Bitcoin’s subsequent leg increased sits inside a broader “every part, in all places, suddenly” bull market that echoes the Nineteen Fifties greater than the Nineteen Nineties—and the underlying engine is fiat debasement that can proceed to funnel financial premiums into impartial reserve belongings equivalent to Bitcoin and gold. That’s the core of veteran macro analyst and investor Mel Mattison’s thesis in a wide-ranging interview on Milk Highway Macro printed Monday, October 7.

Mattison, a former fintech government with 25+ years in finance, argues that traders are misreading the cycle by citing relationships from the Nineteen Seventies and Eighties as an alternative of the sooner regimes that rhyme extra intently with immediately. “I really suppose essentially the most comparable decade is the 50s,” he mentioned, noting that the S&P 500’s common annual return then “was over 19%,” outpacing the Nineteen Nineties.

He described 2024–2025 as an “every part in all places suddenly rally… bonds, shares, gold, Bitcoin, actual property,” pushed by a multi-decade interest-rate cycle and a world “debasement commerce” that has lastly gone mainstream. “The scariest factor to me proper now’s that Morgan Stanley and Goldman Sachs are saying the identical factor that I used to be a 12 months in the past.”

Bitcoin And Gold To Dominate The Debasement Period

Inside that framework, Bitcoin performs the function of digital gold—one in every of two “impartial reserve belongings” poised, in Mattison’s view, to soak up extra financial premium because the fiat system adapts to rising debt masses and geopolitical realignment. He framed the second as a “gold struggle, not a chilly struggle,” pointing to the regular build-up of official gold reserves and various settlement rails.

Associated Studying

“Folks don’t perceive… that is simply getting began,” he mentioned of the bull market in each gold and Bitcoin. Whereas he sees gold as quickly stretched near-term, he reiterated a long-horizon goal according to arguments from different macro commentators: “Do I believe [gold is] going to $20,000 within the subsequent 10 to fifteen years? Sure, completely.” Bitcoin, he instructed, shares in that secular bid because the programmable counterpart: “Bitcoin I see as digital gold and that’s being accepted.”

Mattison’s supercycle name rests closely on coverage structure. He contends that markets are underpricing the US Federal Reserve’s statutory mandate to keep up “average long-term rates of interest,” alongside worth stability and most employment. “Beneath the statute, the FOMC has three distinct mandates… unemployment, worth stability, and ensuring that long-term rates of interest are average,” he mentioned, criticizing the concept the third leg is secondary.

In follow, he expects this to tug policymakers towards yield-curve management (YCC)–fashion interventions if wanted to cap long-tenor yields and stabilize debt service. “There’s no method that they’ll let rates of interest get out of hand,” he argued, including that the Fed may halt quantitative tightening and considerably broaden its stability sheet with out essentially reigniting 2021–2022-style inflation.

“The Federal Reserve may… simply take [its balance sheet] to $20 trillion within the subsequent decade with out creating large inflation,” he claimed, emphasizing that money-supply progress and velocity, not the extent of public debt per se, drive sustained worth strain.

That coverage trajectory, in his telling, is inherently supportive of belongings with financial traits. He dismissed recurring fears over overseas promoting of Treasuries: “When folks discuss… China or Japan [selling], there’s no risk from that,” he mentioned, arguing that home absorption—by banks, mutual funds, stablecoin stability sheets, or the Fed itself—can readily backstop issuance.

Associated Studying

He referred to as curiosity funds “stimulus,” preferring they recycle to US holders somewhat than overseas. On this setting, he believes index-heavy publicity will underperform energetic positioning within the new winners: “To me the massive alpha is… in gold and bitcoin,” with rising markets additionally benefiting from simpler international monetary situations if YCC or associated measures anchor US length.

Markets Can Go A lot Increased For Longer

Mattison’s historic lens additionally shapes his danger calendar. He likens the present mixture of post-pandemic fiscal-monetary coordination and geopolitical fault strains to the interval spanning World Struggle II, the Marshall Plan, and the Korean Struggle. He expects the rally to broaden past mega-cap tech as synthetic intelligence redistributes worth away from conventional SaaS moats, however he additionally flags a latent social-cohesion shock—an eventual part when “not solely do you wish to cut back, you wish to simply get out of danger… even gold.”

The timing, he mentioned, just isn’t imminent: “I actually suppose that’s no less than 12 to 24 months away at a minimal and presumably longer.” Till then, he urges traders to not underestimate how far markets—and Bitcoin—can run in a real bubble part. “In case you’ve by no means lived by means of [the late 1920s or late 1990s], you don’t perceive what the markets can really do,” he mentioned. “In a bubble setting, which I believe we’re heading into, it may possibly go loads increased and loads faster.”

Why This May Be the Largest Bull Run For the reason that Nineteen Fifties w/ @MelMattison1

Wish to understand how we survive $34T of U.S. debt?

Mel makes the contrarian case for why debt isn’t the issue… and why curiosity funds may really stimulate the financial system.

Tune in to know extra

TIME… pic.twitter.com/TqZML1j9TZ

— Milk Highway Macro (@MilkRoadMacro) October 7, 2025

For Bitcoin particularly, the implication is easy in Mattison’s mannequin: so long as the coverage combine tendencies towards looser efficient monetary situations to handle public debt and geopolitical competitors channels settlement into impartial belongings, BTC accrues financial premium alongside gold. Close to time period he anticipates volatility—“very brief time period [gold is] due for… a relaxation,” he famous, implying danger for correlated trades—however the secular path, he insists, stays increased. “I’m not saying this time is totally different,” he mentioned. “I’m really saying this time is like all the opposite occasions”—simply not inside the residing reminiscence of most traders.

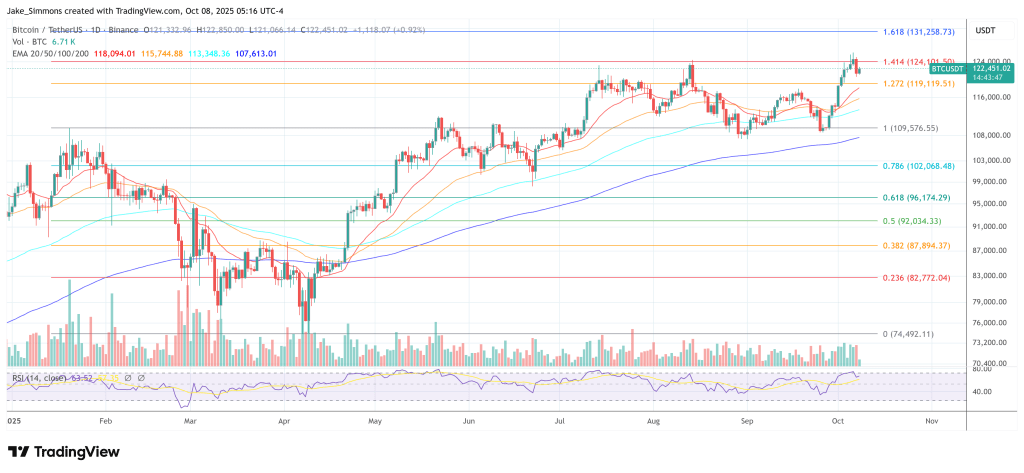

At press time, BTC traded at $122,451.

Featured picture created with DALL.E, chart from TradingView.com