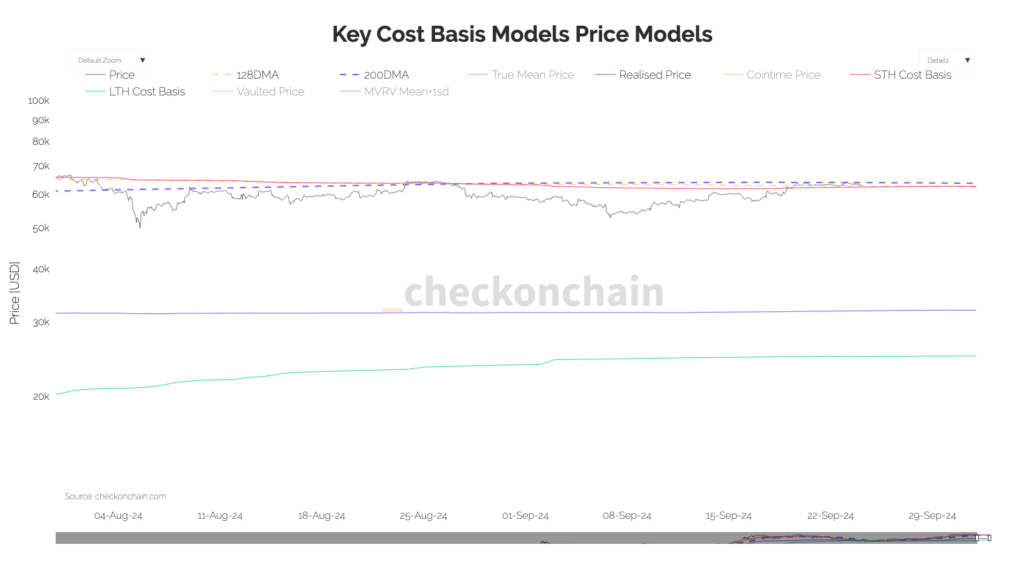

Bitcoin’s value fluctuation between $50,000 and $66,000 since early August continues to see exercise across the short-term holding price foundation, in keeping with checkonchain. The market value started at roughly $66,000 in early August, dipped under $50,000, and climbed again to the $64,000 mark by means of late September.

Brief-term holders (STH) had a price foundation carefully monitoring the 200DMA, staying close to the $63,000 vary, suggesting that current buyers skilled minimal good points or losses relative to the present market value.

In early August, Bitcoin value fell under the STH price foundation earlier than touching it once more on the finish of the month when the STH and 200DMA converged. The worth broke in regards to the STH price foundation in late September and the value lower following Iran’s assault on Israel has induced Bitcoin to the touch the STH as soon as once more, now doubtlessly performing as a help.

Lengthy-term holders (LTH) maintained a considerably decrease price foundation, hovering between $20,000 and $24,000. This disparity signifies that buyers holding Bitcoin over prolonged durations are sitting on substantial unrealized good points.

The 200-day transferring common (200DMA) remained comparatively flat, round underneath $63,000 throughout this era, indicating a steady longer-term development.

The 128-day transferring common (128DMA) additionally decreased from $65,000 to $61,000, reflecting short- to medium-term value actions. The convergence of the 128DMA and the market value could sign potential shifts in market sentiment.

These price foundation fashions present perception into investor habits and market forces following the Bitcoin halving in April. The information suggests a consolidation section, with the market value aligning carefully with the associated fee foundation of short-term holders and transferring averages.

The submit Bitcoin hits help from key stage at short-term holder price foundation appeared first on CryptoSlate.