Bitcoin fell to its lowest ranges since July 8 after Wall Avenue opened on Friday, with costs sliding and merchants scrambling to reassess short-term plans.

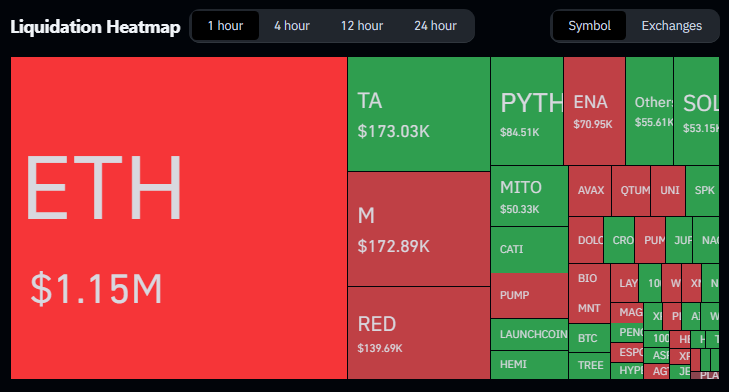

In keeping with CoinGlass, 24-hour crypto liquidations neared $540 million as promoting strain intensified on main exchanges.

Associated Studying

Whales And Change Distribution Stress

Based mostly on stories from market watchers, heavy promoting by massive holders helped push the drop. Distribution on Binance was highlighted by merchants as a key issue that worsened losses.

Bitcoin misplaced practically 5% on the day, and a few massive accounts have been linked to the wave of gross sales that triggered cease orders and fast exits.

Well-liked dealer Daan Crypto Trades pointed to a “key reversal zone” round current ranges and consolidation ranges.

Some consultants had related value ranges on his radar, noting that Bitcoin failed to show $112,000 into help. Different voices out there flagged $114,000 as an vital weekly shut threshold for bulls.

Bullish RSI Divergence Retains A Sliver Of Hope

Technical watchers discovered one vivid spot. In keeping with crypto commentator Javon Marks, the four-hour chart nonetheless reveals a bullish RSI divergence — a sample the place the RSI makes increased lows whereas value makes decrease lows. That setup can trace at an early reversal.

$BTC Good space to maintain watching. Proper on high of the earlier vary & consolidation space. https://t.co/WEaG2IF6nV pic.twitter.com/Y7RftSqDio

— Daan Crypto Trades (@DaanCrypto) August 29, 2025

Marks argued Bitcoin might stage a rebound. He recommended a transfer again towards $123,000 is feasible, which might be roughly a +14% leap from present ranges. That projection is optimistic, and it rests on momentum flipping shortly in favor of patrons.

Macro Knowledge, Seasonal Weak point Add Headwinds

Seasonality and macroeconomic knowledge added strain. September has traditionally been certainly one of Bitcoin’s weaker months, and buyers have been watching US inflation readings intently.

The Federal Reserve’s most popular inflation measure, the Private Consumption Expenditures index, matched expectations and confirmed indicators of an inflation rebound.

Nonetheless, the CME Group’s FedWatch Software confirmed markets pricing in price cuts in September, an element that might assist threat belongings like crypto if it holds.

Associated Studying

Vary Sure For Now, Merchants Watch $112,000–$114,000

Reviews have disclosed that merchants are targeted on a slim set of value markers. If Bitcoin can reclaim $112,000 and maintain a weekly shut above $114,000, bulls would achieve respiration room.

If these ranges fail, extra draw back is feasible and short-term merchants might face additional liquidations.

For now, the market appears tight. Some technical alerts level to a rebound, however macro knowledge and massive sellers are retaining the temper cautious.

Merchants and buyers alike are watching each value motion and financial prints intently because the US heads towards key knowledge and the Fed resolution window on Sept. 17.

Featured picture from Unsplash, chart from TradingView