A day after yesterday’s ATH the place Bitcoin reached $112,000. Bitcoin as we speak formally reached a brand new all-time excessive (ATH) of $113,900, extending its bullish run that reignited in late June. Simply 18 days in the past, BTC was buying and selling round $98,000. Right now’s ATH highlights the accelerating international shift towards viewing Bitcoin as each a retailer of worth and a strategic asset.

In the meantime, $50 million value of Bitcoin shorts had been liquidated up to now hours and over $1.5 billion value of Bitcoin quick positions are set to be liquidated at $120,000, based on information from Coinglass. If Bitcoin continues its upward trajectory, a large quick squeeze may very well be triggered, forcing bearish merchants to purchase again in at increased costs and additional accelerating the worth motion.

In accordance with Polymarket, the world’s largest betting platform, the almost certainly end result of hitting $115,000 by the tip of July is 80% and 44% likelihood of hitting $120,000.

In an interview with Bloomberg, the Federal Reserve Board Member Christopher Waller is contemplating reducing rates of interest this month, which might gas the worth of Bitcoin to go even increased.

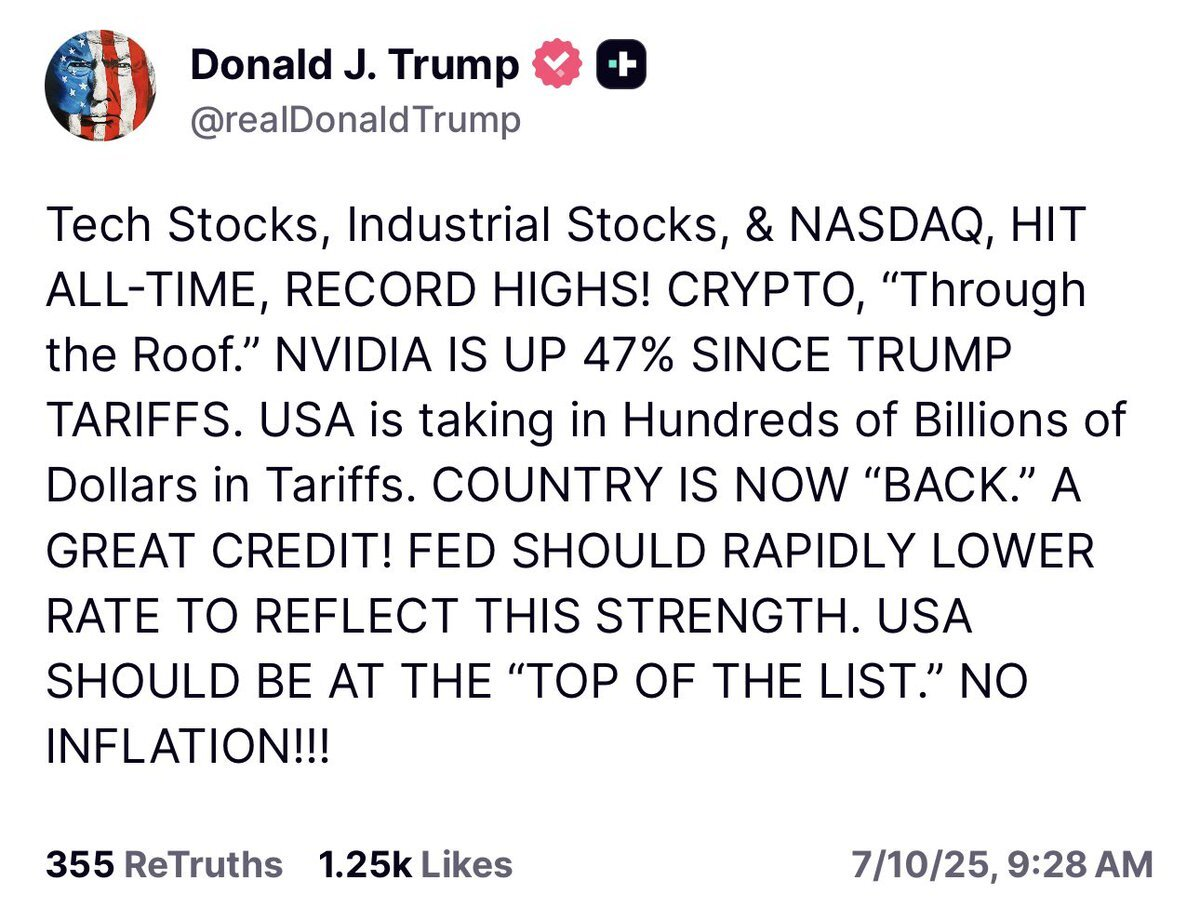

President Donald Trump, who’s been closely pressuring Fed Chair Jerome Powell to chop rates of interest, and even known as for Powell to resign and be investigated by Congress, posted in regards to the worth of Bitcoin rising as we speak on his Fact Social account, together with shares additionally hitting document highs. “CRYPTO, ‘Via the Roof,” the President acknowledged. “FED SHOULD RAPIDLY LOWER RATE TO REFLECT THIS STRENGTH.”

Earlier as we speak, it was reported that 99.85% of all Bitcoin addresses had been in revenue, with that quantity hitting 100% as Bitcoin smashed by way of its new all time excessive above $113,900.

Since November 16, 2022, El Salvador has been steadily buying bitcoin every day for its treasury reserves. Now, the nation has amassed over 6,233 BTC of their treasury. After as we speak’s upward worth motion, El Salvador’s Bitcoin reserves surpassed $700 million in worth.