Simply 19 days in the past, Bitcoin was buying and selling round $98,000. At the moment, it shattered expectations by hitting a brand new all time excessive of $118,820, underscoring the accelerating shift towards viewing Bitcoin as each a retailer of worth and a strategic asset.

BlackRock’s iShares Bitcoin Belief (IBIT) broke its ETF information final evening by surpassing $80 billion in belongings beneath administration, doing so in simply 374 days. That’s almost 5 occasions sooner than the earlier report held by the Vanguard S&P 500 ETF (VOO), which took 1,814 days to succeed in the identical mark.

As of at the moment, IBIT sits at $83 billion and holds over 706,000 BTC, making it the twenty first largest ETF within the US market. Two days in the past, IBIT additionally closed at a brand new all time excessive of $63.58, reflecting an enormous demand for Bitcoin.

The variety of hours the typical American must work to afford one Bitcoin. Based on the most recent chart by Anil Patel, it now takes 3,766 hours, almost two full years of labor on the common US wage, to purchase simply 1 Bitcoin.

Based on a brand new report from Financial institution of America World Analysis, Bitcoin is the highest performing foreign money of 2025, beating out 19 fiat currencies with an 18.2% achieve versus the US greenback year-to-date. This places Bitcoin forward of conventional sturdy performers just like the Swedish krona, Swiss franc, and Euro. The information underscores Bitcoin’s rising power not simply as a digital asset, however as a worldwide financial unit.

Bitcoin has additionally reclaimed its spot among the many world’s most dear belongings, surpassing Amazon to grow to be the fifth largest by market capitalization. With a complete market cap of $2.36 trillion and a worth of $118,820, bitcoin now ranks simply behind tech giants like Apple, Microsoft, and NVIDIA.

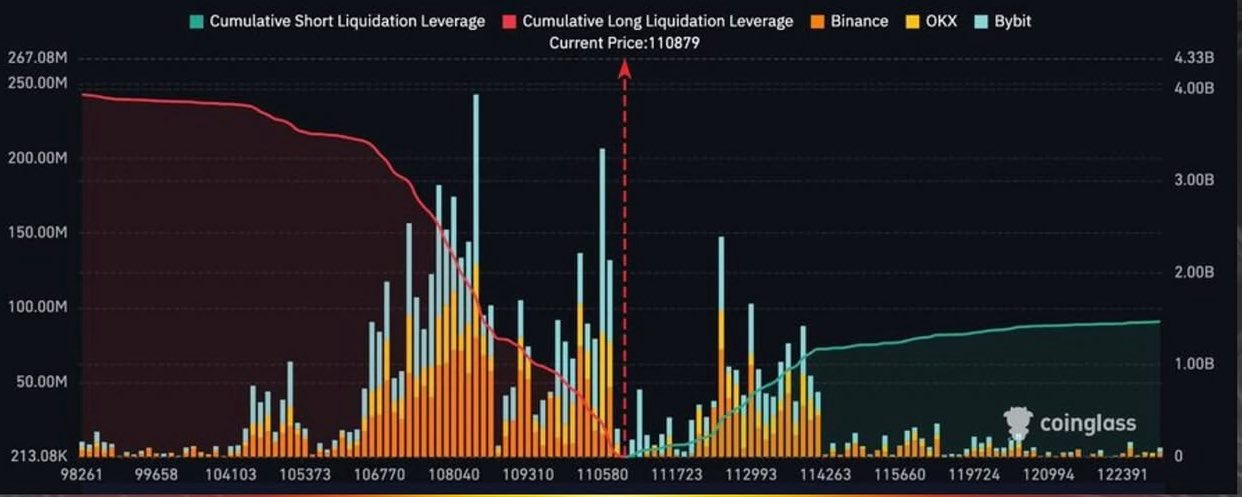

Over the previous few days, greater than $463 million in Bitcoin quick positions have been liquidated, as worth positive aspects get even greater. Based on knowledge from Coinglass, an extra $1.5 billion in brief positions are on the verge of liquidation if Bitcoin hits $120,000.