Bitcoin long-term holders have seen their spending speed up lately, with the most important day by day spike of the yr going down on Friday.

1 To 2 Years Previous Bitcoin Buyers Made Up For The Greatest Half Of The Spike

In a brand new submit on X, on-chain analytics agency Glassnode has mentioned how the exercise of the Bitcoin long-term holders (LTHs) has been trying lately. The LTHs discuss with the BTC traders who’ve been holding onto their cash for greater than 155 days.

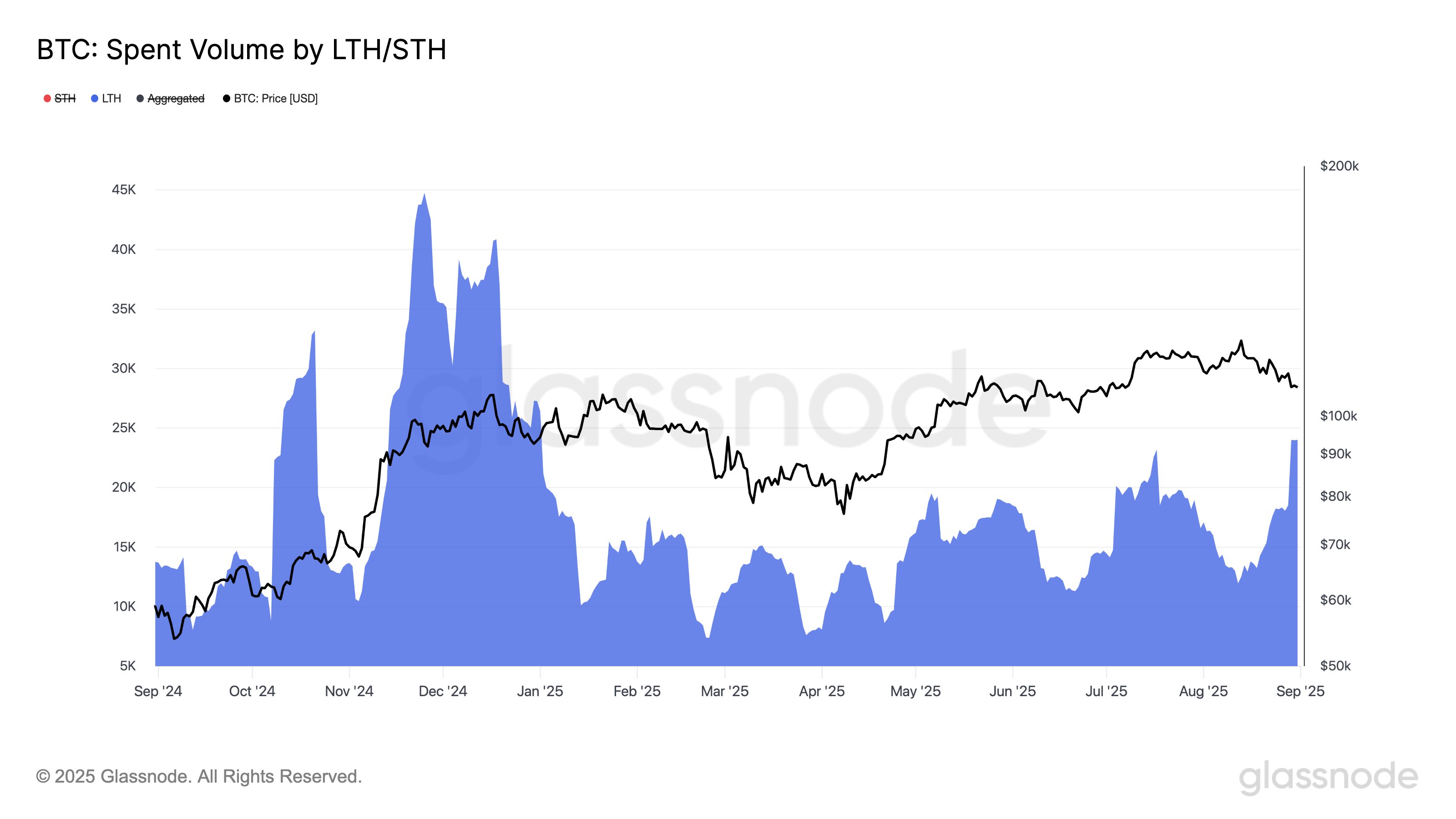

Statistically, the longer an investor holds onto their cash, the much less possible they’re to promote them sooner or later. As such, the LTHs with their comparatively lengthy holding time are thought of to be resolute entities. Regardless of their conviction, nevertheless, there are occasions when even members of this cohort determine to half with their cash. Under is a chart shared by Glassnode that exhibits how spending from this cohort has fluctuated over the previous yr.

As is seen within the graph, the 14-day easy shifting common (SMA) of the Bitcoin quantity spent by the LTHs has shot up lately, indicating the HODLers are ramping up their transaction exercise.

The spike in LTH spending has come after a decline within the BTC value. The timing might be a doable signal that a number of the diamond arms are beginning to suppose the bull run is winding down, so that they have determined to exit with their income whereas they nonetheless can.

Although whereas Bitcoin LTH transactions are elevated proper now, they’re nonetheless considerably beneath the degrees noticed within the final quarter of 2024. Additionally, the smoothed knowledge of the 14-day SMA might recommend the event corresponds to a rise in spending over a interval, but it surely seems that it’s largely as a result of a single giant day by day spike.

From the chart, it’s obvious that this huge spike that occurred on Friday concerned round 97,000 BTC, price a whopping $10.6 billion. That is the most important spending day for the LTHs in 2025 up to now.

The LTH group’s 155-day cutoff implies that the cohort covers a quite giant vary, so right here’s one other chart, this one breaking down how the completely different segments of the group have contributed to this occasion:

It will seem that the 1 to 2-year-old Bitcoin LTHs supplied the most important a part of the spending spike at 34,500 BTC. The 6 to 12 months and three to five years segments are different standouts, every contributing round 16,000 BTC.

BTC Value

Bitcoin slipped towards $107,000 in the course of the weekend, but it surely seems the coin has jumped again to start out Monday as its value is now buying and selling round $109,500.