Onchain Highlights

DEFINITION: The common funding price (in %) set by exchanges for perpetual futures contracts. When the speed is optimistic, lengthy positions periodically pay quick positions. Conversely, when the speed is unfavorable, quick positions periodically pay lengthy positions.

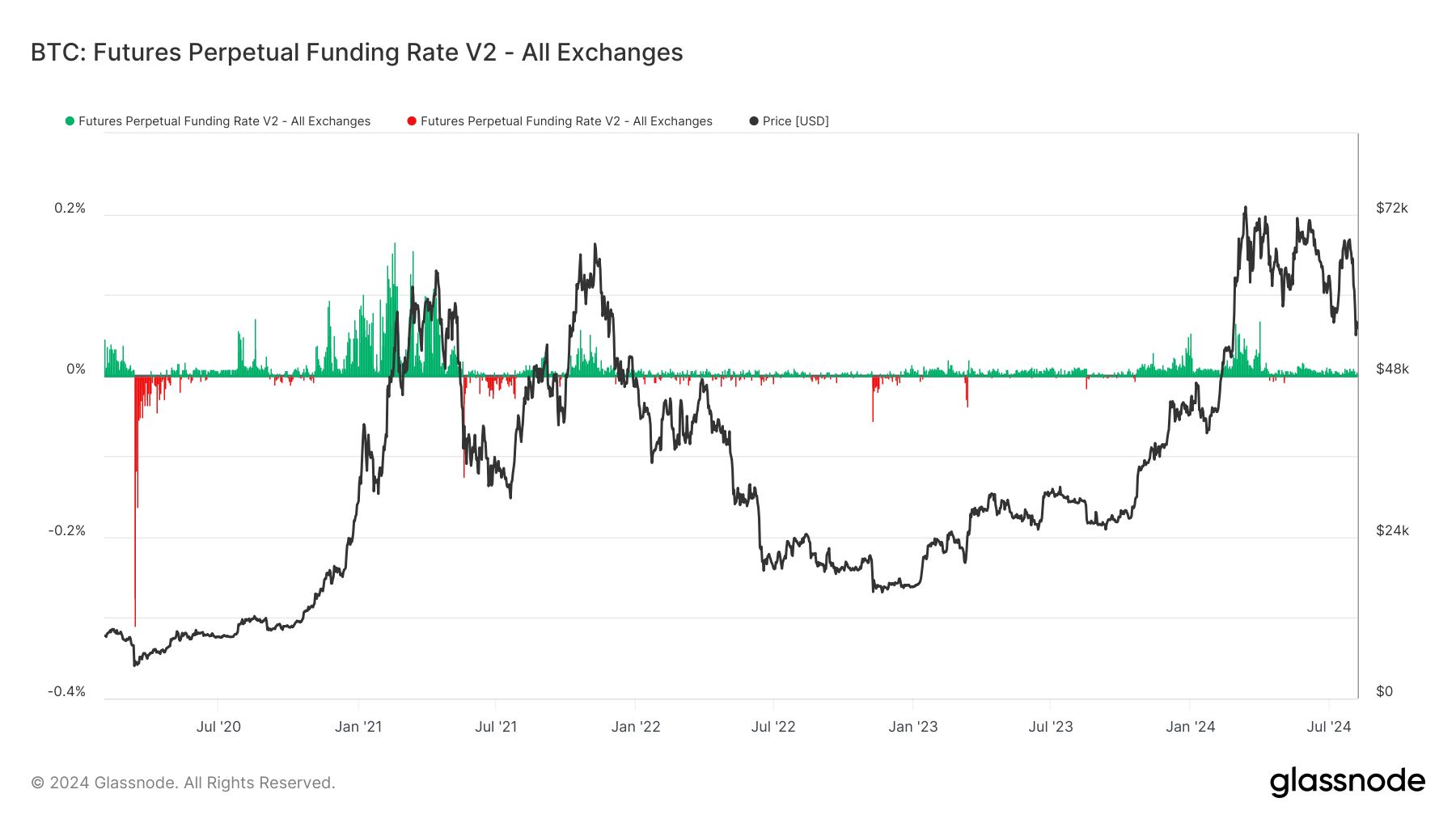

Bitcoin futures perpetual funding charges throughout all exchanges provide a complete view of market sentiment. As the primary chart signifies, there was a notable spike in funding charges through the preliminary section of 2021, corresponding with Bitcoin’s vital worth surge to round $64,000 in April 2021.

This era noticed optimistic funding charges, implying that lengthy positions have been dominant, necessitating periodic funds to quick positions.

Transferring ahead, the interval from mid-2021 to early 2022 illustrates a risky but usually declining development in each Bitcoin’s worth and funding charges. The sharp decline in costs across the finish of 2021 and the start of 2022 is coupled with intermittent unfavorable funding charges, indicating moments when quick positions have been extra distinguished and shorts paid longs.

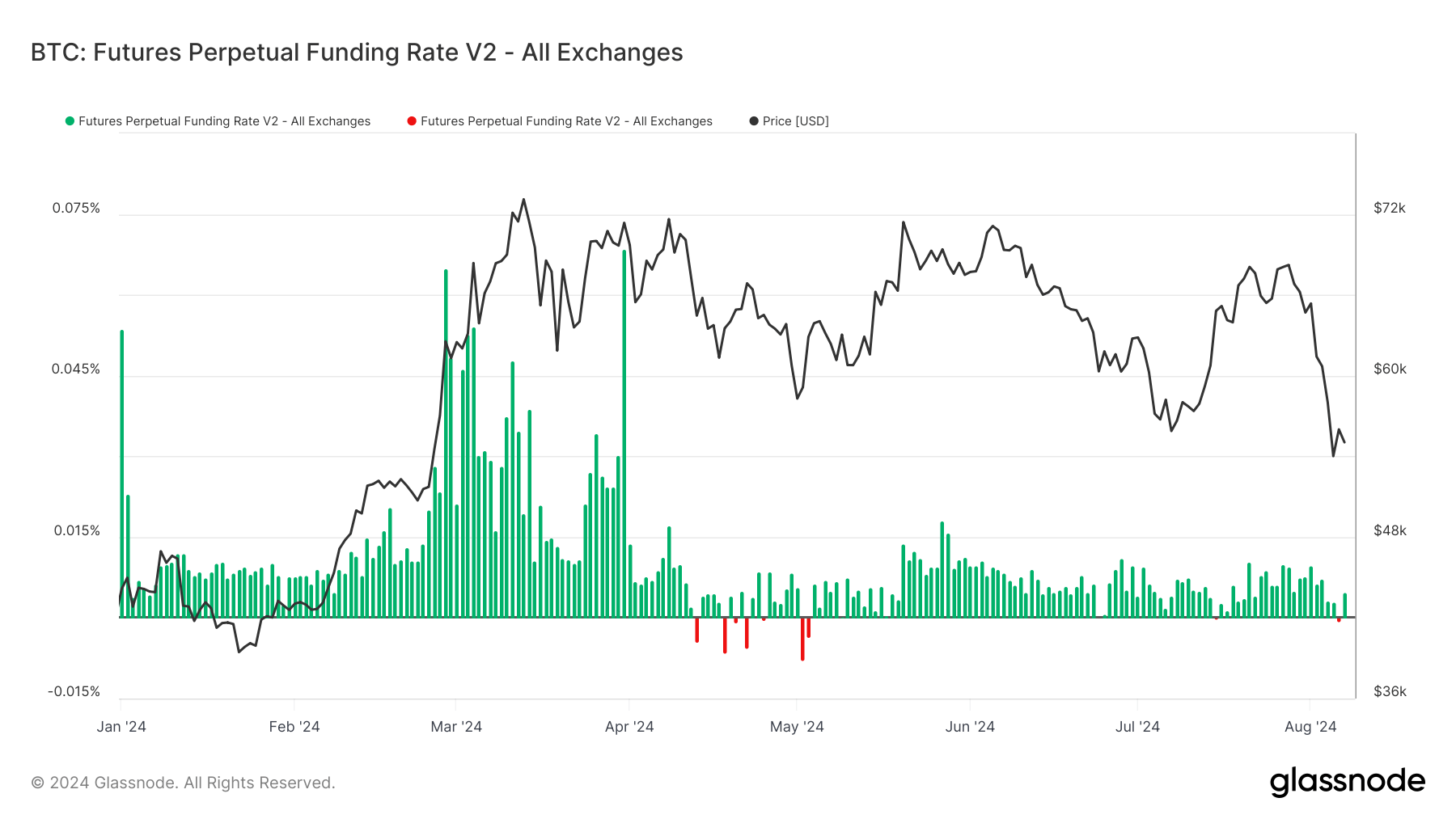

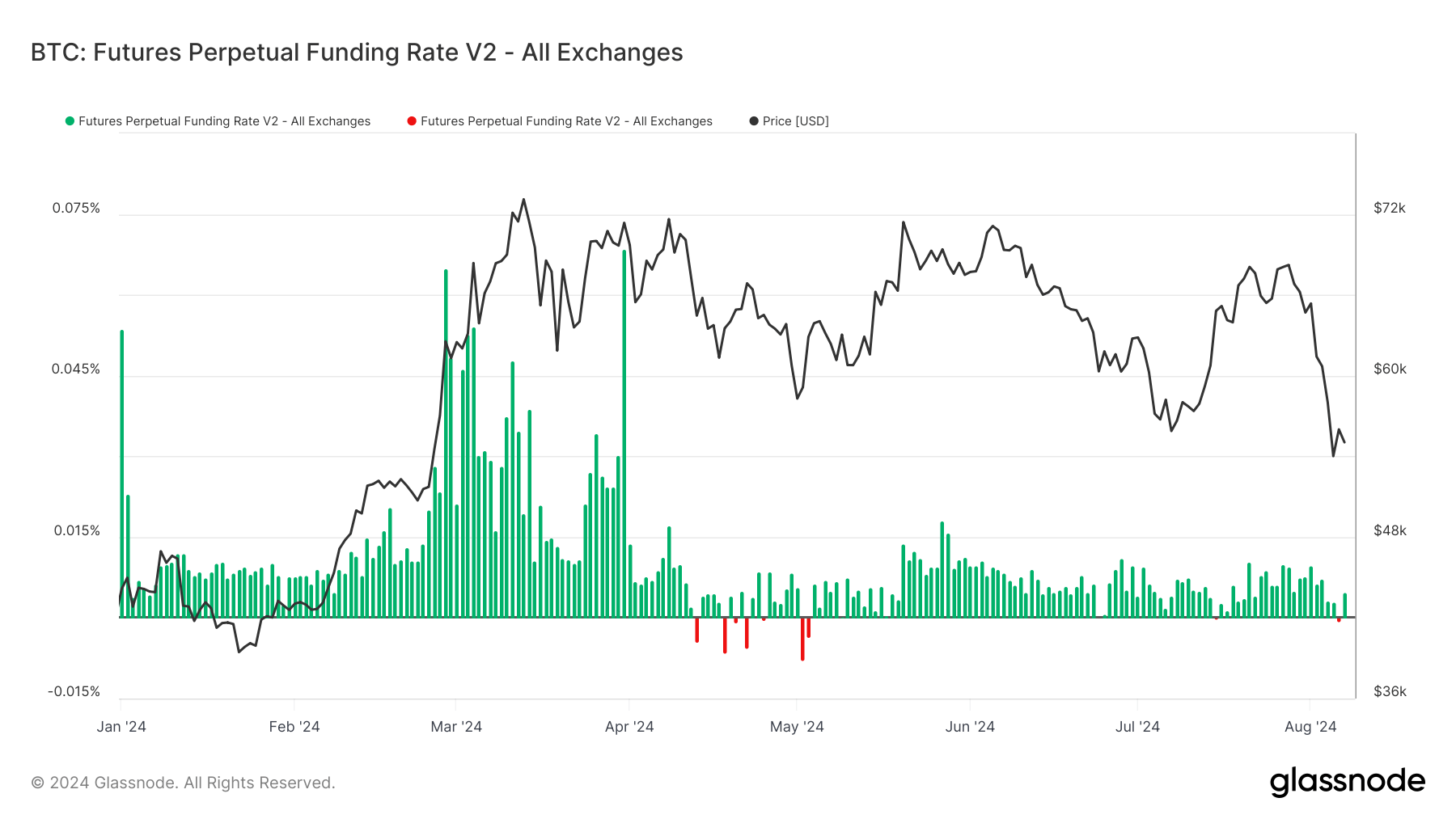

The second chart, specializing in the 12 months 2024, highlights a comparatively steady however low funding price atmosphere, with occasional dips into unfavorable territory. This corresponds with a gradual worth decline from the height in mid-2024 to decrease ranges round $55,000 in August 2024.

The consistency of funding charges close to zero throughout this era suggests a market equilibrium with balanced leverage between lengthy and quick positions.