On-chain information reveals the Bitcoin buyers are actually carrying 121% earnings on common. Right here’s whether or not this has been sufficient for a high up to now.

Bitcoin Profitability Index Is At present Sitting Round 221%

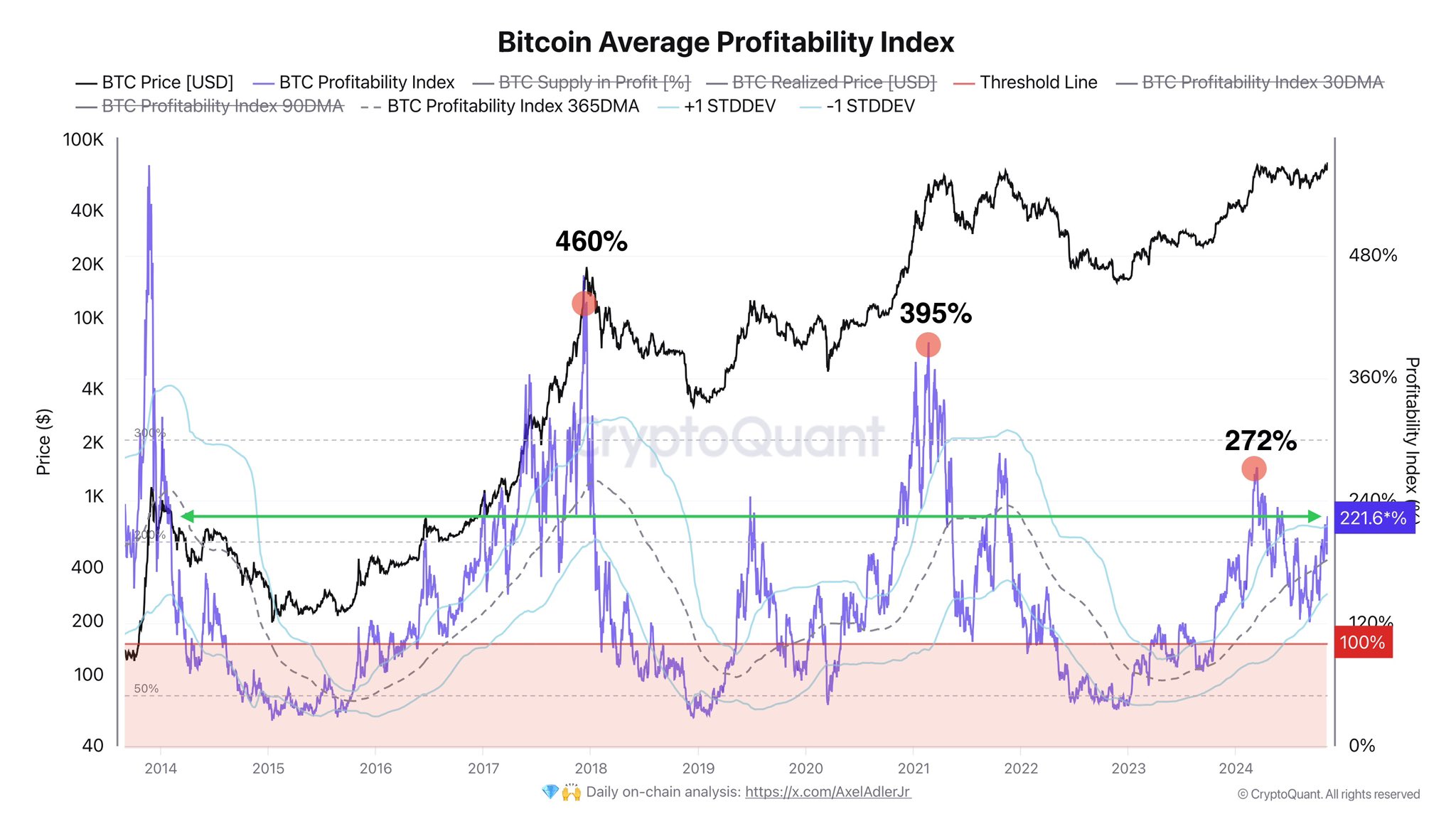

In a brand new publish on X, CryptoQuant writer Axel Adler Jr has mentioned concerning the newest development within the Bitcoin Common Profitability Index. The “Common Profitability Index” is an indicator for BTC that compares the asset’s spot worth with its realized worth.

The “realized worth” right here refers to a measure of the associated fee foundation or acquisition worth of the common investor within the Bitcoin market. This metric’s worth is decided utilizing on-chain information, with the final worth at which every coin in circulation was transacted on the blockchain being taken as its present value foundation.

When the Common Profitability Index is bigger than 100%, it means the spot worth of the cryptocurrency is at present greater than its realized worth. Such a development suggests the common investor is holding a web quantity of revenue.

However, the indicator being underneath this threshold implies the BTC market as an entire is carrying cash at a web unrealized loss. Naturally, the index being precisely equal to 100% signifies the holders as an entire are simply breaking-even on their funding.

Now, here’s a chart that reveals the development within the Bitcoin Common Profitability Index over the previous decade:

As is seen within the above graph, the Bitcoin Common Profitability Index has registered a notable improve lately because the cryptocurrency’s run to the brand new all-time excessive (ATH) worth has occurred.

The indicator has now reached a worth of round 221%, which suggests the buyers are in a big quantity of beneficial properties. Extra significantly, the BTC addresses as an entire are in a web revenue of 121%.

Typically, the upper the earnings of the holders get, the extra doubtless they grow to be to fall to the attract of profit-taking. The present Common Profitability Index stage is excessive, however it’s unsure if it’s excessive sufficient for a mass selloff to grow to be a threat.

Within the chart, the analyst has marked how excessive the metric went on the time of the tops of the earlier bull runs. It will seem that 2017 peaked at 460%, whereas 2021 at 395%.

To date within the present cycle, the very best that the index has gone was 272%, which occurred in the course of the high again in March of this yr. Given the truth that the indicator is but to hit this stage, not to mention the peaks from the final cycles, it’s doable that Bitcoin nonetheless has enough space to run, earlier than a high turns into possible.

BTC Value

On the time of writing, Bitcoin is buying and selling round $76,200, up greater than 9% over the previous week.