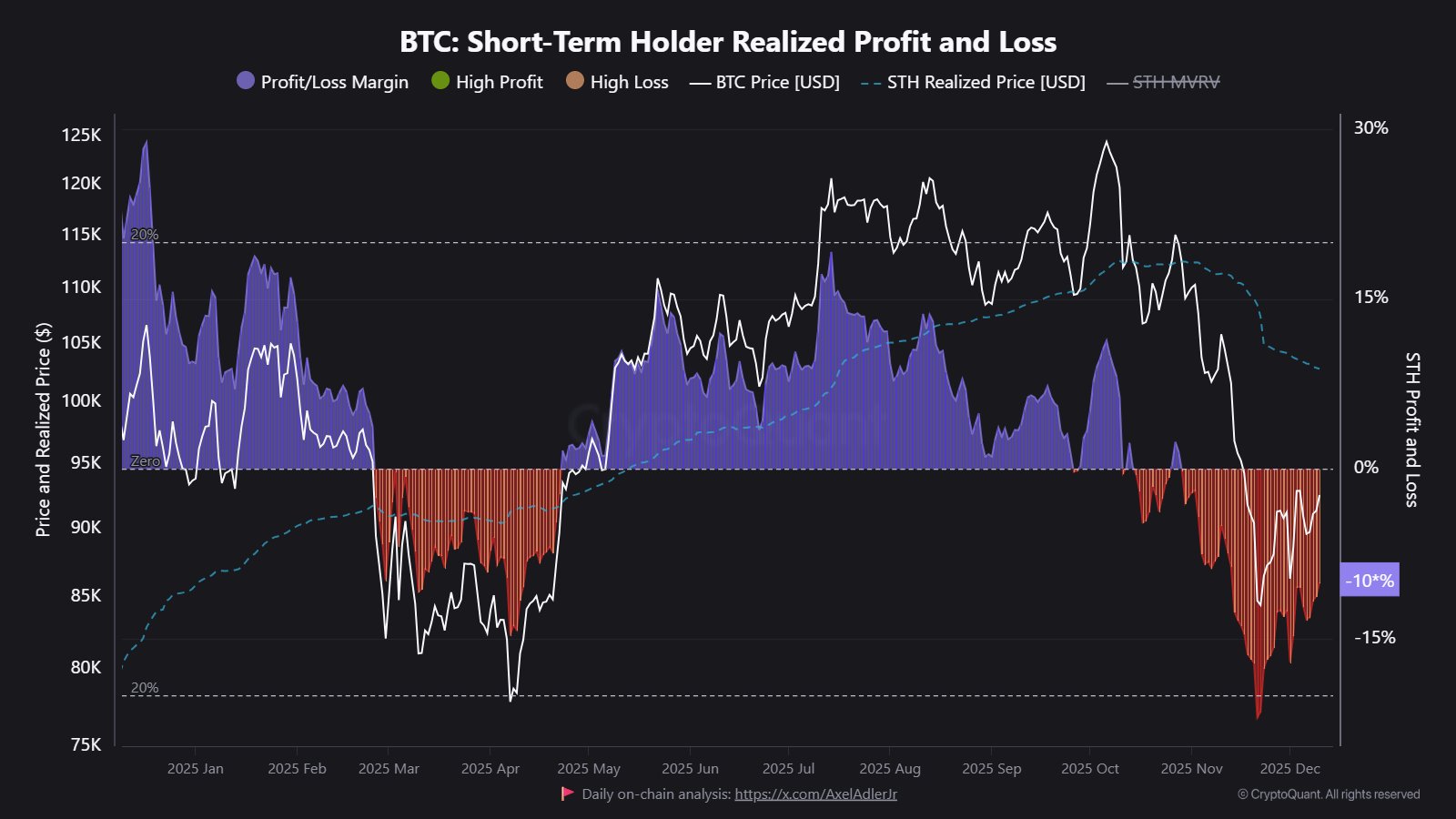

In another information, the Bitcoin short-term holders are nonetheless underneath a notable quantity of stress, as CryptoQuant writer IT Tech has identified in an X submit.

Brief-term holders (STHs) are outlined because the Bitcoin patrons who bought into the market through the previous 155 days. Regardless of the rebound BTC has seen since its November low, STHs are nonetheless in a lack of 10%.

BTC Value

On the time of writing, Bitcoin is floating round $92,400, down 1.5% over the past 24 hours.